Daily Derivatives Report 18th December 2025 by Axis Securities Ltd

The Day That Was:

Nifty Futures: 25,897.8 (-0.2%), Bank Nifty Futures: 59,146.8 (-0.2%).

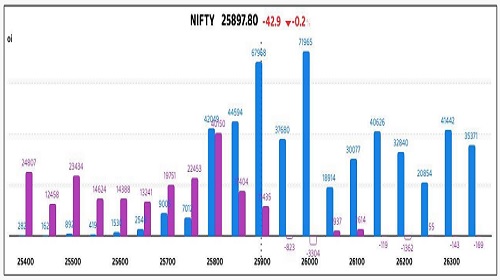

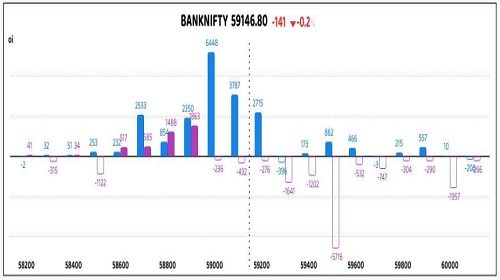

Nifty Futures and Bank Nifty Futures extended their decline for the third consecutive session, closing with moderate losses that suggest a temporary exhaustion of bullish momentum near record highs. Following a positive gap-up opening, both indices were met by aggressive selling pressure in the first hour, leading to a range-bound afternoon and a soft close indicative of persistent profit-booking at psychological resistance levels. Nifty Futures fell 42.9 points as open interest rose by 2.1 percent to 185.69 lakh shares an increase of 3.80 lakh shares indicating a Short Build Up, while Bank Nifty Futures shed 141.0 points as open interest fell by 0.5 percent to 20.96 lakh shares, a reduction of 0.09 lakh shares, pointing toward Long Unwinding. Derivatives data showed the Nifty Futures premium dropped to 79 from 81 points and the Bank Nifty premium declined to 220 from 253 points, alongside a fall in the Nifty put-call ratio (PCR) to 0.77 from 0.84 and a Bank Nifty PCR dip to 0.75 from 0.77. While media, consumer durables, and realty shares declined, PSU bank, IT, and metal shares advanced, and India VIX fell 2.23 percent to 9.84, marking its lowest close for the year; this divergence between volatility and the negative close suggests market participants view the dip as a non-threatening mean reversion rather than a systemic breakdown. Simultaneously, the currency market witnessed the USD-INR pair recover 55 paise from an all-time low to close at 90.38 following suspected RBI intervention, a move that stabilized investor nerves regarding potential capital flight.

Global Movers:

US markets experienced a significant downturn yesterday, as a resurgence of concerns regarding artificial intelligence valuations and extreme market concentration where just ten companies now account for over 40% of total market capitalization triggered a broad-based sell-off. The Dow Jones Industrial Average fell 228 points, or 0.47%, to settle at 47,886, and the S&P 500 Index lost 79 points, or 1.16%, to close at 6,721, marking the fourth consecutive daily decline for both indexes; meanwhile, the tech-heavy Nasdaq Composite bore the brunt of the retreat, tumbling 418 points, or 1.81%, to finish at 22,693 as shares of AI leaders like Broadcom, Oracle, and Nvidia saw sharp declines. In the fixed income market, Treasury yields remained remarkably stable despite the equity volatility, with the yield on the benchmark 10-year U.S. Treasury note holding steady at 4.15% as investors awaited critical consumer price inflation data following a period of data gaps caused by the recent 43-day federal government shutdown. This subdued rate environment, combined with heightening geopolitical tension, drove safe-haven demand into precious metals, propelling Gold futures to approximately $4,364 per ounce and Silver futures to a record high near $66.40 per ounce. Conversely, energy markets staged a sharp 2.1% recovery after hitting multi-year lows earlier in the week, with WTI Crude Oil futures climbing back to $56.7 per barrel after President Trump ordered a naval blockade of sanctioned oil tankers entering and exiting Venezuela, reigniting global supply concerns.

Stock Futures:

Shriram Finance Ltd. (SHRIRAMFIN) advanced sharply as the stock vaulted to a fresh 52?week high, powered by strong buying interest after the company announced a December 19, 2025 Board Meeting to evaluate fundraising options including Rights Issues, QIPs and Preferential Allotments. Momentum intensified after reports that Japan’s MUFG is in advanced discussions to acquire a 20% stake for $3.5–4 Bn, implying a valuation near $10 Bn. The futures curve reflected a firm Long Addition, with a 2.1% price rise and a 1.7% build?up in open interest to 82,103 contracts, supported by 1,379 new positions and a wider futures premium of 8.75 points versus 7 earlier. Options activity showed aggressive call accumulation, with call OI climbing to 27,176 contracts—its highest in three series—against put OI of 15,513, driven by additions of 4,273 and 1,823 contracts respectively. The structure signals call buyers pressing bullish bets while call writers face rising risk, whereas put writers appear more comfortable than put buyers given the skewed OI build?up and strengthening futures trend.

APL Apollo Tubes Ltd. (APLAPOLLO) climbed steadily as renewed demand lifted the stock, supported by heavy turnover and lingering optimism from the company’s Q2FY26 results, which delivered a sharp YoY jump in Net Profit and record sales volume. Derivatives positioning confirmed a Long Addition, with a 1.9% price gain and a 1.3% rise in open interest to 22,438 contracts, aided by 293 fresh futures positions, while the futures premium held broadly steady at 14 points versus 14.1 earlier. Options flows showed a PCR decline to 0.75 from 0.87 as call OI rose to 3,265 contracts with 388 additions, while put OI slipped to 2,463 after a reduction of 50 contracts. The pattern indicates call buyers asserting directional conviction, call writers absorbing higher exposure, and put writers tightening risk as put buyers retreat, aligning with the moderate but persistent long bias in futures.

Polycab India Ltd. (POLYCAB) reversed sharply after a Rs 544.32 Cr block trade on the NSE, where 7.56 Lc shares exchanged hands at an average Rs 7,192.50, triggering profit?taking and snapping a four?day rally as the weighted average price hovered near session lows. The futures market registered a pronounced Short Addition, with a 3.6% price drop and a 17.6% surge in open interest to 17,830 contracts, driven by 2,667 new shorts. Options positioning showed call OI rising to 8,635 contracts and put OI climbing to 5,661, with additions of 2,478 and 1,506 contracts respectively, pushing the PCR slightly lower to 0.66 from 0.67. The derivatives setup reflects put buyers hedging aggressively, call writers strengthening bearish positions, and futures shorts reinforcing downside sentiment as institutional flows dictate direction.

Colgate-Palmolive (India) Ltd. (COLPAL) slumped to a new 52?week low as persistent selling pressure deepened, weighed by weak urban FMCG recovery expectations and the overhang of Q2FY26 results that showed a profit decline following GST?related distribution disruptions in oral care. The stock saw a clear Short Addition, with a 3.5% price fall and a 10.6% rise in open interest to 31,959 contracts, supported by 3,056 new futures positions. Options activity kept the PCR steady at 0.63 as call OI climbed to 13,760 contracts with 2,756 additions, while put OI rose to 8,619 with 1,838 new positions. The configuration suggests call writers reinforcing bearish sentiment, put buyers seeking protection, and put writers remaining cautious, consistent with the expanding short build?up in futures and the stock’s deteriorating price trajectory.

Put-Call Ratio Snapshot:

The Nifty put-call ratio (PCR) fell to 0.77 from 0.84 points, while the Bank Nifty PCR fell from 0.77 to 0.75 points.

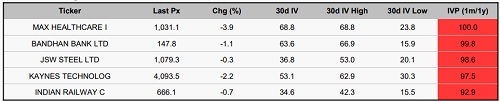

Implied Volatility:

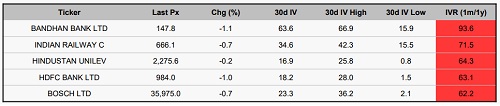

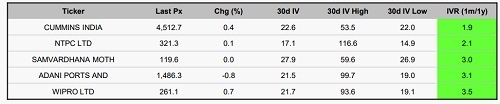

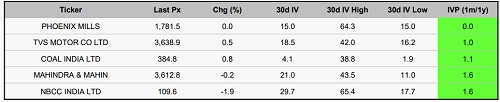

Bandhan Bank and IRCTC are commanding significantly elevated options premiums due to high Implied Volatility Ranks (IVRs) of 94% and 72%, respectively. This surge, reflected in their recent realized volatilities of 64% and 35%, suggests that traders are pricing in potential price swings far more aggressive than what has been recently observed. In contrast, Cummins India and NTPC sit at the opposite end of the spectrum with minimal IVRs, indicating that their options are trading at a significant discount relative to historical norms. Despite having recent realized volatilities of 23% and 17%, the market reflects a state of relative complacency for these stocks, signalling an expectation of near-term price stability and a lack of immediate catalysts for major fluctuations.

Options volume and Open Interest highlights:

CG Power and Suzlon Energy are exhibiting classic signs of a maturing rally. A lopsided Call-to-Put Volume Ratio (5:1 and 4:1) reveals a massive influx of Call buying, which often indicates that the "easy money" has been made. This extreme concentration suggests that the market may be overextended. As retail participation peaks, these stocks are vulnerable to a short-term price correction triggered by institutional profit-taking. In contrast, Dixon Technology and Polycab Ltd are navigating a more cautious landscape. While overall volume ratios remain balanced, there has been a notable surge in Put option volumes with significant Open Interest (OI) is accumulating at lower strike prices, which typically act as a psychological "floor" or support zone. While the sentiment is currently bearish, the concentration of OI at support levels suggests that any further downside may be limited, potentially setting the stage for a minor reversal or consolidation. Extreme price volatility is expected for Kaynes Technology, Hindustan Zinc, JSW Steel, and Tata Motors Passenger Vehicles. These stocks share a common, high-risk derivative setup, substantial one-sided OI is concentrated near their annual price highs. Because these contracts are "crowded" at extreme price levels, a small move in the underlying stock can force a massive liquidation of positions. This "coiled spring" effect is likely to result in a rapid, sharp directional breakout either a final "blow-off" top or a steep, cascading decline as long positions are unwound. (This data covers only stock options with at least 500 contracts traded on the day for both calls and puts).

Participant-wise Open Interest Net Activity:

Index Futures witnessed a total turnover of 7,805 contracts, marked by a stark divergence in institutional conviction. Foreign Institutional Investors (FIIs) aggressively liquidated their entire equivalent of the volume, shedding 7,805 contracts in a wholesale exit. This heavy selling pressure was absorbed by a fragmented bullish front: Clients led the buying with,3,858 additions, followed by Proprietary traders who scaled up by 2,866 contracts, and Domestic Institutional Investors (DIIs) who contributed a modest 1,081 contracts. The data suggests a defensive pivot by global funds, leaving retail and proprietary desks to provide the necessary liquidity. Stock Futures saw a more substantial churn with 18,254 contracts changing hands, characterized by a sharp rotation from "weak hands" to professional desks. FIIs and Clients synchronized their exits, offloading 11,898 and 6,356 contracts respectively. Conversely, Proprietary traders acted as the primary aggressors on the long side, absorbing 10,975 contracts, while DIIs bolstered their portfolios with 7,279 additions. This migration of open interest indicates a concentrated accumulation by domestic professionals and high-frequency desks even as global sentiment remains cautious.

Securities in Ban for Trade Date 18-December-2025:

1. BANDHANBNK

Nifty

Bank Nifty

Stocks with High IVR:

Stocks with Low IVR:

Stocks With High IVP:

Stocks With Low IVP:

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633

More News

Nifty opened on a flat note but selling led the index downwards to end in red - Jainam Shar...