Gold is expected to hold its gains amid weakness in the dollar and safe haven buying - ICICI Direct

Metal’s Outlook

Bullion Outlook

* Gold is expected to hold its gains amid weakness in the dollar and safe haven buying. Escalating trade tension between US and China would likely to increase safe haven bids. Further, most likely chance of rate cut by ECB would provide support to the yellow metal. Moreover, dovish stance on the economic growth by the Fed chair would increase the chance of lower interest rate. The broader trend still remains positive amid trade war uncertainty and increasing inflows in to the bullions. But, profit booking at higher levels could bring some correction in prices.

* On the data front unwinding of call base at 3300 and 3350 strike indicates more up side. Meanwhile, immediate support holds near $3300. MCX Gold June is expected to move towards Rs.96,500,as long as it trades above Rs.94,400 level.

* MCX Silver May is expected to extend its rally toward Rs.97,600, as long as it trades above Rs.94,800 level. Meanwhile, investors will eye key economic numbers from US and Fed members comments to get further clarity.

Base Metal Outlook

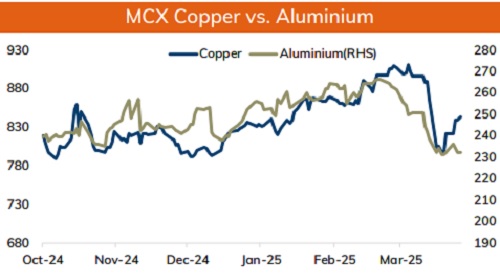

* Copper prices are likely to face resistance and trim its earlier gains amid heightened trade war concerns. But, weakness in the dollar and improved demand from China would help the metal to limit its downside. Furthermore, lower prices and superior import parity would attract more buyers. Meanwhile, investors are keeping a close eye on upcoming trade talks between the US and key partners this week to get further clarity.

* MCX Copper April is expected to hold support of 200 day EMA at Rs.833 and move higher towards Rs.850. Only a move above Rs.850 price may rally towards Rs.858.

* MCX Aluminum April is likely to consolidate in the band of Rs.229 and Rs.235 level. Only above Rs.235 level, it would rise towards Rs.240. MCX Zinc April is likely to face the hurdle near Rs.250 and move in the band of Rs.245 to Rs.250 level. Only below Rs.245 it would turn weaker.

Energy Outlook

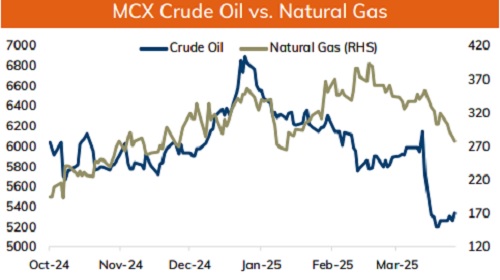

* NYMEX Crude oil is expected to consolidate in the band of $60 and $63 per barrel amid trade war uncertainty. China’s openness to trade talks would boost economic sentiment and support oil prices. A weaker dollar and growing prospects of lower rates by ECB would also support the oil prices. But gains could be capped amid increasing bets of supply improvement from OPEC+ nations. Meanwhile, downward revision to demand growth for 2025 by OPEC and EIA would restrict any major up move in price.

* On the data front, addition of OI in OTM put strike at 60 indicates price to find strong support at $60 per barrel. On the upside a strong call base at 65 strike would act as key resistance. But unwinding of OI in OTM call strikes indicates a recovery in price. MCX Crude oil is likely to consolidate in the band of Rs.5150 and Rs.5400 level. A move above Rs.5400 would open the doors towards Rs.5580.

• MCX Natural gas April is expected to trade lower towards Rs.270 level as long as it trades under Rs.290 level.

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631