Evening Track : Gold stable at highs, market awaits Trump tariff impact by Kotak Securities Ltd

Comex Gold June futures is trading above $3,162 per ounce, ahead of US President Donald Trump’s implementation of sweeping “reciprocal” tariffs, which are expected to take effect later Wednesday which could escalate trade tensions and impact economic growth. Gold's appeal is bolstered by anticipated interest rate cuts, central bank acquisitions, and robust ETF demand, exemplified by the Chinese gold ETF's significant holdings increase. Weak U.S. economic data, including job and manufacturing reports, intensified market focus on Friday's nonfarm payrolls for Federal Reserve policy cues. The Institute for Supply Management's survey highlighted U.S. manufacturing contraction. Upcoming ADP employment data and non-farm payrolls are crucial for assessing the Fed's future rate adjustments.

WTI crude oil stabilized near $71/barrel, halting its recent rally as markets await impending US tariff announcements. Concerns persist that these tariffs, slated for Wednesday, will dampen demand. President Trump's tariff measures, potentially including tiered or reciprocal plans, introduce significant uncertainty. This development compounds existing market volatility stemming from potential supply disruptions due to sanctions on Russia and Iran, juxtaposed with OPEC's production increase. Simultaneously, a bipartisan US Senate group proposes further sanctions on Russia, contingent on its actions in Ukraine. These factors create a complex landscape, balancing supply concerns against potential demand reduction

LME base metals trading with a mixed bias on Wednesday, as copper managed to hold onto gains, rising 0.20% to $9,711/tonne, while aluminum, lead, and zinc drifted lower. Copper’s resilience was supported by China’s Caixin manufacturing PMI, which climbed to 51.2 in March, indicating steady industrial activity despite looming trade risks. However, gains remained capped as investors remained cautious ahead of U.S. President Donald Trump’s highly anticipated announcement on reciprocal tariffs, which are scheduled further during the day. The announcement could reshape global trade dynamics, with potential levies on metals, including copper. Market sentiment remained on edge, with traders weighing the risk of retaliatory measures and broader economic disruptions.

European natural gas prices stabilized around €42/MWh, reflecting market uncertainty amid fluctuating supply and demand. Refilling storage, currently at one-third capacity post-winter, remains a challenge, amplified by the cessation of Russian gas transit via Ukraine. While seasonal spread narrowing offers some relief, increased fuel sourcing is imperative. April's cooler temperatures may elevate heating demand, though rising renewable generation in Germany could mitigate this. Conversely, Norway's facility maintenance has commenced, curtailing crucial supply flows. The market is balancing these factors, assessing the impact on storage replenishment and short-term price dynamics.

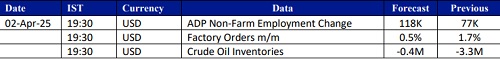

Today, Investors are now awaiting today’s the March ADP employment report, with expectations of 118,000 job increase, Factory Orders along with Crude oil inventories.

Above views are of the author and not of the website kindly read disclaimer

.jpg)