Debt Outlook : MPC Cuts Rates, Keeps Neutral Stance to Balance Growth & Risks Says Puneet Pal, Head Fixed Income, PGIM India Mutual

Below the Quote on Debt Outlook by Puneet Pal, Head Fixed Income, PGIM India Mutual

For the debt market, February started with the Reserve Bank of India’s Monetary Policy Committee (MPC) unanimously reducing the policy repo rate for the first time in 5 years even as the monetary policy stance was retained at “Neutral”. The MPC decision to reduce rates, while retaining the monetary stance at neutral, is aimed at striking a balance between the need to support domestic growth and the increasing external risks which have manifested through the recent INR depreciation. The MPC statement projected CPI inflation to average 4.20%, and the GDP growth at 6.70%, for FY26. This was the first monetary policy meeting of the new RBI Governor, and his statement mentioned that the Flexible Inflation Targeting (FIT) framework has served the Indian economy well over the years, stating that the average inflation has been lower post the introduction of FIT. This statement ensures the continuous support of the RBI for the FIT, in light of earlier comments by the Chief Economic Advisor (CEA) on the need to have a relook at the FIT.

CPI inflation eased to 4.30% during January, compared to market expectations of 4.50% on back of lower food prices though the sequential momentum also came in lower. “Core inflation” remained below 4% and in light of the continuous downtrend in food prices, February’s inflation is expected to be lower than 4%. WPI inflation was also lower compared to market expectations coming in at 2.31% led by lower food inflation though “core” WPI inflation inched to a six-month high of 1%. Trade deficit widened to USD 23 bn for January, compared to USD 21.9 bn in December 2024, as exports moderated while imports remained steady. The Q3-FY25 GDP growth came in-line with expectations at 6.20%. CSO estimates FY25 growth at 6.50%, compared to 6.4% earlier, which implies Q4-FY25 growth at 7.60%, which appears optimistic.

The aggregate savings rate remained stable at 30.70% during FY24, which was similar to the reading for FY23. While physical savings reduced marginally to 13.0%, the financial savings improved to 5.2%, driven by a rise in net assets. Government savings moderated to -0.9% as fiscal consolidation continued while the private sector savings rate fell to 10.7%. The investment rate dropped to 31.4% (FY2023: 32.6%), largely led by moderation in corporate and household investments, even as the public sector and government investment rates improved.

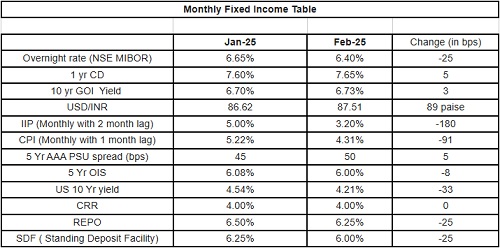

RBI continued with its proactive stance on liquidity management as it doubled the size of OMO purchases and bought a total of INR 80,000 cr worth of bonds. This is on top of INR 59,000 cr worth of OMO purchases in January, bringing the total OMO purchases in 2025 to INR 1,39,000 cr. Apart from the OMO purchases, RBI has also conducted FX Buy/Sell swaps of USD 15 bn, thus infusing a total liquidity of INR 2,70,000 cr since the beginning of 2025. The benchmark 10 yr bond yield ended the month at 6.73% rising 3 bps during the month, despite the RBI conducting aggressive OMO purchases. Profit booking from banks, expectations of a shallow rate cutting cycle, and INR weakness led to yields rising and the curve steepening. The longer segment of the yield curve underperformed as yields rose by 10 bps in the 40 yr segment. During February, INR continued on its depreciation path and ended the month at 87.51 depreciating 1.02% during the month. FPI flows were positive in debt with USD 1.44 bn inflows while equity market saw FPI outflows.

Money market yields remained under pressure despite lower overnight rates on back of liquidly infusion by RBI. The 1 yr maturity CD’s were trading around 7.65% and 3-month maturity CD yields were trading at 7.55% levels at month-end.

The OIS yields came down across the curve reacting to the liquidity infusion by RBI with the 1 yr and the 5 yr OIS yield coming down in tandem by 8 bps.

Globally, US bond yields tumbled with the benchmark 10 yr bond yield lower by 33 bps ending the month at 4.21% on back of softer economic data. Central banks continued to ease monetary policy though long bond yields rose in Europe, China and Japan.

We expect another rate cut by the MPC in its April meeting and we continue to expect further steepening of the yield curve with the shorter end of the curve (4-8 yrs) outperforming the longer end of the curve. We expect the benchmark 10 yr bond yield to continue to trade in a range of 6.60% to 6.80%.

Above views are of the author and not of the website kindly read disclaimer

More News

Perspective on RBI MPC Announcement by Vinit Bolinjkar- Head of Research at Ventura