Daily Derivatives Report By Axis Securities Ltd

The Day That Was:

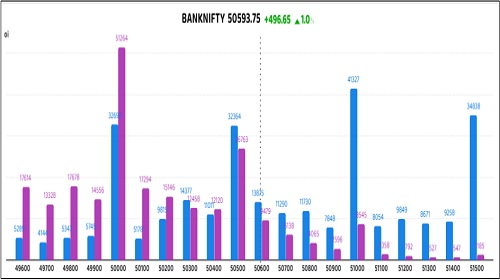

Nifty Futures: 23,379.85 (0.8%), Bank Nifty Futures: 50,593.75 (1.0%).

Nifty futures continued their impressive rally for the fifth consecutive session, closing up 180 points thanks to broad-based buying across multiple sectors, despite underwhelming global market conditions. All sectoral indices ended in positive territory, with the exception of consumer durables and metals, while oil & gas, media, and telecom sectors each rose by 2%. The Nifty recorded its best weekly performance after a notable 14% drop from its September highs, ending with a 4.27% weekly increase—the highest since February 2021. On Friday, the Bank Nifty index also closed positively, gaining 497 points, with a weekly gain of 5.1%. In currency updates, the Indian rupee appreciated by nearly 1% this week, strengthening by 39 paise to Rs 85.97 against the U.S. dollar. This represented a 1.45% appreciation over the last eight sessions, marking the longest streak since December 2021, as foreign portfolio investors transitioned from net sellers to net buyers in Indian equities for the second time this week. The Nifty futures premium increased to 29 points from 10, and the Bank Nifty premium decreased from 34 to 0 points.

Global Movers:

US stocks finished higher after a volatile day, with the S&P 500 and the Dow finishing 0.1% up and the Nasdaq 100 climbing 0.4%. The recovery in the final minutes of Friday helped both indexes avoid a fifth straight week of losses. Individual investors have continued to buy into the dip however, with data from JP Morgan showing that the group invested $12B into American stocks in the week ending Mar 19. Coming to other markets, the VIX dropped and ended below 20 for the third straight day, the dollar and the 10-year trsy yield rose, bitcoin fell, Gold fell 0.8% - the most since Feb 27 - while oil was flat just under $70/barrel.

Stock Futures:

In Friday's session, increased trading volumes and price action were seen among stocks such as Manappuram Finance, Hindustan Petroleum Corporation, Jindal Stainless Limited, and Voltas Limited, indicating heightened investor interest and strong momentum.

Manappuram Finance shares soared, reaching an all-time high with a 7.7% price increase, supported by unprecedented trading volume. This surge followed Bain Capital's announcement of a Rs 4,385 crore investment to acquire an 18% stake through a preferential allotment of equity and warrants at Rs 236 per share, a 30% premium. This deal establishes Bain Capital as a joint promoter, pending regulatory and shareholder approvals, and includes a seat on the board. Concurrently, a significant 42.2% drop in open interest occurred, representing a short covering of 325.7 lakh shares—the year's largest single-day decrease. The combined price rise and a sharp decline in open interest indicate a large amount of short squeeze amid positive news flow, suggesting a potential for continued upward price movement for near term.

Hindustan Petroleum Corporation's stock experienced a significant 6.3% rally, culminating in a two-month high and the largest single-day percentage gain since June 2024, accompanied by record monthly trading volumes. This surge was fueled by the recent enactment of the Oilfields (Regulation and Development) Bill, 2024, by the Indian Parliament, which promises fiscal stability and ease of business for oil and gas companies, notably eliminating concerns over new taxes, such as a windfall profits tax. In tandem with this price surge, open interest contracted by 4.4%, a reduction of 25.2 lakh shares, marking the first decline after futures open interest reached a series high. This substantial open interest reduction, the largest single-day unwinding in the current series, strongly indicates aggressive short covering. The confluence of this accelerated short covering and the record trading volume signals a strong bullish sentiment, suggesting a high probability of continued near-term price appreciation.

Jindal Stainless Limited's stock experienced a sharp 4.8% decline, reaching a new weekly low and the lowest close in ten trading sessions. This downturn followed the announcement of Anurag Mantri's resignation as Executive Director and Group CFO, effective April 4, 2025. Concurrently, open interest surged by 21%, adding 10.8 lakh shares, pushing futures open interest to a three-month peak. This was accompanied by record yearly highs in both call and put option open interest. The combined surge in futures and options open interest strongly suggests a substantial build-up of new short positions, reflecting a significant increase in bearish sentiment.

Voltas Limited's stock price declined by 3.2%, coinciding with a 14.9% surge in open interest, adding 14.2 lakh shares—a monthly high—signalling a significant short build-up. Despite promising volume growth potential due to record-breaking warm temperatures in India, HSBC lowered its target price by 15%, expressing concerns about margin recovery, rising costs, and competitive pressures that could potentially overshadow the expected summer volume surge. The synchronised price drop and increase in open interest indicate a strong bearish market positioning. Further price declines accompanied by rising open interest would solidify investor conviction in the anticipated negative impact of production costs and competitive pressures.

Put-Call Ratio Snapshot:

The Nifty put-call ratio (PCR) fell to 1.15 points from 1.16 points, while the Bank Nifty PCR rose from 1.17 points to 1.26 points.

Implied Volatility:

Titagarh Rail Systems and Steel Authority of India have shown significant fluctuations in their stock values, as reflected by their high implied volatility ratings of 100 each. Currently, their implied volatilities are at 59% and 87%, indicating that the increase in implied volatility makes options for these stocks more expensive. Consequently, traders may resort to hedging strategies to mitigate risks associated with price changes. In contrast, IRFC and HDFC Life Insurance have achieved the lowest implied volatility scores of 2 and 10, respectively, with implied volatilities (IVs) of 28% and 26%. This reduced volatility indicates that their options are relatively more attractive, presenting a favorable opportunity for traders interested in long positions.

Options volume and Open Interest highlights:

IndusInd Bank and Computer Age Management Services are attracting significant attention from traders, as reflected by their impressive call-to-put volume ratios of 6:1 each, indicating a generally positive market sentiment. However, these ratios may also reveal diverse and opposing perspectives among investors. Conversely, Torrent Pharmaceuticals and HCL Tech are witnessing an increase in put option volumes relative to call options, suggesting heightened concern about possible market downturns. Regarding positioning, Jindal Stainless and KEI Industries boast the highest open interest in both call and put options. Furthermore, in terms of call options, Computer Age Management Services leads, while BSE tops the list for put options, signalling a higher probability of future price fluctuations. (This data considers only those stock options that saw a minimum of 500 contracts traded on the day for both calls and puts).

Participant-wise Open Interest Net Activity:

The index futures market experienced a moderate contraction in client-long positions, decreasing by 20,051 contracts —a less severe decline than the previous session's 23,039. Conversely, Foreign Institutional Investors (FIIs) demonstrated a robust, albeit marginally reduced, accumulation of 14,355 contracts, signalling continued bullish conviction. Proprietary traders further bolstered this positive sentiment with a notably amplified addition of 5,133 contracts, a significant upswing from the prior session's 1,693. In the stock futures segment, a lessened deceleration in client long positions, with a reduction of 44,823 contracts compared to the previous 57,029, suggests a potential stabilisation or a waning bearish momentum. Similarly, FIIs maintained a substantial, though diminished, buying interest, adding 29,783 contracts. However, proprietary traders exhibited a sharper reduction in long positions, decreasing by 9,435 contracts —a considerable moderation from the previous decline of 46,723 contracts.

Securities in Ban for Trade Date 24-March-2025:

1) HINDCOPPER

2) INDUSINDBK

3) POLYCAB

Nifty

Bank Nifty

Stocks with High IVR:

Stocks with Low IVR:

Stocks With High IVP:

Stocks With Low IVP:

Stocks With High Call Volume To Put Volume

Stocks With High Put Volume To Call Volume

Call Open Interest Relative to Record High

Put Open Interest Relative to Record High

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633