EcoCapsule Oct'25: Growth With (Purse) Strings Attached By SBI Capital Markets

EXECUTIVE SUMMARY

Tariffs established as the new abnormal though their disruptive edge is yet to fully cleave off economic realities

After months of uncertainty, US tariffs now appear set to stay — with evolving country and product coverage — though their full economic impact is still unfolding. Chinese exports to the US fell 33% y/y in Aug’25, but overall shipments rose 4.4%, indicating supply chain rerouting rather than disruption. Inflationary pressures have been shared largely by exporters and retailers, with consumers now beginning to feel the pinch. The US has refrained from duties on critical items like electronics and generic drugs, acknowledging key trade-offs. As tariff effects percolate through the economy, their long-term structural impact may be locked in before fully visible.

Global environment leading to diversification from USD as the world looks for alternate hard assets

The near-term fallout of recent US policy choices is still evolving, but their longer-term effects are becoming clearer. The erosion of US dominance is reflected in declining demand for US Treasuries — with global Central Banks now holding more gold than US Treasuries for the first time in 30 years. As the USD’s primacy wanes, precious metals have gained, though no credible reserve alternative has yet emerged. The CNY remains a distant contender, while growing political interest in cryptocurrencies signals a search for new anchors in the shifting global monetary order.

Race to rebalance investments could create a melting pot which is simmering with asset bubbles

Amid shifting capital flows across asset classes, a parallel transformation is unfolding in the real economy. Artificial intelligence has become the new investment frontier, with capital chasing unproven models under the belief that “AI can fund its own growth.” Valuations have surged, exemplified by OpenAI’s recent USD 500 bn valuation, making it the world’s most valuable private startup. Yet, many AI use cases remain speculative, and monetisation pathways are far from clear. For investors, discernment and measured optimism may prove more valuable than blind conviction in the AI narrative.

Domestic consumption expected to cushion the descent for growth in H2

India faces steep 50% US tariffs, prompting a pivot to domestic growth levers. Both the Union and States have amped up their capex in YTDFY26, which is set to reflect in GFCF. Realising that the backbone of an inward looking services economy like India is consumption, GST rate changes have been instituted coinciding with the festive season. As per CAIT, this will boost festive sales to Rs. 4.75 trn – an all-time record. Early signs of enthusiasm are reflected in auto retail sales, which showed strong growth on year during the Navarathri period.

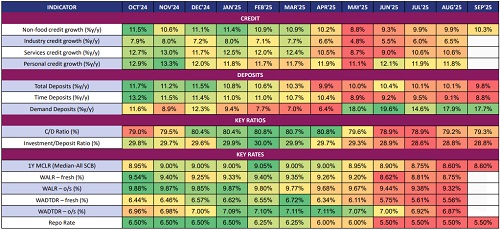

RBI ushersin a new era of (de)regulation to ease credit flow to productive sectors

With a view to improve credit access at a time when private capex is selective and corporate leverage is low, the Central Bank has taken several steps. This includes a draft proposal removal of the sector level cap on lending to large borrowers – which provides a relief to big players in times like now when banking rates may be favourable vis-à-vis the bond market. The restriction on banks from doing acquisition finance is also proposed to removed, along with greater lending limits for LAS, loans against units of REIT/InvIT, and removal of caps for lending against listed debt. Streamlining of risk weights for Basel III capital and a very gradual glide path towards ECL norms implementation also provide wiggle room. As an good omen in light of these auspicious developments, C/D ratio exceeded 80% for the first time in FY26 for the fortnight ended 19 Sep’25.

Equity markets buoyant on domestic investor interest despite scepticism of global investors

India remains amongst the busiest primary equity markets in CY25, with Oct’25 set to be a record month for issuances. This comes at a time when net FPI equity outflow was at USD 18 bn in YTDCY25. Plainly, domestic investors have shown a voracious appetite to mop up large issuances and reposed their faith in the markets even when foreign investors have stumbled. We expect primary market issuance in FY26 to be similar to FY25 levels.

A multipronged approach is being followed in India – capex is being done by the Government, eased tax norms are instituted to trigger private consumption, and principle based lending norms are in store to smoothen credit flow - to ameliorate global pressures. The message is – control the controllables and the uncontrollable shall become controllable.

MACROECONOMIC OVERVIEW

H1 GROWTH EXPECTED TO BE BETTER THAN H2

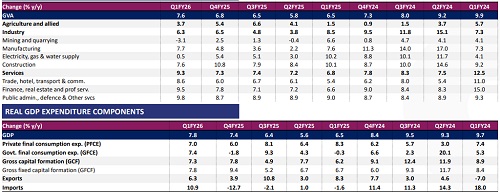

REAL GVA SECTORAL BREAK UP

* Real GDP growth outpaced market estimates, with domestic anchors like strong consumption and robust capital formation driving domestic it. This was despite crosswinds from muted trade and global tariff turmoil. Notably, manufacturing took the reigns of industrial growth, with services, led by financials, outshining other sectors

* Nominal GDP will remain challenged in FY26 as inflation sinks, and we expect an 8.5% y/y figure to register

INDIA ON BRINK OF FESTIVE PICKUP

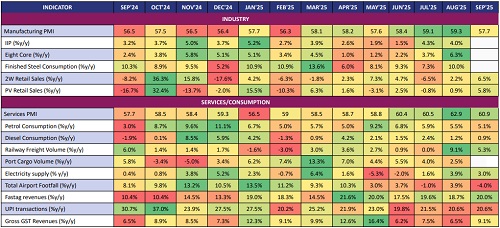

CONSUMPTION BEACON AUGMENTED BY FLASHING INDUSTRIAL GROWTH

Industrial growth likely springboarded on domestic resilience, despite global cues

* Manufacturing PMI of 57.7 in Sep’25 is suggestive of a strongly expansionary industrial output, as buoyant demand helps producers pass on commodity led input price hikes. Rising export orders reflect demand from Asia as punitive tariffs dent US demand.

* IIP’s strong growth in Aug’25 is supported by mining and electricity rebound, while eight core index grew at the strongest pace in over a year due to steel, cement and coal. Steel trade flows show divergence, with exports rising 54% y/y, while imports falling 31% y/y in Aug’25, as anti-dumping guardrails take effect.

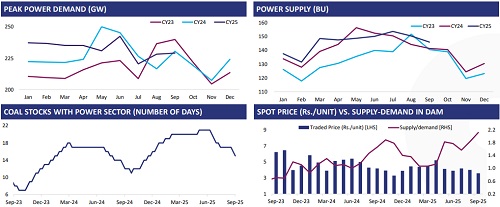

* Rainfall stood at 108% of LPA for the monsoon season, with North-West exceeding LPA by 27%. Despite that, power generation grew 3.2% y/y in Sep’25, with Western region leading charge, indicative of robust industrial activities even as cooling demand remains subdued. Robust mining activity is reflected in surge in power generation in Eastern region

GST reforms boost consumption at start of festive season, firecrackers to shower in Oct’25

* GST collections’ 9.1% y/y surge in Sep’25 is reflective of buoyant demand and efficient tax administration, despite tax cuts being passed on to consumers at accelerated pace. Robust eway bill generation and onset of festive season bodes well for consumption story

* Petrol and diesel sales corroborate with high freight movement and festive mobility in Sep’25

* Notably, according to Unicommerce, e-commerce volumes rose 21% y/y, while q-comm volumes rose 85% y/y in the 6-day festive season sale period, indicative of buoyant discretionary demand and consumer’s impulsive preference for instant delivery

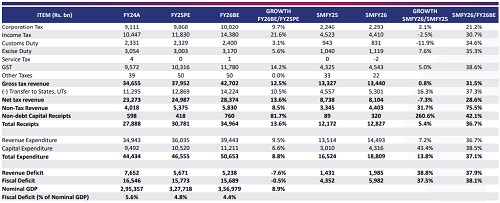

UNION MAINTAINS FISCAL PATH WITH BORROWINGS IN CHECK

* Gross tax revenues have remained flattish in 5MFY26 due to a fall in income tax collections being offset by moderate rise in corporation taxes and GST. GST relief provided is expected to lead to a shortfall of ~Rs. 480 bn

* Expenditure has steadily increased on both capital and revenue front as the Union has taken pole position once again in stimulating the GDP amidst lagging private capex. Nevertheless, with borrowings for FY26 expected to be ~Rs. 100 bn below BE, fiscal deficit goals are likely to be achieved

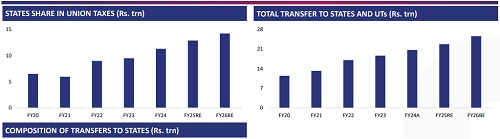

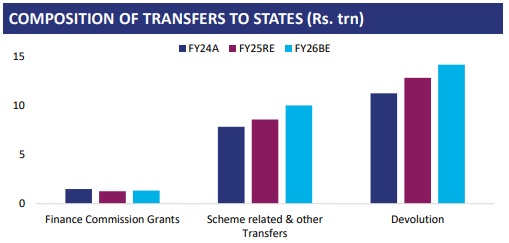

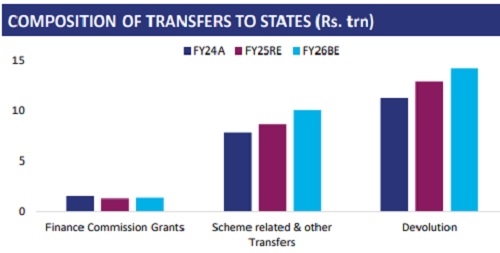

STATES RECEIVE EXTRA DEVOLUTION FROM THE UNION

* Union released an additional tax devolution of Rs. 1.01 trn to State governments. This is in addition to normal monthly devolution due to be released on 10 Oct’25. U{ received the highest allocation at Rs. 182 bn, followed by Bihar at Rs. 102 bn

* GST Compensation cess was effectively removed for most goods starting 22 Sep’25, with exceptions on sin products lasting only until loans raised for State compensation are fully repaid

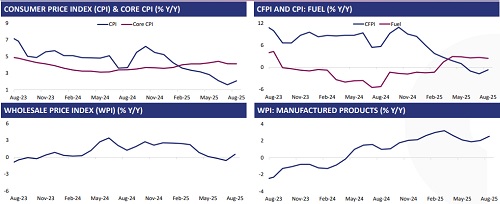

INFLATION CONCERNS HAVE RECEDED TO THE BACKGROUND

* CPI rose from its nadir to the lower end of the tolerance band driven by softer core inflation and lesser contractions in food inflation. MPC has slashed its target for headline CPI by 50 bps at 2.6% in FY26, with ample monsoon and reservoir levels aiding food inflation while GST cuts aide the Core

* WPI posted its first positive reading in 3 months as global commodity price hikes raised the ante for manufactured products, countered by decline in both primary articles and fuel & power. Notably, edible fats and oil seeds became dearer, while sharp corrections were seen in potato and onion prices

* CPI rose from its nadir to the lower end of the tolerance band driven by softer core inflation and lesser contractions in food inflation. MPC has slashed its target for headline CPI by 50 bps at 2.6% in FY26, with ample monsoon and reservoir levels aiding food inflation while GST cuts aide the Core

* WPI posted its first positive reading in 3 months as global commodity price hikes raised the ante for manufactured products, countered by decline in both primary articles and fuel & power. Notably, edible fats and oil seeds became dearer, while sharp corrections were seen in potato and onion prices

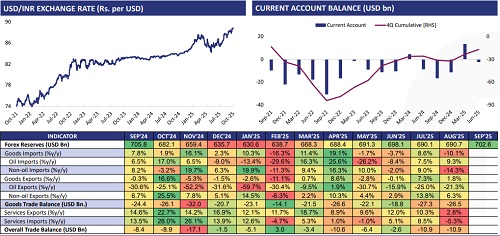

CURRENT ACCOUNT DEFICIT REMAIN MANAGEABLE DESPITE TRADE CONCERNS

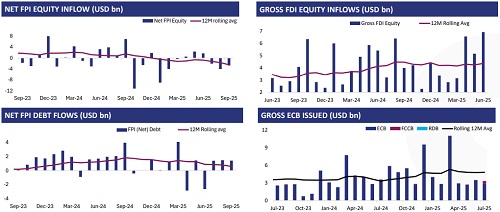

FII FLOWS DIVERGENT IN EQUITY AND DEBT???????

* FPIs withdrew USD 2.7 bn worth from domestic equities in Sep’25, taking the total outflow for 9MCY25 to USD 17.5 bn, its second highest since inception. The previous exodus in 9MCY22, to the tune of USD 22 bn, was due to breakout of Russia-Ukraine war and aggressive US rate hikes, offset to net USD 16.5 bn outflow in CY22, lower than current

* Debt inflows hit highest mark in 7-months, with copious flows through FAR securities, as elevated yields and strong fundamentals attracts patient capital

POWER DEMAND REMAINS MUTED IN SEP’25

* Power consumption rose 3.2% y/y to 145 BU in Sep’25. DAM prices fell 15% y/y to Rs. 3.6 /unit, as high renewable generation provided supply side liquidity.

* MNRE has proposed to include solar wafers under ALMM from Jun’28, provided there are atleast 3 independent manufacturers by then. Further, Union is expected to rebid ~40 GW of stalled RE projects in the absence of PPAs, where no notable investments have happened. In relief to discoms, GoM has discussed new reform-based scheme for debt restructuring

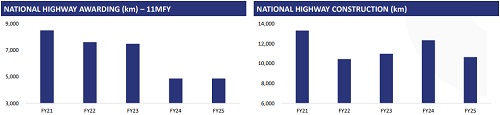

UNION AIMS TO REVAMP HIGHWAY CONCESSION AGREEMENTS

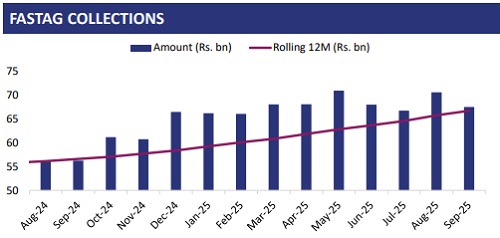

* FasTag collections rose 20% y/y in Sep’25, lower than the bumper collections of Aug’25

* Union tightened the bid provision framework for highway projects and introduced stringent criteria to improve execution, accountability and transparency

* According to media sources, Union is planning to introduce new model concession agreements, allowing investors to take entire risk of construction of greenfield highways and collect toll during concession

CREDIT GROWTH ON REDEMPTION PATH

Above views are of the author and not of the website kindly read disclaimer