Stocks in News & Key Economic Updates 16th December 2025 by GEPL Capital

Stocks in News

* UNO MINDA: The company has completed the acquisition of the remaining 49.9% stake in its arm, Uno Minda Buehler Motor, making it a wholly owned subsidiary.

* DELHIVERY: The company has launched intracity shipping for customers in Mumbai and Hyderabad through the Delhivery Direct app.

* ZYDUS LIFE SCIENCES: The USFDA has accepted the resubmitted New Drug Application for CUTX-101 by the company’s arm; CUTX-101 is a copper histidinate therapy for treating Menkes disease in pediatric patients.

* HCL TECH: The company has extended its partnership with Aurobay Tech to manage and optimize technology services in Sweden and China.

* DECCAN CEMENTS: The company has commenced commercial production at its Line-3 cement plant, taking total cement capacity to 4 million tonnes per annum.

* BL KASHYAP: The company has secured a Rs.616 crore order from Sattva CKC for structural and civil works.

* KNR CONSTRUCTIONS: The company has received a demand order of Rs.72 crore, including interest, from the Hyderabad tax authorities.

* SENORES PHARMA: The company plans to acquire a 100% stake in Apnar Pharma for a total enterprise value of nearly Rs.91 crore.

* PG LIFE: The board has appointed Amol Lone as CFO, approved the transfer of the API business to the newly incorporated arm RPG Active Pharma, and sanctioned an investment of Rs.105 crore in the subsidiary.

* NEWGEN SOFTWARE: The company has secured an order worth Rs.16.5 crore from a leading Indian bank.

Economic News

* RBI data show rosy picture of poll-bound Tamil Nadu, reveal Karnataka’s gaps: Tamil Nadu is leading southern states in key people-facing metrics like jobs and tourist footfall, according to recent RBI data. The state's manufacturing-powered growth, evident in its strong export figures and GSDP growth, is outpacing Karnataka's tech-centric economy. This progress is seen as a significant boost for the ruling DMK ahead of assembly polls.

* Unemployment rate falls to 4.7% in November, lowest since April: India's unemployment rate dropped to 4.7% in November, its lowest since April, with joblessness declining in both rural and urban areas. The overall decrease was more pronounced among women, and labor force participation also reached its highest point since April, indicating strengthening labor market conditions.

Global News

* BOJ Poised for Landmark Rate Hike, Signals Gradual Exit from Ultra-Easy Policy: The Bank of Japan is expected to raise interest rates to 0.75% a threedecade high marking its second hike this year and reinforcing its commitment to gradually normalise policy despite global headwinds. Persistently high inflation driven by food prices and expectations of continued strong wage growth have strengthened the BOJ’s confidence that Japan is sustaining an inflation–wage cycle. Governor Kazuo Ueda is likely to signal further rate hikes, though at a cautious, data-dependent pace, as rates move toward the estimated neutral range of 1–2.5%. Policymakers are also mindful of yen weakness, which could fuel imported inflation and strain households, prompting coordination with the government to curb excessive currency declines while balancing growth, inflation, and financial stability.

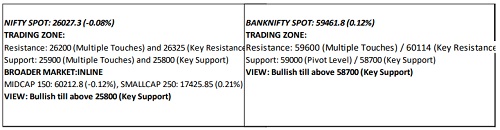

Technical Snapshot

Key Highlights:

Government Security Market:

* The Inter-bank call money rate traded in the range of 4.50%- 5.35% on Monday ended at 4.80%.

* The 10 year benchmark (6.48% GS 2035) closed at 6.5931% on Monday 6.5931% on Friday .

Global Debt Market:

U.S. Treasury yields started the week lower on Monday as investors looked ahead to several economic data reports this week, which will offer insight into the state of the U.S. economy. The benchmark 10- year Treasury yield dipped over 2 basis points to 4.166%, and the two -year Treasury yield also fell less 2 basis points to 3.509%. The 30-year Treasury bond yield was lower by nearly 3 basis points to 4.829%. The highlight of the week will be the release of key inflation data on Thursday, the consumer price index report for November. It is expected to show that headline inflation increased to 3.1% on a yearly basis in November, according to FactSet consensus estimates. Core inflation, which excludes volatile food and energy prices, is forecast to also come in at 3.1%.Weekly initial jobless claims are also due on Thursday, with November’s existing home sales data set to be released on Friday

10 Year Benchmark Technical View :

The 10 year Benchmark (6.48% GS 2035) yield likely to move in the range of 6.58% to 6.5975% level on Tuesday

SEBI Registration number is INH000000081.

Please refer disclaimer at https://geplcapital.com/term-disclaimer

More News

Daily Market Commentary : Indian Equity Markets witnessed a sharp decline with Nifty50 plung...