Daily Derivatives Report 28th November 2025 by Axis Securities Ltd

Nifty Futures and Bank Nifty Futures extended their winning streak for a second consecutive session, driven by continued optimism regarding potential US and domestic interest-rate cuts next month, which spurred fresh buying and supported risk appetite. Nifty Futures rose 9.7 points and Bank Nifty Futures climbed 214.6 points, closing with modest gains after both indices briefly scaled fresh all-time highs intraday before trimming gains into the close, suggesting profit booking at elevated levels. This domestic exuberance was tempered by concerns over global economic growth and European indices trading in the red during the latter half of the Indian trading session, which acted as a headwind and contributed to the profit booking. The derivatives segment showed distinct positioning: Nifty Futures' rise was accompanied by a decrease in open interest by 1.06 lakh shares (a reduction of 0.7%) to 148.21 lakh shares, indicating Short Covering. In contrast, Bank Nifty Futures saw its gain coupled with an increase in open interest by 1.17 lakh shares (an increase of 7.4%) to 16.87 lakh shares, pointing to Long Build Up. The Nifty premium saw a marginal decline to 175 from 176 points, while the Bank Nifty premium increased from 289 to 295 points. Sectoral rotation was evident as Media, Private Bank, and IT stocks advanced, while Oil & Gas, Realty, and Consumer Durables declined. Market volatility, as measured by the India VIX, tumbled 1.52% to 11.79. Meanwhile, the Rupee declined 8 paise to close at 89.22 against the US Dollar, after settling flat on Wednesday, as market participants keenly anticipate the upcoming Q2 GDP numbers and the RBI policy meeting, which are acting as a near-term catalyst or source of caution for fresh market direction.

Global Movers:

U.S. equity markets concluded a strong run, extending a four-day rally that saw major indices clinch fresh highs ahead of the Thanksgiving holiday closure. The Dow Jones Industrial Average surged 315 points (0.7%) to close at 47,427. The S&P 500 also advanced, gaining 0.7% to settle at 6,813, while the tech-heavy Nasdaq Composite rose 0.8% to finish at 23,215. This bullish sentiment was largely fueled by increasing market certainty regarding future monetary policy. Financial markets have now priced in an approximate 85% probability of the Federal Reserve implementing an interest rate cut at its December meeting. In the bond market, the yield on the 10-year U.S. Treasury retreated to 4 %. In the commodities complex, Gold futures were above the $4,200 per ounce mark, burnishing their safe-haven appeal on rate-cut optimism, while WTI Crude Oil was trading near $58.48 per barrel.

Stock Futures:

Ashok Leyland Ltd. surged to a fresh 52-week high, propelled by strong volumes and bullish sentiment after board approval for the HLFL-NDL Ventures merger, a move seen as corporate simplification that typically commands market re-rating. The stock registered a Long Addition with a 4.5% price gain and 10.3% rise in open interest, with futures OI at 25,669 contracts and 2,398 new additions. The PCR climbed to 0.88 from 0.77, while options data showed call OI at 9,560 and put OI at 8,380, with incremental additions of 4,007 and 4,125 respectively. The balanced build-up in both sides signals heightened speculative activity, with option buyers positioning for volatility and writers maintaining a cautious stance.

Samvardhana Motherson International Ltd. (Motherson) rallied to a new 52-week high, extending gains for a third straight session as auto ancillary tailwinds and upbeat analyst coverage fueled momentum despite no immediate company-specific trigger. The stock saw a Long Addition with a 3.9% price rise and 10.3% increase in open interest, with futures OI at 28,380 contracts and 2,657 new additions. Futures closed at a premium of 1.49 points to spot, up from 1.42 previously. Options positioning reflected call OI at 7,244 and put OI at 4,544, with additions of 1,250 and 830 respectively. The skew toward calls highlights bullish bias among buyers, while sellers appear to be conceding ground to sustained upward momentum.

Kaynes Technology India Ltd. (Kaynes) retreated sharply, under pressure from elevated working capital needs and delayed receivables, notably from PGCIL, tempering sentiment despite long-term optimism. The stock recorded a Short Addition with a 3.9% price decline and 22% rise in open interest, with futures OI at 21,839 contracts and 3,941 new additions. Futures premium narrowed to 59.5 points from 68.5, reflecting reduced confidence. Options data showed call OI at 20,650 and put OI at 8,993, with additions of 8,229 and 2,335 respectively. The heavy call build-up against weaker price action suggests aggressive bearish positioning by writers, while buyers remain exposed to downside risk.

LTIMindtree Ltd. (LTIM) advanced on sector-wide optimism as easing US rate concerns lifted the Nifty IT index and bolstered outlook for global technology services. The stock posted a Long Addition with a 2.2% price gain and 10.7% rise in open interest, with futures OI at 15,658 contracts and 1,512 new additions. The PCR rose to 0.64 from 0.53, while options data showed call OI at 4,248 and put OI at 2,738, with additions of 1,095 and 1,080 respectively. The near-equal build-up across calls and puts reflects balanced positioning, with buyers anticipating continued momentum and writers hedging against sector-driven volatility.

Put-Call Ratio Snapshot:

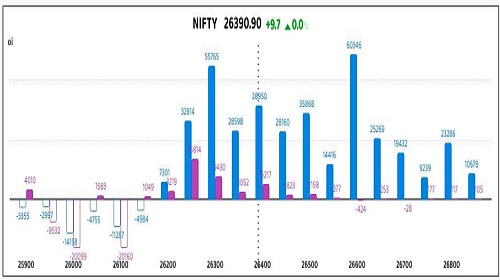

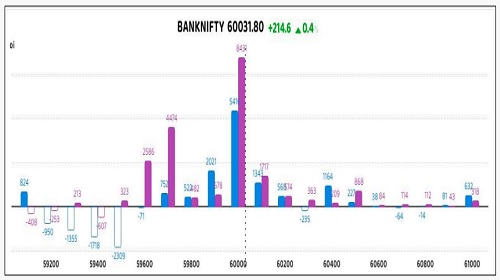

The Nifty put-call ratio (PCR) fell to 1.16 from 1.45 points, while the Bank Nifty PCR rose from 1.18 to 1.2 points.

Implied Volatility:

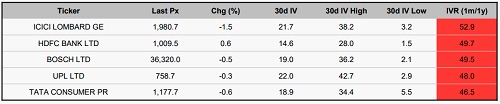

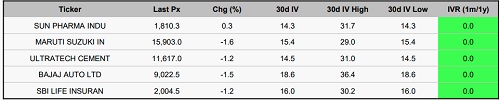

The market perceives heightened risk in ICICIGI and HDFC Bank, as their Implied Volatility Ranks (IVR) are elevated at 53% and 50%. Despite having higher-than-median realized volatilities 22% for ICICIGI and 15% for HDFC Bank the high IVRs suggest that option prices are inflated. Therefore, selling options through Short Premium Strategies is advisable to capitalize on the rich premiums, benefiting from time decay and the tendency for volatility to mean revert. Conversely, SUN Pharma and Maruti Suzuki exhibit the lowest IVR levels across the F&O segment. Their options are currently considered below value due to this low implied volatility, while their realized volatilities remain steady at 15% (for both). This presents a favorable scenario for adopting Long Premium Strategies to purchase inexpensive options and secure exposure.

Options volume and Open Interest highlights:

SRF and RVNL are exhibiting supposedly bullish signs, reflected in their 4:1 Call-to-Put ratios. However, this high Call buying has simultaneously inflated their Implied Volatility, rendering option premiums overly expensive. This substantial market enthusiasm for Calls frequently acts as a contrarian warning, suggesting that the current upward price trend might be nearing a short-term peak. Conversely, Federal Bank and Heromotoco are struggling under the weight of defensive market positioning. The combination of high Put volumes and a large concentration of Open Interest at lower price levels points to a bearish sentiment that is currently hindering their price movement. JSW Steel and HindUnilvr are witnessing significant accumulation of Call Open Interest near their 52-week highs. Meanwhile, TMPV and REC Ltd are seeing a similar saturation, but on the Put side. Traders should watch these six stocks closely for consolidation. If their prices stabilize, the subsequent liquidation of these heavily concentrated positions could generate a sharp, high-velocity move in price. (This data covers only stock options with at least 500 contracts traded on the day for both calls and puts).

Participant-wise Open Interest Net Activity:

In Index Futures, a total change of 3,712 contracts saw Foreign Institutional Investors (FIIs) aggressively add 3,484 contracts, counterbalanced by substantial trimming of 3,609 contracts by Proprietary Traders and a minor reduction of 103 contracts by Clients, suggesting a bullish FII conviction against proprietary skepticism. Conversely, Stock Futures experienced a total change of 45,727 contracts, where Clients significantly accumulated 39,700 contracts. This unprecedented client buying was met with heavy liquidation, as FIIs offloaded 33,824 contracts and Proprietary Traders reduced their holdings by 11,903 contracts, highlighting a speculative, risk-on appetite from the retail segment in specific stocks that contrasts with institutional and proprietary de-risking.

Nifty

BankNifty

Stocks with High IVR:

Stocks with Low IVR:

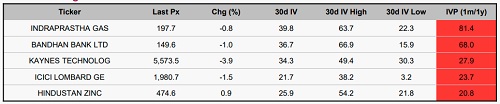

Stocks With High IVP:

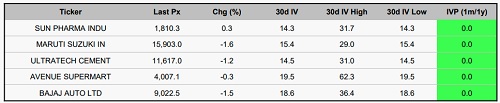

Stocks With Low IVP:

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633