Daily Derivatives Report By Axis Securities Ltd

The Day That Was:

Nifty Futures: 24,373.0 (-0.3%), Bank Nifty Futures: 55,326.4 (-0.4%).

Nifty Futures concluded Thursday’s session with a marginal decline of 67 points, following a substantial upward trend over the previous seven trading sessions. After a tumultuous initial hour characterised by significant price fluctuations, although in a narrow range, the major indices settled in negative territory for the remainder of the session, ultimately closing near the day's lowest point. This occurred despite the session being a monthly Futures and Options (F&O) expiry, a time when volatility typically intensifies in Index options and particularly for stocks within the F&O segment due to increased rollover activities. Declines were observed in the Real Estate, FMCG, and Consumer Durables sectors, while the Pharmaceutical and Metal sectors exhibited gains. Market participants largely overlooked UBS's recent upgrade of its outlook on Indian equities to "neutral" from "underweight". In the forex market, the Indian Rupee rebounded from initial losses, ultimately appreciating against the US Dollar on Thursday, despite a concurrent rise in crude oil prices as the dollar index experienced a slight decline. The domestic currency concluded the day stronger, gaining 15 paise to close at 85.27, recovering from a prior closing value of 85.42 against the greenback. Furthermore, the India VIX, which serves as a bellwether for market volatility, remained relatively stable at 16.25%, reflecting an increase of 0.3 points. The Nifty futures premium for May expiry increased to 126 points, whereas the Bank Nifty premium dropped from 187 to 125 points.

Global Movers:

US stocks climbed for a third day, led by technology shares. The S&P 500 rose 2%, while the Nasdaq 100 climbed 2.8%. The S&P has posted three days of gains of at least 1.5%, which is the longest such run in over 50 years. Meanwhile, President Trump said that the US was in talks with China, which has reiterated that full rollbacks on unilateral tariffs are needed. Stocks also benefited from increasing bets that the Fed will cut rates should job losses increase. In markets, the VIX fell around 7% for the second straight day, the dollar dropped 0.5%, the 10-year treasury yield declined for the third session, bitcoin fell slightly, gold advanced for the first day in three, while nymex oil rose on comments from the US energy secretary that trade war concerns are going to be temporary.

Stock Futures:

During the prior trading session, Divi's Laboratories, Dalmia Bharat, Syngene International, and Hindustan Unilever witnessed significant volume expansion coupled with heightened price volatility. This confluence suggests robust market dynamism and elevated investor participation in these counters.

Divi's Laboratories experienced a robust 4.9% intraday surge, its most significant single-session gain since early October 2024, fueled by unprecedented trading volumes over the past seven months. This bullish momentum was underpinned by Citi's reiterated 'Buy' rating, projecting a substantial 19% upside and naming Divi's its top pharmaceutical sector pick. The price appreciation coincided with a Long Addition, evidenced by a 33.8% increase in open interest, excluding the expired April series. Current futures open interest stands at 29,557 contracts, incorporating a fresh addition of 750,000 shares. Concurrently, a notable contraction in put option activity drove the put-call ratio down sharply to 0.50, indicating a reduction in hedging strategies amidst bullish sentiment, potentially amplified by the monthly F&O expiry.

Dalmia Bharat recorded a significant 4.5% intraday advance, marking its largest single-session percentage accretion since September 2023, accompanied by a three-month peak in traded quantity. This upward trajectory followed the disclosure of its financial outcomes for the fourth quarter of fiscal year 2025, wherein consolidated net earnings expanded by 38.09%. Nevertheless, operational revenue contracted by 5.01% year-over-year, sales volume diminished by 2.27%, and pre-tax profit augmented by 32.67%. Earnings before interest, taxes, depreciation, and amortization (EBITDA) escalated by 21.25%, resulting in an enhanced EBITDA margin of 19.4%. The counter experienced a Long build-up, characterized by both price appreciation and a 14.7% expansion in open interest. The present futures open interest is 11,248 contracts, with a further accumulation of 400,000 shares in open interest. Examining option positioning reveals a total call open interest of 2,413 contracts and a put open interest of 1,046 contracts, reflecting reductions of 1,801 and 2,250 contracts, respectively. Consequently, the put-call ratio (PCR) compressed from 0.78 to 0.43, while the stock's rollover stood at a robust 92.8%, up from 87.5%.

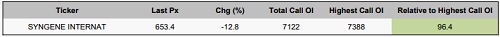

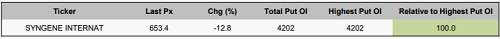

Syngene International witnessed a significant 12.7% intraday plunge, its most substantial single-day erosion in value coupled with record-breaking volume since its market debut. This sharp downturn followed the announcement of its fiscal year 2025 reporting quarter's standalone net earnings, which contracted by 8.11%. Although the quarter's revenue reached ?1,018 crore, representing an 11% year-over-year expansion from ?916.9 crore, it fell short of Street projections of ?1,066 crore. The company also cautioned about impending pressure on profitability, citing a volatile macroeconomic landscape and the assimilation of recent capital expenditure. SYNGENE registered a Short Addition, characterized by a price decline and a substantial 66.8% surge in open interest, excluding the expired April contracts. The current open interest in the future stands at 9,602 contracts, with a fresh accumulation of 3,850 contracts, both marking the highest levels observed this year. These metrics collectively underscore a bearish outlook for the stock, potentially influenced by fundamental updates and broader market dynamics.

Hindustan Unilever registered a notable 3.8% erosion in value, its most significant single-session percentage drop in the past half-year. This downturn was sparked by a fiscal year 2025 earnings report, revealing a 3.7% year-over-year increase in net earnings, alongside a 2.4% rise in operational revenue. However, during the investor briefing, the stock reversed its post-earnings gains, following management's indication of future gross margin moderation as the company focuses on maintaining its price-value proposition. This announcement precipitated a short addition in the stock, accompanied by a price contraction and a 38% expansion in open interest, excluding expired April contracts. The present futures open interest stands at 57,064 contracts, incorporating a new accumulation of 4.7 million shares, thereby elevating the stock's futures open interest to its current year peak. Simultaneously, the Put-Call Ratio (PCR) edged up to 0.67 from 0.74, while implied volatility experienced a 6% or 1.5-point decline to 22.5%. A surge in futures open interest, coupled with declines in implied volatility and the Put-Call Ratio, could indicate brewing uncertainty in stock.

Put-Call Ratio Snapshot:

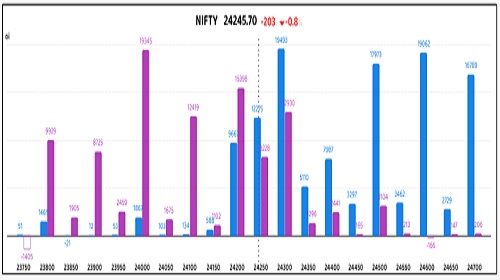

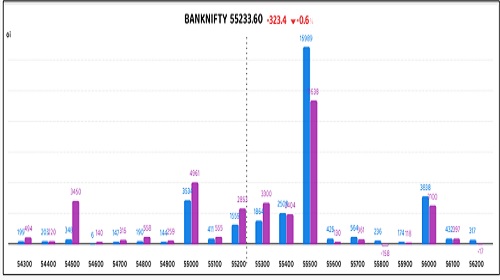

The Nifty put-call ratio (PCR) for May expiry fell to 1.03 from 1.15 points, while that of Bank Nifty PCR fell from 1.2 to 1.16 points.

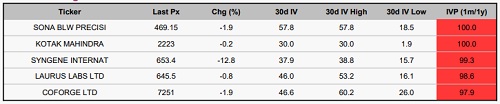

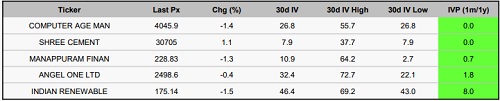

Implied Volatility:

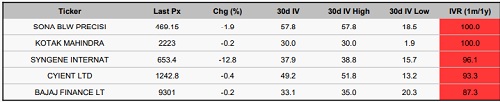

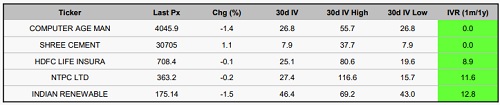

Kotak Bank and Sona Blw Precision Forgings have experienced significant shifts in their stock prices, evident from their elevated implied volatility rankings. The increase in implied volatility to 30% for Kotak Bank and 58% for Sona Blw Precision Forgings suggests that options are becoming pricier, leading traders to explore risk management strategies to counteract price swings. Conversely, CAMS and HDFCLIFE Insurance display the lowest implied volatility rankings, with IVs at 27% and 25%, respectively. This decrease in volatility indicates their options are comparatively more attractive, offering a favourable chance for investors seeking to establish long positions.

Options volume and Open Interest highlights:

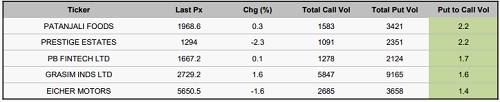

Divi's Laboratories and Adani Energy Solutions are experiencing a positive outlook, as evidenced by call-put volume ratios of 4:1 for both. This signifies robust demand for call options, indicating expectations of increasing prices. However, a pronounced call skew could imply potential overvaluation. In contrast, Grasim Industries reports a put-call volume ratio of 2:1. At the same time, Eicher Motors has seen a rise in put volume activity, indicating a cautious sentiment amid worries about potential price drops. Nevertheless, extremely high put volumes might suggest an oversold market, presenting potential contrarian buying opportunities. Regarding positions, Syngene International is the only stock that has shown significant open interest in both call and put options, suggesting potential price volatility that could act as resistance or drive prices upward. (This data considers only those stock options that saw a minimum of 500 contracts traded on the day for both calls and puts).

Participant-wise Open Interest Net Activity:

In index futures, of the total 45,931 contracts that witnessed a change, clients exhibited a notable reduction of 23,847 contracts, highlighting a cautious stance or reduced participation. In stark contrast, Foreign Institutional Investors (FIIs) aggressively expanded their positions, adding 45,931 contracts, which was evident in their Long–Short ratio jumping from 0.49 to 0.69, signalling bullish intent or strategic repositioning. Meanwhile, proprietary traders curtailed their exposure by 19,375 contracts, possibly indicating risk aversion or profit-booking. In the stock futures segment, a broader movement involving 276,156 contracts revealed divergent strategies. Clients pared their positions by 8,569 contracts, while FIIs marked a substantial decline of 186,855 contracts, underscoring a potentially bearish outlook or reallocation of resources. Conversely, proprietary traders displayed significant confidence, accumulating 276,156 contracts, likely reflecting a calculated bet on specific opportunities.

Securities in Ban for Trade Date 25-April-2025: NIL.

Nifty

Bank Nifty

Stocks with High IVR:

Stocks with Low IVR:

Stocks With High IVP:

Stocks With Low IVP:

Stocks With High Call Volume To Put Volume

Stocks With High Put Volume To Call Volume

Call Open Interest Relative to Record High

Put Open Interest Relative to Record High

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633

More News

Quote on Pre-Market Comment 29th December 2025 by Aakash Shah, Technical Research Analyst, C...