F & O Rollover Report - Axis Securities

NIFTY HIGHLIGHTS

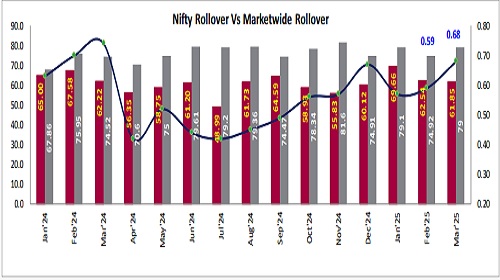

On Wednesday, the Nifty March rollover was at 61.9%, slightly down from 62.5% on the same day of the previous expiry and lower than both the three-month average of 62.7% and the six-month average of 62%, indicating a decline in rollover activity. The rollover cost in March stands at 0.68% as of Wednesday, compared to 0.59% on the same day of the previous expiry, indicating an increase in costs for traders this month. Bank Nifty’s March rollover stood at 69.3% on Wednesday, compared to 58.2% on the same day of the previous expiry, which is higher than the three-month average of 68.8% and the six-month average of 68.4%, reflecting a more substantial confidence among investors in the Bank Nifty. The market-wide March rollover stood at 79.0% on Wednesday, compared to 74.9% on the same day of the previous expiry, which is higher than the three-month average of 76.31% and the six-month average of 77.2%. This indicates a robust overall market participation. The option data for the March series indicates a strong Call Open Interest (OI) at the 24,000-strike price, followed by 23,800. In contrast, a substantial concentration of Put OI is observed at 23,000, with additional levels at 23,300. This suggests the likely range for the current expiry is between 23,300 and 23,800.

Nifty Rollover Vs Market wide Rollover

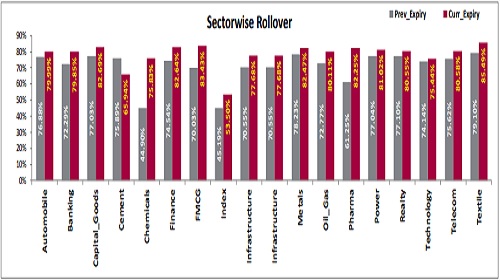

Stock & Sector Highlights

- Manappuram, Berger Paints, Supreme Industries, Cyient, and KPIT Technologies saw higher rollover on Wednesday compared to the same day of the previous expiry.

- IndusInd Bank, DMart, HCL Technologies, Eicher Motors, and Sun Pharmaceutical saw lower rollover on Wednesday compared to the same day of the previous expiry.

- The highest rollover in the current expiry for the day is seen in Lodha, Oil, Colgate-Palmolive, ICICI Lombard, and Crompton.

- The lowest rollover in the current expiry for the day is seen in IndusInd Bank, HCL Technologies, DMart, ACC, and OFSS.

Sector-wise Rollover

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633

More News

Monthly Technical Outlook & Picks - Axis Securities