Gold is expected to face the hurdle near $3350 and move lower towards $3275 per ounce amid easing trade war concerns - ICICI Direct

Metal’s Outlook

Bullion Outlook

* Gold is expected to face the hurdle near $3350 and move lower towards $3275 per ounce amid easing trade war concerns. Growing optimism over trade deal between US and other major trading nations would negate the safe haven appeal in the bullion. But, no clarity on trade negotiations between US and China could provide some support to the bullions. Furthermore, expectation of slower job growth numbers and sharp drop in advance GDP numbers would increase the chance of Fed rate cut, which could provide support to the yellow metal.

* On the data front fresh addition of OI in OTM call strike at 3350 has been observed, which would act as key hurdle for now. On the downside, OI at 3250 put strike also seen a addition in OI. For the day, MCX Gold June is expected to face the hurdle near Rs.96,200 and move towards Rs.95,000 level. Below, Rs.95,000, it would turn weaker towards Rs.94,200.

* MCX Silver June is expected to consolidate in band of Rs.96,800 and Rs.98,800 level. Below Rs.96,800, it would turn weaker towards Rs.95,200.

Base Metal Outlook

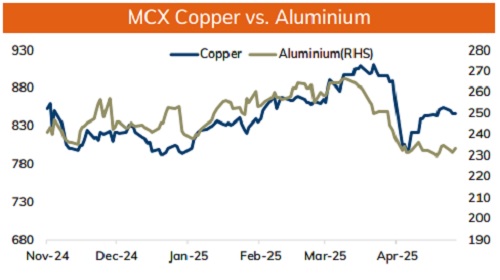

* Copper prices to hold its ground and move in a positive territory on hopes of demand improvement in China. A rise in copper import premiums which hit highest in six months indicates tightness in the physical market. The Yangshan premium jumped from a low of $35 a ton in late February to $93 this week, reflecting sharp demand in China as warehouse stocks noted a sharp drawdown. Furthermore, threat of copper- specific tariffs would increase more flow of the metal to US ahead of duties. Moreover, scope of fresh round of stimulus from China to counter the tariffs would support prices to stay higher.

* MCX Copper May is expected to hold the support near Rs.848 and move higher towards Rs.860. Above Rs.860 it would open the doors towards Rs.870. On the flip side, close below Rs.848, it would turn weaker.

* MCX Aluminum May is likely to consolidate in the band of Rs.233 and Rs.238 level. Only above Rs.238 level, it would turn bullish towards Rs.242. MCX Zinc May is likely to find support at Rs.248 and move towards Rs.254. A move above Rs.254 level would open the doors towards Rs.256.

Energy Outlook

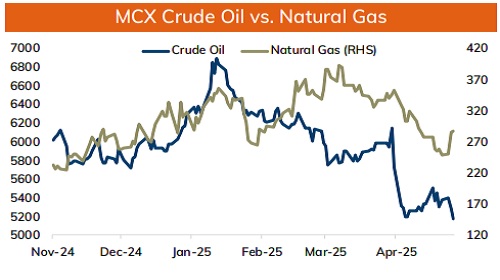

* NYMEX Crude oil is expected to face the hurdle near $62 per barrel and move lower towards $58 mark on the prospects of weak demand and oversupply. Weaker than expected economic numbers from US and sluggish demand growth from China would likely to weigh on oil prices. Further rise in API crude oil inventories by 3.8 million barrels last week would likely to weigh on prices. Additionally, OPEC+ members are expected propose a second consecutive month of faster output hike in June. Meanwhile, investors will keep an eye on talks between US and Iran, as any positive outcome could ease sanction on Iranian oil and improve supply.

* On the data front, an increasing OI in OTM calls indicates price to face strong resistance at $63 level. On the downside $60 would act as key support. But, unwinding of OI in ATM and OTM put strikes suggest further correction. MCX Crude oil May is likely to weaken towards Rs.5100, as long as it trades under Rs.5320 level. Below Rs.5100, it can move lower towards Rs.4980.

* MCX Natural gas May is expected to move in the band of Rs.278 and Rs.296

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631