Federal Bank Reports Record-High NII and Fee Income; Net Profit Rises 10.85% QoQ

Federal Bank delivered another strong quarter for the period ended 30 September 2025, marked by all-time highs in both Net Interest Income and Fee Income, and consistent growth across core metrics.

Key Highlights (Q2 FY26):

* Record NII at Rs.2,495 crore, reflecting stable margins.

* Highest-ever fee income at Rs.886 crore, underscoring continued momentum in non-interest revenue streams.

* CASA ratio improved to 31.01%, up 94 bps YoY; CASA deposits grew 10.71% YoY to Rs.89,591 crore.

* Operating profit stood at Rs.1,644.17 crore, up 5.65% QoQ.

* Net profit rose 10.85% QoQ to Rs.955.26 crore, driven by robust operating income and efficient cost management.

* ROA at 1.09% and ROE at 11.01%, maintaining healthy profitability metrics.

* Net Interest Margin improved 12 bps QoQ to 3.06%.

* Total deposits increased 7.36% YoY, while net advances grew 6.23% YoY, reflecting balanced franchise growth.

* Asset quality remained among the best in the decade with GNPA at 1.83% and NNPA at 0.48%.

* CRAR stood strong at 15.71%, ensuring a comfortable capital position.

* Provision Coverage Ratio remained robust at 73.45%.

Mr. KVS Manian, Managing Director & CEO said: “Having spent over a year in this role, I have a deep sense of conviction about where the Bank stands today and the direction we’re headed. Over the past few quarters, we’ve undertaken several strategic reorientations to strengthen our foundation and build for the future — and the results are beginning to show.

Our CASA franchise continues to demonstrate sustained and meaningful growth, reflecting the trust of our customers and the consistency of our team’s execution. We’re also broadening our asset mix thoughtfully, increasing the share of our mid-yield portfolio in a measured and disciplined way. At the same time, our fee income has seen strong, double-digit sequential growth, underscoring the breadth and resilience of our earnings.

Our asset quality remains solid, supported by prudent risk management and a balanced approach to growth. As we look ahead, we’re shaping an organisation that’s agile in its thinking, disciplined in its actions, and firmly anchored in the stability and values that define Federal Bank.

Operating Review

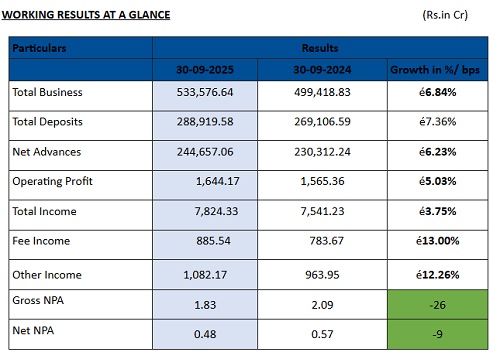

Total Business

Total Business of the Bank reached Rs. 533,576.64 Cr. registering a growth of 6.84% YoY.

Credit Growth

On the Asset side, Net advances increased from Rs. 2,30,312.24 Cr. as on 30th September 2024 to Rs. 2,44,657.06 on 30th September 2025, a growth of over 6.23% YoY.

Deposit Growth

Total Deposits increased from Rs. 269,106.59 Cr. as on 30th September 2024 to Rs. 288,919.58 Cr as on 30th September 2025, registering a growth of 7.36 %.

Operating Profit & Net Profit

The Bank registered Operating Profit of Rs. 1,644.17 Cr and Net Profit of Rs. 955.26 Cr for the quarter ended 30th September 2025.

Income & Margins

Net Interest Income grew 5.41% YoY from Rs. 2,367.23 Cr to Rs. 2,495.24 Cr for the quarter ended on 30th September 2025. Total income of the Bank for the quarter grew by 3.75% YoY to reach Rs. 7,824.33 Cr. Earnings per share (EPS) annualized is Rs. 15.42 for the quarter. Net Interest Margin is at 3.06.

Key Ratios

ROA & ROE of the Bank for the quarter stood at 1.09% and 11.01% respectively.

Resilient Asset Quality

Gross NPA of the Bank as at the end of Q2 FY26 stood at Rs. 4,532.01 Cr, which as a percentage to Gross Advances stood at 1.83%. The Net NPA and Net NPA as a percentage to Net Advances, as on 30th September 2025 stood at Rs. 1,165.16 Cr and 0.48% respectively. Provision Coverage Ratio excluding Technical Write Off was 73.45 %.

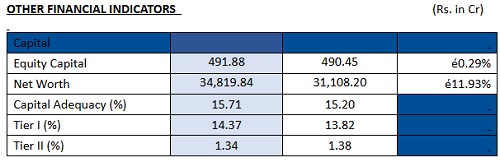

Net Worth & Capital Adequacy

Net worth of the Bank increased by 11.93% YoY, from Rs. 31,108.20 Cr to Rs. 34,819.84 Cr, as on 30th September 2025. Capital Adequacy Ratio (CRAR) of the Bank, computed as per Basel III guidelines stood at 15.71 % as at the end of the quarter.

Footprint

The total number of banking outlets come to 1595. The number of ATMs/ Recyclers as on 30th September 2025 is 2082 (incl mobile ATMs).

Above views are of the author and not of the website kindly read disclaimer

.jpg)