Fiscal Accounts : Taking stock of general government finances by Emkay Global Financial Services Ltd

The Centre’s 1HFY26 fiscal position is not overly concerning vs BE, while States’ fiscal fragility seems backloaded in 2H. However, C and S expenditure trends have been divergent. Centre’s frontloaded capex has not been mirrored by States even as both Centre and States have strived for revex curtailment. 1H revenue has been stretched for both, thanks to optimistic budgetary assumptions, with 2H looking better for the Centre. Centre’s capex is likely to degrow ~20% in 2H after the huge ~40% growth in 1H, while States’ capex growth may stay sub-10% (implying States’ FY26E capex/GDP at 2.2% vs FY25P: 2.3%), due to strain from populismled spending and limited revenue mobilization levers. While Centre’s FD/GDP BE of 4.4% looks to be in sight, a ~20bps slippage in States’ BE 3.2% FD/GDP seems likely. This risks a revisit of a bond supply overhang in 4Q, necessitating ~Rs1- 1.5trn OMOs ahead, amid DD-SS mismatch and impending liquidity tightness.

Prudent 1H fiscal for Centre and States amid lower revex; capex trends diverge

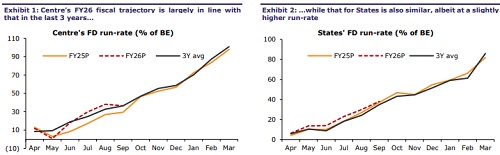

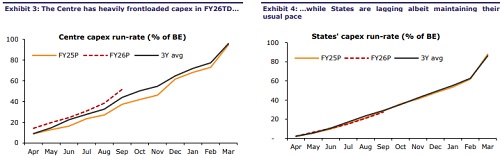

1HFY26 fiscal accounts depict a prudent fiscal position for the Centre, with 1H fiscal deficit (FD) at 37% of BE (vs 1HFY25/3Y average of 29%/36%) – FY25 had seen much lower expenditure in 1H due to elections, though the current fiscal position is broadly in line with that in the last 3 years. While Centre’s tax collection growth has been sluggish, slower revex has kept the deficit contained, even with capex frontloading. Despite noise around States’ fiscal fragilities, data for 17 key states depicts that even with strained revenue, the 1H FD has been bearable (38% of BE vs 1HFY25/3Y average of 37%/35%). However, the manner of consolidation for both Centre and States has continued to vary, led by divergent expenditure trends. Centre’s frontloaded capex (with ‘core’ capex also being healthy) has not been mirrored by States (Centre: 52% of BE achieved vs 27% for States), even as both Centre and States have tried to control revex (Centre: 44% of BE achieved; States: 41%). In fact, Centre’s revex (ex-interest) has exhibited negative growth in 1H (-3% vs BE: 7%), with States also seeing a much lower growth vs BE (8% vs BE: 19%), albeit higher than the Centre’s. The revenue front has been strained for both, led by gross tax/own tax revenue.

Centre’s FD/GDP of 4.4% still in sight; States risk slippage of 10-20bps from 3.2%

While the Centre’s lower tax receipts in FY26E vs budgeted will be partly offset by higher non-tax revenue (RBI + PSU dividends), States will face more revenue pressure amid lower devolution and significant slippage vs unrealistic BE for grants (~135% growth rate for 2HFY26!). Centre’s 2H revex growth may track at 10-12%, while capex growth will turn negative (due to base effects); for States, expenditure growth may stay similar to that in 1H. We maintain the Centre’s FY26E FD/GDP at 4.4% and believe that concerns around fiscal slippage (amid lower direct tax revenue and GST rationalization) could be allayed by trimming miscellaneous capex and revex, among other items. However, the general government fiscal position may still be at risk of slippage, led by States, due to their weak revenue position and pressure from sticky revex (populist/freebie spending). States’ FD/GDP is poised to cross 3% for a 3 rd straight year, with a risk of 10-20bps slippages from the estimated FY26BE of 3.2% (FY25P: 3.3%).

Bond supply overhang to haunt again in 4Q; watch for Rs1-1.5trn OMOs ahead

The frontloading of issuances in 1H by C+S (led by 20Y+ papers) along with a demand drought from captive investors such as banks and shift in investment behavior of long players strained the bond market in recent months. The lack of clarity on policy rate direction has also put pressure. Bond yields have held steady in recent sessions, helped by auction cancellation and likely secondary-market bond purchases by the RBI (~Rs300bn since the last week). Amid impending liquidity tightness and the need to widen market depth beyond the most liquid papers, additional OMO purchases to the tune of Rs1-1.5trn may be in the offing, providing a more supportive backdrop for bonds. States’ borrowing in 3QFY26 so far (~Rs1.3trn) has been ~36% lower than the already-low indicative amount of ~Rs2.8trn, due to an extra devolution instalment received from the Centre at end-Sep which cushioned its revenue to an extent. Additionally, media reports suggest States have been asked to defer bond auctions amid rising yields to ease supply pressures and avoid crowding out during supply-heavy periods. This may lead to SDL supply turning heavily back-ended in 4QFY26 (~Rs 5trn), when Centre’s borrowing is lower. Key to watch ahead is the tenor of States’ issuances, so as to accommodate structural and regulatory changes impacting demand by domestic investors.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354