Gold is expected to slip further towards $3270 level on strong dollar and surge in US treasury yields - ICICI Direct

Metal’s Outlook

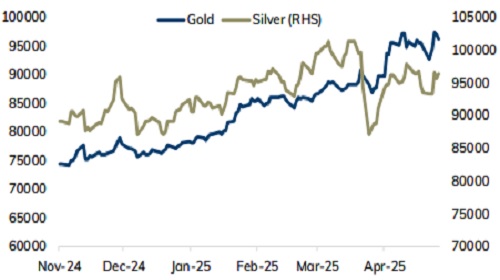

Bullion Outlook

* Gold is expected to slip further towards $3270 level on strong dollar and surge in US treasury yields. Further, demand for safe haven may fade on optimism over potential trade deal between US and its major trading partners after US and UK announced a bilateral trade deal. Moreover, investors hope breakthrough in trade talks between US and China when they meet on Saturday. Additionally, US Federal Reserve has left its interest rate steady and signaled that central bank is in no hurry to cut interest rate. Furthermore, market will keep a close eye on speeches from several Fed officials for further insight into economy and central banks policy path. Meanwhile, sharp fall may be cushioned on rising geopolitical tension between India and Pakistan

* Spot gold is likely to slip further towards $3270 level as long as it stays below $3350 level. MCX Gold June is expected to slip back towards Rs.95,000 level as long as it stays below Rs.96,800 level

* MCX Silver July is expected to slip further towards Rs.94,300 level as long as it trades below Rs.96,700 level.

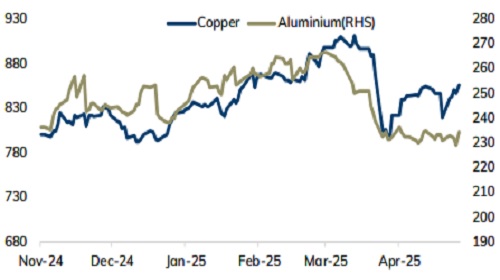

Base Metal Outlook

* Copper prices are expected to trade with positive bias on rise in risk appetite in the global markets and as China has announced raft of stimulus measures to soften economic damage caused by US tariffs. Moreover, Yangshan copper premium, which reflects demand for copper imported into China, reached $102 per ton. Additionally, bilateral trade deal between US and UK, raised hopes of such more deals with other major trading partners, easing global trade war concerns. Further, hopes of a breakthrough in trade talks between US and China when they meet on 10th May in Switzerland

* MCX Copper May is expected to rise towards Rs.862 level as long as it stays above Rs.842 level. A break above Rs.862 level prices may rise further towards Rs.867 level

* MCX Aluminum May is expected to rise towards Rs.237 level as long as it stays above Rs.232 level. MCX Zinc May is likely to move north towards Rs.254 level as long as it stays above Rs.248 level.

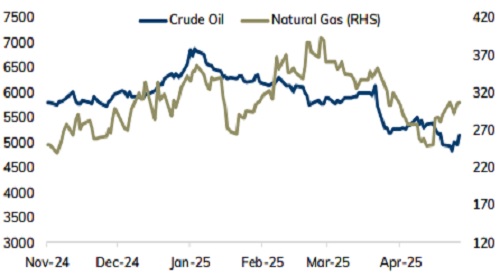

Energy Outlook

* NYMEX Crude oil is expected to trade with positive bias and rise towards $61.50 level on optimistic global market sentiments. Further, US and China’s top officials will meet this week for negotiation over tariffs, step towards resolving trade dispute. While, the announcement of trade agreement between US and Britain added to the positive sentiment. Additionally, US imposed sanctions on 2 small Chinese refiners for buying Iranian crude oil. However, sharp upside may be capped on strong dollar. Moreover, OPEC+ will increase oil output which could limit further price gains.

* MCX Crude oil May is likely to rise further towards Rs.5280 level as long as it stays above Rs.5050 level. A break above Rs.5280 prices may rally further towards Rs.5380 level.

* MCX Natural gas May is expected to rise further towards Rs.320 level as long as it stays above Rs.296 level.

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631