FIIs were net buyers in Cash to the tune of 2301.87 Cr and were net buyers in index futures to the tune of 560.10 Cr - Nirmal Bang Ltd

Summary

* Indian markets closed on a flat note where buying was mainly seen in IT, Metals, Pharmaceutical Sectors. Nifty June Futures closed at 25160.60 (down 21.20 points) at a premium of 56.35 pts to spot.

* FIIs were net buyers in Cash to the tune of 2301.87 Cr and were net buyers in index futures to the tune of 560.10 Cr.

* India VIX decreased by 4.61% to close at 14.02 touching an intraday high of 14.74.

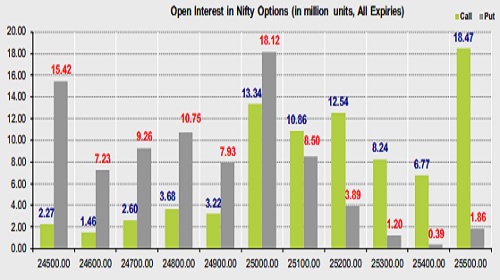

* The above second chart shows previous trading day’s change in Nifty options where Addition in OI were seen in 25500, 25300, 25200 , 25100 strike Calls and at 24900, 25000, 25100, 25200 strike Puts indicating market is likely to remain range bound in the near term.

* Highest OI build-up is seen at 25500 strike Calls and 25000 strike Puts, to the tune of 18.47mn and 18.12mn respectively.

Open Interest in Nifty Options:

Outlook on Nifty:

Index is likely to open on a flattish note today and is likely to remain range bound during the day.

Please refer disclaimer at https://www.nirmalbang.com/disclaimer.aspx

SEBI Registration number is INH00000176

More News

The Nifty opened the trading session on positive note and continued the bullish momentum in ...