F & O Rollover Report - Axis Securities

Nifty

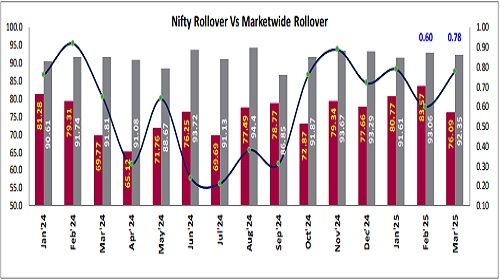

The Nifty March series rollover stood at 76.1% on Thursday, compared to 83.6% for the previous expiry, which is lower than the three-month average of 80.7% and the six-month average of 78.8%. On the other hand, the Bank Nifty March series rollover stood at 77.0% on Thursday, compared to 81.6% at the previous expiry, which is higher than the three-month average of 76.2% and the six-month average of 73.6%. As the April series begins, Nifty Futures show 14,073,750 shares in open interest, a drop from 17,639,400 shares in the previous series. This represents a reduction of 3,565,650 shares, accompanied by a 4.6% price increase. Meanwhile, Bank Nifty Futures commenced the April series with an open interest of 3,532,380 shares, compared to 3,459,570 shares in the previous series, representing an increase of 72,810 shares and a price gain of 5.8%. The Nifty's rollover cost in April was 0.8% on Thursday, up from 0.6% at the previous expiry, while that of Bank Nifty's rose to 0.6% from 0.5%, indicating rising costs for long positions. For the April series, the Option data shows a significant concentration of Call Open Interest (OI) at the 24,000 strike price, followed closely by 23,500 and 25,000. In contrast, the highest concentration of Put OI is at the 23,000 mark, with 22,500 and 23,500 following. This suggests a likely range for the series between 22,500 and 24,500, with 23,500 identified as a key level based on the current data.

Nifty Rollover Vs Market wide Rollover

Fii’s , Stock & Sector Highlights

- Bergepaint, Escorts, Manappuram, Supremeind, and Persistent saw higher rollover on Thursday compared to the same day of the previous expiry.

- Dmart, HCL Tech, BPCL, Sun Pharma, and Bharat Forge saw lower rollover on Thursday compared to the same day of the previous expiry.

- Fii’s Futures Index Long ratio for the current expiry is at 40%, up from 16% in the previous expiry, indicating an increase in long contracts and a potential bullish outlook.

- FIIs have initiated their positions in the current series with 60,054 contracts on the Future Index Long, an increase from 41,784 contracts in the previous expiry. In contrast, the Future Index Short begins with 90,609 contracts, a significant decrease from 215,318 contracts at the last expiry.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633

More News

Quote on Weekly Market by Krishna Appala, Sr. Research Analyst, Capitalmind Research

.jpg)