Daily Derivatives Report 30 June 2025 by Axis Securities Ltd

The Day That Was:

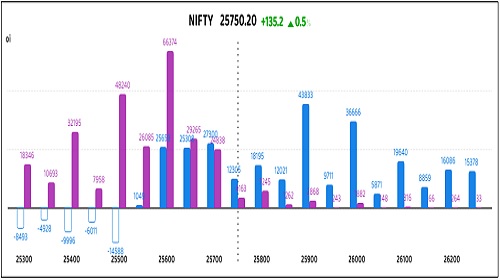

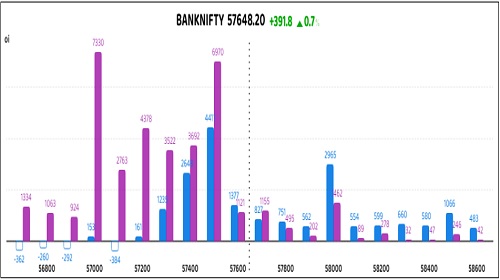

Nifty Futures: 25,750.2 (0.5%), Bank Nifty Futures: 57,648.2 (0.7%).

On Friday, Nifty Futures advanced by 135 points, and Bank Nifty Futures surged by 392 points, as both benchmark indices extended their fourth consecutive session of gains. This upward trajectory was primarily fuelled by the announced ceasefire between Israel and Iran, which significantly relieved geopolitical tensions and subsequently drove oil prices lower. The easing of these tensions fostered a strong risk-on sentiment among investors. Bank stocks were particularly robust, propelling the Nifty Bank index to a fresh all-time high. However, the upside in the broader market was partially capped by lingering concerns over upcoming tariff deadlines. Sectoral performance was mixed: Oil & Gas, Pharma, and PSU Bank shares registered advances, while Realty, Consumer Durables, and IT shares experienced declines. The India VIX, a key indicator of market volatility expectations, receded by 1.60%, settling at 12.39, while concurrently, the Indian rupee strengthened significantly, appreciating by 21 paise to close at 85.47 per dollar on Friday, marking its best weekly performance in two and a half years against the U.S. dollar compared to Thursday's close of 85.70. Nifty Futures premium increased significantly to 112 points from 66 points, while Bank Nifty Futures premium jumped dramatically from 50 to 204 points.

Global Movers:

US stocks rose, with the S&P 500 rising 0.5% to a new record as investors brushed off fears of a trade war with Canada. Meanwhile, the Nasdaq 100 scaled another record as it advanced 0.4%. Elsewhere, President Trump said that he was halting discussions with Canada as the latter levied a digital services tax on the US and threatened that he will announce new tariff rates for its neighbour as early as next week. He also added that the US had made agreements with a few countries and that the July 9 deadline could be extended or shortened. In economic data, the Fed's preferred inflation gauge -- core PCE -- rose 0.2%, slightly more than expected. Coming to related markets, the VIX fell for the sixth straight day, the dollar index and the 10-year Treasury yield rose for the first time in six sessions, gold prices fell for a second week, while brent crude prices were mostly flat and on track to suffer their worst weekly plunge in two years.

Stock Futures:

Market indicators pointed toward a shift in sectoral sentiment on Friday, evidenced by heightened volume and volatility in key counters—namely Adani Total Gas, Hindustan Petroleum, Phoenix Mills, and AB Capital. The activity suggests rotation or revaluation within these sectors.

Adani Total Gas Ltd. (ATGL) recently experienced a robust uptrend, extending a five-session winning streak with a cumulative gain of nearly 11%, propelled by a surge in trading volume. This bullish momentum was primarily catalysed by the unveiling of a strategic alliance between Adani Total Gas and Jio-BP, a joint venture between Reliance Industries and BP. Concurrent with this price appreciation, in Friday's session, ATGL witnessed a short covering, marked by a 5.6% price gain and a marginal 0.7% decrease in open interest, with current futures open interest standing at 5,537 contracts, representing a shedding of merely 36 contracts. Regarding options positioning, the aggregate open interest in call options registered 3,901 contracts, outpacing the 1,979 contracts in put options, reflecting an addition of 2,710 call contracts and 1,293 put contracts. This derivatives data suggests that while futures participants observed a modest unwinding, option market activity indicates a majority of call buying interest, potentially signalling bullish sentiment among option buyers, even as option writers absorbed this increased demand.

Hindustan Petroleum Corp. Ltd. (HPCL) exhibited a robust upward trajectory, extending its positive trend with an impressive gain exceeding 11% over the past week, bolstered by elevated trading volumes. This optimistic sentiment primarily emanates from the recent downturn in crude oil prices, which have receded to pre-Middle East tension levels, directly benefiting Oil Marketing Companies (OMCs) such as HPCL through enhanced marketing margins and reduced input costs. HPCL experienced a long addition, evidenced by a 4.2% price gain and a significant 9.5% increase in open interest, bringing current futures open interest to 25,348 contracts, an addition of 2,205 new contracts, equivalent to 44.7 Lc shares in open interest. Furthermore, the futures closed at a 2.05-point premium to the spot price, marking a 0.9-point decrease from the prior session's 2.95-point premium. In terms of options positioning, the aggregate open interest in call options reached 5,121 contracts, surpassing the 4,491 contracts in put options; however, new additions in put options totalled 1,320 contracts, outpacing the 245 contracts added to call options. This derivative's dynamic suggests that while futures participants initiated fresh long positions, option market activity indicates a notable increase in put buying, possibly reflecting a heightened demand for downside protection among option buyers.

Phoenix Mills Ltd. (PHOENIXLTD) experienced a downturn in Friday’s session, marked by increased trading volume. This recent dip occurred despite the company's ongoing expansion initiatives, encompassing new area additions and strategic brand repositioning aimed at future-proofing its revenue streams. However, the current decline is potentially attributable to the subdued performance of the Nifty Realty index, which has underperformed the broader market rally, thereby contributing to the stock's negative momentum. PHOENIXLTD witnessed a long unwinding, characterised by a 3.5% price decrease and a marginal 0.3% reduction in open interest. Current futures open interest stands at 9,764 contracts, reflecting an unwinding of a mere 25 contracts. In terms of options positioning, total open interest in call options reached 1,124 contracts, surpassing the 924 contracts in put options, consequently driving the Put-Call ratio down to 0.82 from 1.14. Notably, call options saw an addition of 691 contracts, compared to 430 contracts added in put options. This derivatives activity suggests that while futures participants engaged in a modest unwinding of long positions, option market dynamics indicate a pronounced increase in call buying interest, potentially signalling a speculative view on future price recovery among option buyers, or call writing from option-savvy traders.

Aditya Birla Capital Ltd. (ABCAPITAL) experienced a downward movement, reversing a five-day streak of gains, accompanied by a decline in investor participation, evidenced by lower trading volumes. A pivotal factor contributing to this decline was the unfolding news of a cyber fraud incident involving the Aditya Birla Capital Digital Limited (ABCD) app, wherein ~Rs 2 Cr worth of digital gold was illicitly sold from 435 customer accounts, instilling a cautious sentiment, notwithstanding the company's confirmation that affected accounts were restored and balances replenished. ABCAPITAL witnessed a long unwinding, characterised by a 2.5% price decrease and a 3% decrease in open interest. Current futures open interest stands at 17,389 contracts, reflecting an unwinding of 537 contracts, translating into 16.6 Lc shares in open interest. In terms of options positioning, the aggregate open interest in call options reached 5,927 contracts, outpacing the 3,924 contracts in put options, consequently driving the Put-Call ratio to 0.66, its lowest in the last three series. Notably, there was a significant addition of 888 contracts in call options, compared to a mere 51 contracts added in put options. This derivatives landscape suggests that while futures participants engaged in a pronounced unwinding of long positions, option market activity indicates a massive accumulation of call options, potentially reflecting a contrarian bullish conviction among option buyers.

Put-Call Ratio Snapshot:

The Nifty put-call ratio (PCR) fell to 1.25 from 1.28 points, while the Bank Nifty PCR marginally dropped from 1.14 to 1.13 points.

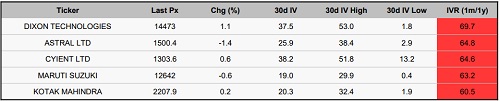

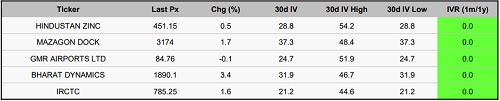

Implied Volatility:

Dixon Technologies (India) and Astral Ltd show significant stock price volatility, indicated by high implied volatility (IV) scores of 70 and 65. Currently, Dixon's IV stands at 37%, and Astral's at 26%. This increase in IV has raised option premiums, prompting traders to modify their risk management approaches to adapt to market changes. Conversely, Mazagon Dock and Hind Zinc are more stable, with the sector's lowest IV scores—37% for Mazagon Dock and 29% for Hind Zinc. Their steady volatility makes them attractive options for investors seeking long positions amid increased market uncertainty and volatility.

Options volume and Open Interest highlights:

Adani Green and Birlasoft are showing strong bullish signals, with call-to-put ratios of 4:1, suggesting trader optimism about short-term price gains. However, such high ratios might also indicate overvaluation in the options market, so caution is recommended for those looking to open new long positions. Conversely, Dabur India and Apl Apollo Tubes seem more cautious, exhibiting higher put-to-call ratios and increased put trading, which reflect investor concerns about possible declines. While this could point to bearish sentiment, the rising put volume may also signal oversold conditions, creating contrarian opportunities for traders expecting a reversal. Regarding positions, UNO Minda holds significant open interest in call options, followed by JIO Finance in both call and put options, hinting at expected price movements that could define key resistance or support levels. These patterns suggest potential sharp market swings, favouring strategies that capitalise on volatility. (This data considers only those stock options that saw a minimum of 500 contracts traded on the day for both calls and puts).

Participant-wise Open Interest Net Activity:

On Friday, a notable divergence in positioning emerged across equity derivatives, offering critical insights into prevailing market sentiment. In index futures, the market witnessed a total change of 2700 contracts. This movement was primarily driven by a significant reduction of 2700 contracts by clients, indicating a decidedly bearish stance or a move to de-risk. Conversely, Foreign Institutional Investors (FIIs) exhibited a clear bullish bias by adding a substantial 1449 contracts, while proprietary traders also displayed a positive outlook, increasing their positions by 569 contracts. This stark contrast in index futures positions – a complete client unwinding against active accumulation by institutional and proprietary participants – suggests a complex interplay of risk perception and directional conviction. In the stock futures segment, a much larger volume of 48260 contracts changed hands, reflecting broader activity and potentially more granular sentiment. Here, clients demonstrated a clear optimistic bias, significantly augmenting their long positions by 11051 contracts. FIIs further amplified this bullish momentum with a substantial addition of 31338 contracts, underscoring their confidence in specific equity movements. Proprietary traders, too, contributed to the positive sentiment by adding 5871 contracts. The simultaneous increase in long positions across all participant categories in stock futures—clients, FIIs, and proprietary traders—signals a widespread bullish outlook on individual equities.

Securities in Ban for Trade Date 30-June-2025: NIL

Niftya

Bank Nifty

Stocks with High IVR:

Stocks with Low IVR:

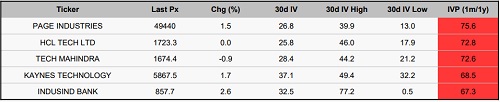

Stocks With High IVP:

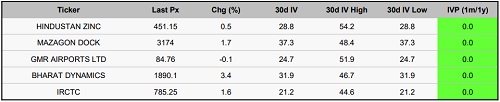

Stocks With Low IVP:

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633

.jpg)