Daily Derivatives Report 24th November 2025 by Axis Securities Ltd

The Day That Was:

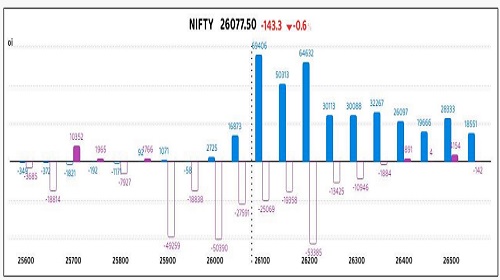

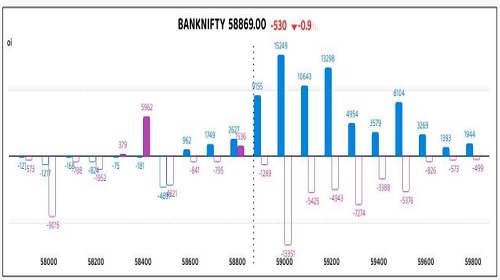

Nifty Futures: 26,077.5 (-0.5%), Bank Nifty Futures: 58,869.0 (-0.9%).

Nifty Futures and Bank Nifty Futures ended with substantial losses on Friday, snapping a two-day gaining streak and experiencing a downward correction that reflected broader market consolidation amid weak global cues. Investors turned cautious as the latest US jobs data failed to offer clarity on the Federal Reserve's rate-cut trajectory, keeping global markets on edge, which subsequently led to profit booking by domestic investors after indices hit new highs in prior sessions. Nifty Futures fell 143.3 points with an increase in open interest by 7.98 lakh shares, rising 4.0% to a total of 205.83 lakh shares, indicating Short Build Up. Similarly, Bank Nifty Futures shed 530 points, also showing Short Build Up with its open interest increasing by 13,075 shares, a 0.6% rise, to a total of 21.95 lakh shares. This derivative action was accompanied by a sharp decrease in premiums: the Nifty futures premium narrowed significantly from 29 to 9 points, and the Bank Nifty premium dropped steeply from 51 to 1 point. Barring the Nifty FMCG index, all other sectoral indices on the closed in the red, with metal, PSU bank, and realty shares experiencing the steepest declines. Simultaneously, India VIX, a gauge of near-term volatility expectation, surged 12.3% to 13.63, the highest single-day gain since mid-April, which is a clear indication of heightened caution among market participants expecting higher price swings in coming sessions. Further underscoring the market pressure, the Rupee saw its steepest single-day fall in over three months, sinking 93 paise to close at an all-time low of 89.61 a dollar, breaching the 89-a-dollar-mark for the first time and signifying an unprecedented wave of dollar demand due to significant domestic and global pressures.

Global Movers:

U.S. equity markets have been volatile and posted weekly losses, driven primarily by the tech sell-off and uncertainty around the Federal Reserve's monetary policy path. The Nasdaq Composite suffered the steepest weekly loss, falling approximately 2.7%. The S&P 500 and the Dow Jones Industrial Average also finished the week in the red, with declines of just under 2.0% and 0.8%, respectively. Market sentiment was volatile, swinging dramatically based on shifting expectations for a December rate cut by the Federal Reserve. Comments from a New York Fed President on Friday signaled potential support for an additional rate cut, which fueled a sharp late-week rally, with the Dow closing up nearly 500 points on Friday. The yield on the 10-year US Treasury ended the week lower at 4.06%, down from 4.15% at the end of the previous week. Gold experienced a slight decline of 0.3% to $4065 per ounce, and Silver saw a drop of 1.3% to $50.02 per ounce, with the metals complex overall exhibiting a cautious sentiment reacting to the weaker U.S. Dollar Index (DXY) and shifting Federal Reserve rate expectations. WTI Crude Oil (Future) futures fell 1.59% to $57.50 per barrel as Geopolitical Event speculation around a potential US-Russia-drafted peace plan for Ukraine raised prospects for higher Russian oil exports, exacerbating oversupply concerns.

Stock Futures:

IndusInd Bank Ltd. (INDUSINDBK) surged after the lender dismissed market speculation around a potential Qualified Institutional Placement, terming such reports “speculative and factually inaccurate” in its exchange filing. The denial restored investor confidence, triggering strong buying interest and driving the stock’s outperformance against a muted broader market. Futures reflected Long Addition with a 1.9% price gain and a 3.3% rise in open interest to 70,614 contracts, including 2,222 fresh positions. Options data showed call open interest at 27,081 contracts and put open interest at 21,267, with incremental additions of 182 and 1,707 respectively, pushing the Put-call ratio to 0.79 from 0.73. The positioning indicates option buyers are skewed towards puts while option writers are more active on calls, reflecting cautious optimism amid renewed sentiment.

Sammaan Capital Ltd. (SAMMAANCAP) rebounded sharply after the company clarified that no investigative agency has any pending probe and those loans cited in the PIL are fully repaid, with the Supreme Court making no adverse observations. The reassurance lifted sentiment, driving a 1.5% price gain supported by Short Covering as futures open interest fell 6.3% to 24,010 contracts with 1,622 positions shed. The futures premium to spot widened marginally to 1.77 points from 1.76. Options activity showed call open interest at 14,359 contracts and put open interest at 8,610, with declines of 1,068 and 422 respectively. The contraction in both sides suggests option buyers unwound positions while option writers reduced exposure, signaling stabilizing sentiment after volatility.

JSW Energy (JSWEnergy) extended its decline for a third session as the resignation of CFO Pritesh Vinay unsettled investors, raising concerns over financial leadership continuity and execution risks. The stock fell 4.2% with Short Addition evident as futures open interest rose 3.3% to 43,566 contracts, including 1,402 new positions. The futures premium narrowed to 2.55 points from 3.3, reflecting weakening conviction. Options data showed call open interest at 19,325 contracts and put open interest at 9,104, with additions of 5,103 and 2,817 respectively, lifting the Put-call ratio to 0.47 from 0.44. The build-up in calls relative to puts highlights option buyers hedging downside risk while option writers lean towards selling puts, underscoring persistent bearish undertones.

Mahindra & Mahindra Ltd. (M&M) advanced as investors cheered ambitious long-term guidance unveiled at its Investor Day, with management targeting an organic revenue CAGR of 15%–40% across FY26–FY30, well above the 25% CAGR achieved over the past five years. The clarity and conviction in growth plans for Auto and Farm segments bolstered institutional confidence, driving a 0.7% price gain alongside Long Addition. Futures open interest climbed 1.8% to 94,510 contracts with 1,695 new positions. Options positioning showed call open interest at 28,628 contracts and put open interest at 19,499, with additions of 5,065 and 1,615 respectively, pulling the Put-call ratio down to 0.68 from 0.76. The skew reflects option buyers favoring calls while option writers increase put exposure, signaling constructive sentiment aligned with the company’s growth narrative.

Put-Call Ratio Snapshot:

The Nifty put-call ratio (PCR) fell to 1.03 from 1.44 points, while the Bank Nifty PCR fell from 1.25 to 0.96 points.

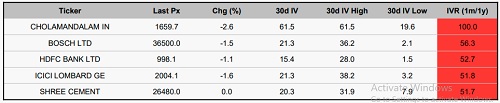

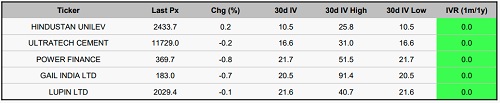

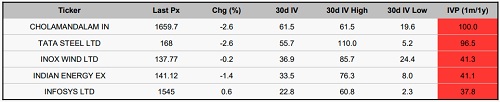

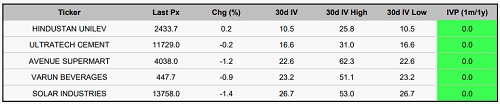

Implied Volatility:

Cholamandalam Investment and HDFC Bank due to their exceptionally high Implied Volatility Ranks (IVR)—100% and 53%, respectively. This elevated IVR suggests that the market is overpricing future volatility, making their options contracts unusually expensive with their Realized Implied Volatility at 62% and 15%, the high IVR favors short premium strategies (selling options). This approach is designed to profit from the expected mean reversion of volatility and the subsequent decay of the inflated time premium. Conversely, long premium strategies (buying options) would be less profitable here. In sharp contrast, HindUnilever and UltraCemco Ltd are ideal candidates for long premium strategies (buying options). Their IVR levels are among the lowest in the Futures & Options (F&O) segment, indicating that their option contracts are relatively cheap. With modest realized volatilities (11% and 17%), the low-volatility environment is conducive to purchasing options.

Options volume and Open Interest highlights:

SONACOMS and VBL are characterized by this aggressive optimism, evidenced by an extreme 4:1 Call-to-Put Volume Ratio that has significantly driven up Implied Volatility (IV), consequently making their option premiums costly for initiating new long positions. However, this high volume of Call buying is frequently interpreted as a contrarian indicator, suggesting the current upward momentum may be nearing a point of fatigue or a near-term peak. Conversely, HCL Tech and JSW Energy reflect a hedged or bearish outlook, demonstrated by substantial Put option volumes and a high concentration of Put Open Interest (OI) at lower strikes, which establishes downward pressure toward support levels. This highly positioned state is mirrored in GMR Airport and INOX Winds, where Call OI is concentrated at 52-week highs, and similarly in TMPV and NMDC on the Put side. Crucially, for all these heavily positioned stocks, any period of price stability or consolidation could precipitate a rapid closure of these concentrated hedges, potentially resulting in a powerful short-covering price rally or the liquidation of long positions. (This data covers only stock options with at least 500 contracts traded on the day for both calls and puts).

Participant-wise Open Interest Net Activity:

In index futures, the overall change of 14,208 contracts was entirely propelled by a significant, aggressive accumulation of 14,208 contracts by Proprietary traders an unequivocal, strong long bias. This decisive influx precisely counteracted the material liquidation initiated by both Foreign Institutional Investors (FIIs), who modestly but noticeably decreased their exposure by 4,282 contracts, and Retail/High Net Worth Individual Clients, who substantially reduced their long positions by 4,135 contracts, suggesting a cautious retreat from index longs by these two groups. Conversely, the stock futures segment, witnessing a total position change of 29,580 contracts, revealed a palpable bearish alignment among institutional players set against a strong retail bullish conviction. FIIs demonstrated a pronouncedly negative outlook through a massive shedding of 16,817 contracts, while Proprietary traders mirrored this bearish sentiment with a significant reduction of 12,763 contracts. This wholesale institutional de-risking was powerfully absorbed by the Retail/HNI Clients, who showed an unwavering, dominant bullish appetite by aggressively adding 23,727 contracts, highlighting a clear positional conflict and a speculative skew among non-institutional participants.

Nifty

Bank Nifty

Stocks with High IVR:

Stocks with Low IVR:

Stocks With High IVP:

Stocks With Low IVP:

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633

More News

Market Commentary Closing for 22nd September 2025 by Bajaj Broking