Global Economy Update for October 2025 by CareEdge Ratings

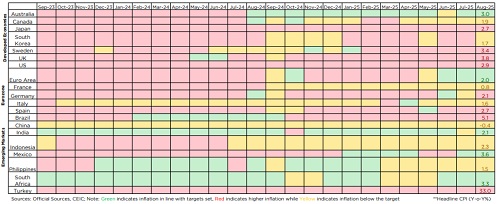

Diverging Inflation Across Developed and Emerging Markets

* Higher inflation in most of the developed economies is being driven by persistent core pressures, rising service costs, increasing wages and surge in debt levels. In the US, additionally, higher tariffs have led to higher inflation.

* In contrast, inflation is moderating faster in emerging markets due to earlier monetary tightening, a relative weakening of the USD and declining food prices. Thus, it provides monetary space for interest rate cuts

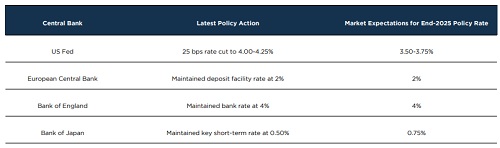

Fed Cuts Rates; ECB, BoE and BoJ Hold Steady

* The Fed lowered its policy rate by 25 bps in September, highlighting rising downside risks to employment, even as inflation remains elevated. The dot plot now signals two more cuts this year, up from one previously.

* Inflation in Japan has been easing but has consistently stayed above the central bank’s 2% target for more than three years. The market expects a potential rate hike by the Bank of Japan by the end of the year.

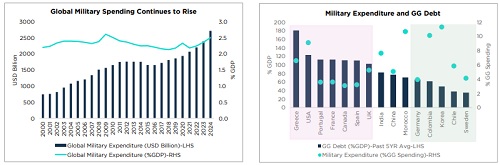

Global Military Spending Increases, Low Fiscal Space in Debt-Laden Nations

* Global military expenditure surged to USD 2.7 trillion in 2024, in nominal terms, accounting for 2.5% of global GDP, marking the sharpest annual increase since the end of the Cold War, at 9.4%.

* Greece, the U.S., France, Italy, Spain, the UK, and Canada face limited fiscal space for increased military spending due to already elevated debt levels. China’s official debt figures exclude augmented liabilities, potentially understating fiscal constraints.

* India’s low general government revenue and high debt-to-GDP ratio of 81% further constrain its fiscal space for extra military spending.

* Colombia, Chile, and South Korea already have relatively high defense expenditure, but their moderate debt levels offer some fiscal buffers.

* For a detailed report, refer to - Defense Spending in a Debt-Laden World: Strategic Priorities vs Fiscal Realities

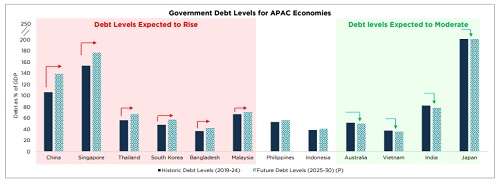

APAC: Rising Sovereign Debt Could Reduce Fiscal Policy Space

* Future debt trajectory for economies in the APAC region is expected to be divergent- Economies marked in green are projected to witness moderation in growth levels. In contrast, the economies marked in red are expected to see a rise in future debt levels.

* For the economies marked in red, any additional fiscal support to offset trade-related shocks may strain public finances and challenge long-term debt sustainability.

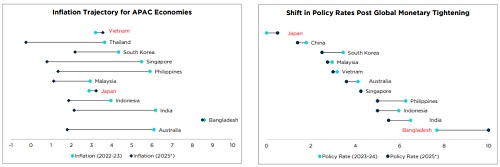

APAC: Easing Inflation is Expected to Allow Flexibility on the Monetary Policy Front

* With inflation moderating and policy rates retreating from their peaks, most APAC economies have greater monetary policy space to manage uncertainties.

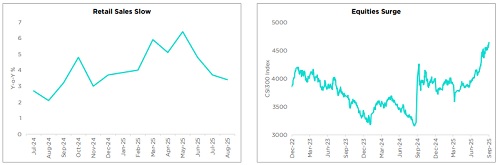

China: Equity Markets Climb Despite Domestic Challenges

* Retail sales growth fell to 3.4% Y-o-Y in August, marking a third consecutive monthly decline. The support from the consumer goods trade-in program appears to be fading, while prolonged property sector stress and a weak labor market are weighing on consumer confidence and spending.

* Tech-led optimism is contributing to the stock market rally, as China aims for self-sufficiency in the production of advanced AI chips.

* For a detailed report, refer to - CGIL China Rating Rationale

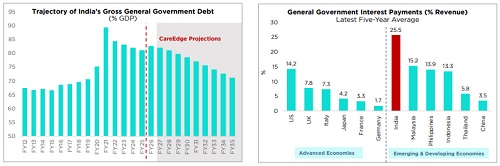

India: Government Debt Consolidation Stays on Track

* Amid the global landscape of rising government debt, we project India’s general government debt to moderate from the currently estimated 81% of GDP to about 77% by FY31 and further to 71% by FY35

* Centre’s fiscal consolidation and sustenance of GDP growth momentum (~6.5%) are expected to support the medium-term debt consolidation.

* However, the sticky aggregate state debt amid the distribution of freebies by some states remains a monitorable going forward.

* While India’s government debt is projected to moderate, the elevated interest payments (% revenue receipts) are expected to remain a challenge.

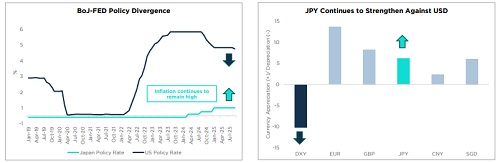

Japan: BoJ-Fed Policy Divergence Continues to Weaken Carry Trade Position

* Bank of Japan (BoJ) holds a hawkish stance, while the Fed has adopted a dovish bias. This policy divergence has exerted further upward pressure on the JPY, challenging its carry trade position.

* The unwinding of carry positions, coupled with political uncertainty, has steepened Japan’s yield curve as the risk premium is increasing.

* The resulting rise in yields holds implications for Japan’s fiscal outlook, given already high public debt levels.

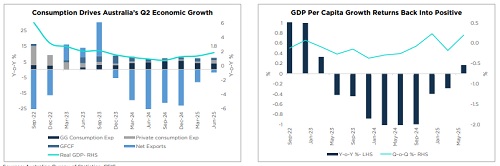

Australia: Q2 GDP Growth Hits 2-Year High

* Australia’s GDP accelerated to 1.8% Y-o-Y (0.6% Q-o-Q) in Q2 2025, up from 1.4% Y-o-Y (0.3% Q-o-Q) in Q1, driven by a 2% rebound in household consumption (vs 0.8% in Q1) and narrowing of the net exports' deficit.

* The long per capita recession ended in Q2 2025, with GDP per capita rising 0.2% Q-o-Q and 0.2% Y-o-Y.

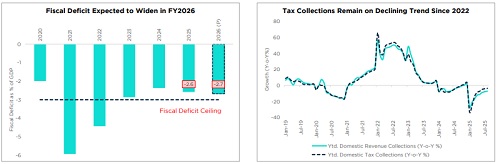

Indonesia: Unpopular Policy Measures Could Strain Fiscal Position

* The Indonesian government has approved the budget for FY 2026, with an expected fiscal deficit of 2.68% of the GDP. The Budget for FY 2026 is estimated to be around USD 234.4 bn, marking 7.5% increase from the previous year’s deficit target.

* Direct tax collections have remained negative since 2022, reflecting subdued purchasing power and ongoing pressures from the country’s cost-of-living challenges.

* Low revenue mobilization, coupled with potential fiscal expansion, could put upward pressure on currently low debt levels (~40% of GDP in 2024) and impact investor confidence.

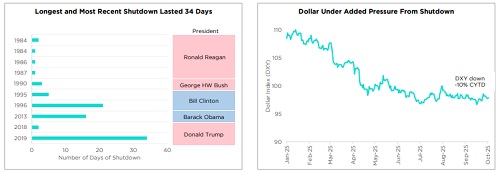

US: Government Shutdown Begins 1 October 2025 Amidst Partisan Standoff

* During government shutdowns, non-essential federal services are paused, with some employees furloughed. Publication of key data releases also gets disrupted.

* It will be important to monitor the duration of the current shutdown, as extended shutdowns can weaken consumer and investor sentiment and slow overall economic activity.

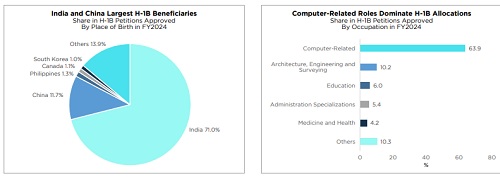

US: H-1B Visa Fee Hike Adds to Concerns Over US Policy Shifts

* H-1B visas, widely used by technology firms, primarily benefit Indian and Chinese workers, with a total of 3,99,395 visa petitions approved in FY2024.

* The recent hike in the US visa fee to USD 100,000 for new applications complicates immigration and adds to uncertainty in the US policy landscape, already affected by frequent trade policy shifts.

* For a detailed report, refer to - CGIL US Rating Rationale

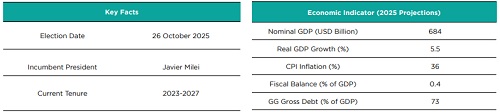

Argentina: Midterm Elections Key for Policy Continuity

* Argentina is scheduled to hold crucial legislative elections in October, a juncture at which President Javier Milei seeks to fortify his parliamentary influence, with 127 of 257 seats in the Chamber of Deputies and 24 of 72 seats in the Senate up for election.

* Milei’s party, La Libertad Avanza, currently lacks a majority in both chambers, making it difficult to advance his sweeping agenda focused on liberalization and deregulation.

* President Milei’s “chainsaw economics” represents a sweeping fiscal reform strategy, characterized by aggressive austerity measures aimed at curbing public expenditure, streamlining the state apparatus, and reasserting market-driven principles.

* A recent corruption scandal has damaged the President’s anti-corruption image and hurt his approval ratings.

* For a detailed report, refer to - CGIL Argentina Rating Rationale

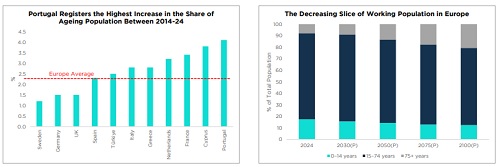

Europe: The Demographic Squeeze

* Population ageing has been a structural trend in Europe for decades, steadily pushing up the old-age dependency ratio.

* This is driven by three key factors - rising life expectancy, persistently low fertility rates, and the ageing of the post-war baby-boom generation.

* The demographic shift is already manifesting in labor shortages across Europe.

* Looking ahead, it implies slower potential growth, higher pension and healthcare burdens, and significant shifts in savings and consumption patterns

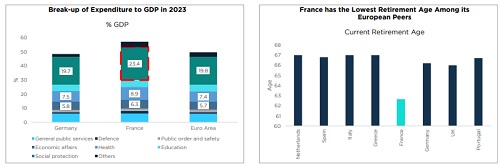

France: High Pensions at the Core of its Fiscal Dilemma

* France has a very high social spending as compared to its EU peers at about 23% of GDP, of which about 14.7% is attributed towards pension spending.

* France’s low retirement age is a key driver of increasing pension expenditures.

* In 2023, a law was enacted to gradually raise the retirement age to 64 by 2032. However, this reform has sparked widespread protests.

* Given the high political fragmentation, there is a significant risk that the law could be reversed.

* For a detailed report, refer to - CGIL France Rating Rationale

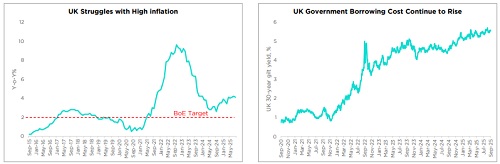

UK: Rising Inflation and Soaring Gilt Yields

* The UK is navigating a turbulent economic landscape, marked by surging inflation and rising borrowing costs that are unsettling financial markets.

* High inflation in the UK is due to a combination of elevated energy costs, increased minimum wages, and higher employer National Insurance contributions, thereby increasing labor costs for businesses.

* UK government bond yields are rising as persistent inflation and growing fiscal deficits erode investor confidence, prompting higher risk premiums.

Ethiopia: Humanitarian Strain Threatens Economic Stability

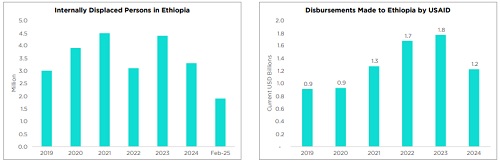

* Ethiopia is facing acute humanitarian challenges stemming from internal conflict, regional instability, and climate-related disasters, resulting in 3.3 million internally displaced persons (IDP) in 2024. As of February 2025, the cumulative number of IDPs has already reached 1.9 million.

* The 2024 Humanitarian Response Plan was significantly underfunded, with only 55% of the required USD 3.2 billion mobilized. A further USD 2 billion is required to effectively manage this crisis in 2025.

* Reduced US Aid may hinder response efforts in dealing with the crises and further strain Ethiopia’s fiscal space and growth prospects.

* For a detailed report, refer to - CGIL Ethiopia Rating Rationale

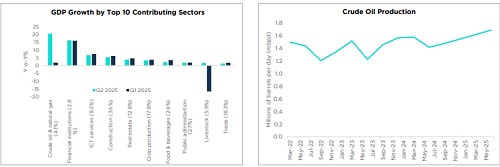

Nigeria: Economic Growth Reaches Four-Year High

* Nigeria’s GDP grew 4.2% Y-o-Y in Q2 2025, the fastest pace in 4 years, up from 3.1% in Q1 2025 and 3.5% in Q2 2024.

* The oil sector grew by 20.5% Y-o-Y in Q2 2025. The growth in the financial sector and other services has sustained their growth momentum in Q2 2025, while livestock has also recorded positive Y-o-Y growth of 1.6% in Q2 2025 following a contraction in Q1 2025.

* Stronger security measures lifted oil output to 1.68 mbpd in Q2 2025 (vs. 1.41 mbpd in Q2 2024), keeping the oil sector a positive growth driver despite lower oil prices. Overall, GDP growth is projected at 3.4% in 2025.

* For a detailed report, refer to - CGIL Nigeria Rating Rationale

Above views are of the author and not of the website kindly read disclaimer