Daily Derivatives Report 20th November 2025 by Axis Securities Ltd

Nifty Futures: 26,071.0 (0.5%), Bank Nifty Futures: 59,227.4 (0.4%).

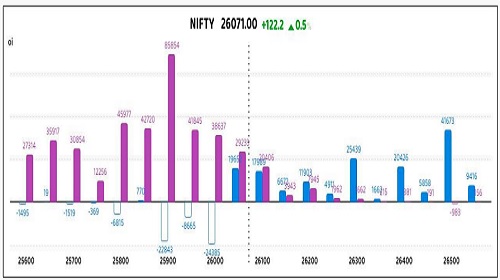

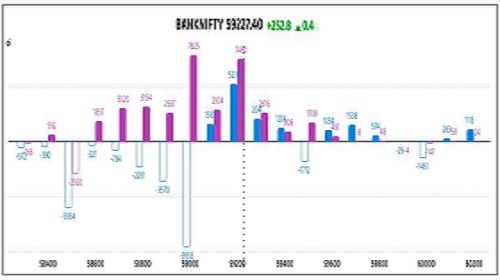

Nifty Futures and Bank Nifty Futures exhibited a resilient rebound from a weak start, ending with substantial gains and closing above the prior session high, with the primary catalyst being strong buying in IT stocks. This domestic strength was influenced by optimism surrounding a proposed India-US trade pact, which also saw institutional investors appear to redirecting funds toward emerging markets like India. While local sentiment was buoyant, global traders remained cautious ahead of the upcoming Nvidia earnings report and the US Fed's FOMC minutes, reflecting an overhang of uncertainty regarding technology sector valuation and the future trajectory of US monetary policy. Nifty Futures advanced 122.2 points, accompanied by a decrease in Open Interest (OI) by 5.64 lakh shares (a 2.8% reduction to 196.54 lakh shares), signaling Short Covering. Concurrently, Bank Nifty Futures rose 252.8 points, seeing an increase in Open Interest by 0.59 lakh shares (a 2.9% increase to 21.01 lakh shares), which indicates Long Build Up. Reflecting a reduction in near-term expectations, the Nifty Futures premium decreased to 18 points from 39 points, and the Bank Nifty Futures premium decreased from 75 to 11 points. Sectorally, IT, PSU Bank, and Healthcare shares advanced, while Realty, Oil & Gas, and Media shares declined. Market expectations of volatility, measured by the India VIX, eased, declining 1% to 11.97. Finally, the Rupee settled with a 2 paise gain at 88.58 against the US Dollar.

Global Movers:

U.S. equity benchmarks staged a robust turnaround on Wednesday, effectively halting a recent streak of declines as aggressive positioning ahead of a crucial technology earnings report fueled a broad recovery. The Dow Jones Industrial Average managed a modest uplift, advancing +0.10% to finish the session at 46,138.77. More significantly, the bellwether S&P 500 snapped its consecutive four-day losing streak by gaining +0.38%, concluding the day at 6,642.16. The clear leader of the session was the Nasdaq Composite, which saw its value jump +0.59% to a close of 22,564.23, driven by heavy buying in the technology sector as investor anxiety over the AI sector's valuation was softened by the highly anticipated earnings report from chip giant Nvidia, released after the close. The yield on the benchmark 10-year US Treasury edged higher, settling around 4.10%, reflecting the decreased likelihood of immediate and decisive Fed action, as Policymakers held "strongly differing views" on the necessity of a near-term rate reduction, specifically regarding a potential December cut. In the commodity space, the outlook was mixed. Spot Gold traded near $4,098 per ounce and Spot Silver hovered around $51.47 per ounce. Both precious metals held firm, finding their traditional safe-haven role counterbalancing the persistent strength of the U.S. Dollar, which was indirectly supported by the Fed's cautious, split policy signal.

Stock Futures:

Coforge Ltd. surged as Gartner projected India’s IT spending to rise in 2026, underpinned by enterprises accelerating AI adoption and expanding investments in generative AI software. Riding the broader Nifty IT rally, Coforge’s niche strength in Travel and Insurance reinforced investor confidence, propelling a 4.4% price gain alongside a 1.5% rise in futures open interest to 35,611 contracts with 509 new additions. Futures traded at a premium of 6.9 points to spot, widening by 2.8 points from the prior session. Options positioning reflected heightened activity, with call open interest at 15,174 contracts after 938 additions and puts at 8,419 contracts with 2,325 added. The derivatives setup suggests option buyers are tilting toward protective puts while option writers face a skewed call-to-put balance, signaling cautious optimism amid elevated sector momentum.

Max Healthcare Institute Ltd. advanced sharply as robust quarterly earnings drove sentiment, with net profit soaring 74.3% YoY and revenue climbing 25% YoY, decisively beating forecasts. Brokerages reiterated bullish ratings and higher targets, citing strong execution and aggressive capacity expansion. The stock registered a 4% price gain on short covering, with futures open interest falling 7.6% to 33,016 contracts after shedding 2,721 positions. Options data showed call open interest at 10,082 contracts after a steep reduction of 6,161, while puts rose modestly to 7,116 contracts with 431 additions. PCR improved to 0.71 from 0.41, while implied volatility eased to 30.38%, down 14.85%. The derivatives profile indicates option buyers are shifting toward puts for hedging, while option writers are retreating from calls, reflecting tempered risk appetite despite strong fundamentals.

Sammaan Capital Ltd. collapsed as Supreme Court observations on alleged financial irregularities involving former promoters triggered panic selling and heightened regulatory risk perception. The stock plunged 12.4% with futures open interest surging 11% to 28,482 contracts, adding 2,825 positions, signaling aggressive short build-up. Options activity was intense, with call open interest climbing to 17,651 contracts after 6,604 additions and puts rising to 10,928 contracts with 5,057 added. PCR rose to 0.62 from 0.53, while implied volatility spiked to 62.88%, up 58.95%. The derivatives landscape underscores option buyers aggressively positioning on both sides for volatility, while option writers are pricing in heightened risk premiums, reflecting deepening bearish sentiment.

Biocon Ltd. slipped as profit booking and valuation concerns overshadowed strong biosimilars performance amid execution risks tied to the BBL-Viatris integration. The stock fell 3% with futures open interest down 2.1% to 20,586 contracts after unwinding 434 positions. Futures premium narrowed to 2.8 points from 3.95, a decline of 1.15 points. Options positioning showed call open interest at 11,607 contracts with 1,264 additions, while puts stood at 9,348 contracts with 291 added. The derivatives setup highlights option buyers selectively accumulating calls while option writers cautiously balancing exposure, reflecting a mixed stance where optimism on fundamentals is tempered by valuation-driven caution.

Put-Call Ratio Snapshot:

The Nifty put-call ratio (PCR) rose to 1.29 from 0.94 points, while the Bank Nifty PCR rose from 1.16 to 1.23 points.

Implied Volatility:

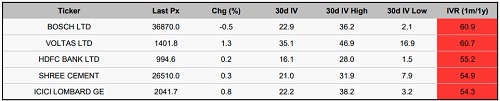

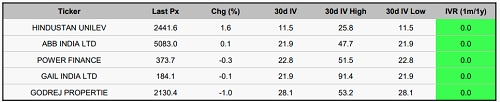

Voltas Ltd (61% IVR) and HDFC Bank (55% IVR) are both positioned at the upper end of their historical volatility range, a condition that has led to significant overpricing in their options market, evidenced by their realized implied volatilities of 35% and 16% respectively; consequently, short premium strategies are favored for these stocks to monetize the inflated time value in anticipation of a volatility mean reversion, as long premium approaches are economically unattractive. In contrast, Hindustan Unilever and ABB Ltd are trading at the lowest IVR levels in the F&O segment, making their option contracts relatively cheap, given their realized implied volatilities are 12% and 22% respectively; this low-volatility environment makes long premium strategies suitable, offering a favorable risk/reward and breakeven metric by providing an asymmetric opportunity for outsized returns driven by potential future price movement or expansion in volatility.

Options volume and Open Interest highlights:

Voltas Ltd (61% IVR) and HDFC Bank (55% IVR) exhibit historically elevated implied volatility, making their options expensive with realized implied volatilities of 35% and 16% respectively, which favors short premium strategies to capitalize on inflated time value ahead of an expected volatility mean reversion, as long premium strategies are uneconomical; conversely, Hindustan Unilever and ABB Ltd are characterized by the lowest IVR levels, resulting in relatively cheap options with realized implied volatilities of 12% and 22%, creating a favorable environment for long premium strategies which offer an asymmetric payoff (limited outlay, high return potential) from price movement or volatility expansion, alongside better risk/reward and breakeven metrics. Meanwhile, Solar Industries and Prestige Estates show measured bullishness, but the spike in speculative Call buying has inflated Implied Volatility, making long options costly and suggesting potential trend fatigue, while Sammaan Capital and Bharti Airtel display a protective bias with concentrated Put OI exerting downward pressure toward support, though price stabilization could lead to a swift short-covering rally as hedges unwind; lastly, GMR Airport shows market indecision with balanced expansion in Call and Put OI near 52-week highs, requiring caution until a clear breakout or breakdown occurs, NMDC's high Call OI near annual highs indicates deliberate Call writing creating a resistance ceiling, and PFC's sustained Put OI accumulation around yearly peaks underscores a defensive stance for capital preservation against potential drawdowns. (This data covers only stock options with at least 500 contracts traded on the day for both calls and puts).

Participant-wise Open Interest Net Activity:

In index futures positions, totalling 6,256 contracts, presents a diametrically opposed view of market direction among key participants. The precipitous decline of 6,036 contracts by Retail Clients signifies a pronounced bearish divestment, concurrently countered by significant bullish accretion from institutional players: Foreign Institutional Investors (FIIs) augmented their net long positions by 1,218 contracts, while Proprietary traders executed a substantially aggressive long accumulation of 5,038 contracts, collectively pointing toward an underlying institutional bullish conviction in the broader index trajectory. Conversely, the Stock Futures segment, witnessing a turnover of 26,423 contracts, revealed an unorthodox divergence in risk appetite: Retail Clients registered a minimal contraction of 238 contracts; however, FIIs displayed a powerful, concentrated bullishness through the addition of 12,870 contracts. This potent FII long-bias was starkly offset by the massive, defensive short-selling of 26,185 contracts by Proprietary traders, resulting in an ambivalent overall sentiment within the single-stock derivatives space, where institutional speculation is sharply split.

Nifty

Bank Nifty

Stocks with High IVR:

Stocks with Low IVR:

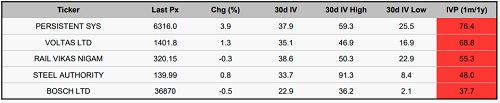

Stocks With High IVP:

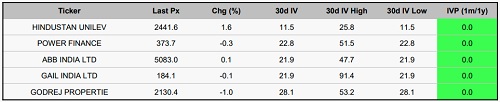

Stocks With Low IVP:

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633

More News

Daily Derivatives Report By Axis Securities Ltd