Daily Derivatives Report 15th December 2025 by Axis Securities Ltd

The Day That Was:

Nifty Futures: 26,009.5 (0.6%), Bank Nifty Futures: 59,496.2 (0.4%).

Nifty futures and Bank Nifty futures closed Friday's session with strong gains, underpinned by a significant boost in global risk-on sentiment following the US Federal Reserve's key 25-basis-point rate cut and a less-aggressive forward projection for future hikes. Both indices experienced a substantial gap-up opening, directly reflecting the positive global cues, but spent the first half of the day consolidating horizontally near the session's high, which indicated a successful absorption of early profit-booking pressure from short-term traders. The Nifty ultimately saw a decisive upward thrust in the final hour of trading, pushing it to its closing high. In the derivatives segment, Nifty Futures posted a gain of 135.9 points, concurrent with a 0.3% increase in open interest, rising by 58,170 shares to 181.95 lakhs, signalling a clear Long Build Up. Conversely, Bank Nifty Futures climbed 161.6 points despite a 2.6% decrease in open interest, which fell by 52,220 shares to 19.41 lakhs, an unmistakable indicator of Short Covering. The premium for Nifty futures compressed to 98 points from 111 points, while the Bank Nifty premium decreased from 286 points to 268 points. Sectoral performance saw a distinct rotation, with Metal, Realty, and Consumer Durables shares advancing, led by the Nifty Metal index which surged 2.6% to 10,536 and extended its three-session rally to 4.2%, while FMCG and Media shares declined. Ahead of India's inflation data release, market volatility—as gauged by the India VIX—slipped by 2.8% to 10.11. In the currency market, the Rupee slumped 9 paise against the U.S. dollar, closing at an all-time low of 90.41.

Global Movers:

US markets retreated on Friday, ending the week on a softer note as investors continued to digest the Federal Reserve’s recent policy action, a 25-basis point (bps) rate cut that lowered the federal funds rate to a target range of 3.5%–3.75%. While the easing signal initially sparked a rally, momentum cooled by the week's close. The Dow Jones Industrial Average pulled back by 246 points or 0.5% to settle at 48,458, retreating from its recent record highs. Similarly, the S&P 500 Index gave up early gains, sliding 74 points or 1.1% to finish at 6,827. The tech-heavy Nasdaq Composite faced sharper pressure, declining by 399 points or 1.7% to close at 23,195, underscoring continued caution in the technology sector. In fixed income, Treasury yields ticked higher, with the yield on the benchmark 10-year U.S. Treasury note rising to 4.19%. Meanwhile, the lower-rate environment continued to support precious metals, Gold futures (February 2026 contract) climbed to approximately $4,302.50 per ounce, and Silver futures extended their rally to trade around $62.05 per ounce. Conversely, energy markets remained subdued, with WTI Crude Oil futures hovering near $57.53 per barrel amid lingering concerns over global supply balances.

Stock Futures:

Hindustan Zinc Ltd. (HINDZINC) surged to a new 52?week high in Friday’s session, propelled by a sharp upswing in global silver prices that hit fresh records following the US Federal Reserve’s rate cut, igniting strong interest in non?yielding precious metals. The stock logged a 7.3% advance alongside an 11.6% rise in futures open interest to 30,719 contracts, with 3,198 new positions signalling firm long?side conviction. Options activity showed a PCR of 0.79, up from 0.67, as call OI climbed to 32,844 contracts with 13,285 additions, while puts rose to 25,898 contracts with 12,842 new positions. The build?up reflects aggressive call and put buying, though the relatively lower PCR and sizeable call OI expansion indicate call writers retaining a marginal upper hand even as futures data confirms a dominant long?addition trend.

GMR Airports Infrastructure Ltd. (GMRAIRPORT) rebounded sharply with a 6.5% rise after two sessions of weakness, as renewed buying overshadowed uncertainty tied to the Supreme Court’s December 3, 2025 hearing on User Development Fee dues—an outcome that could materially strengthen the company’s balance sheet and cash flows. Futures open interest increased 1.2% to 26,225 contracts with 302 fresh additions, underscoring steady long build?up. The PCR improved to 0.62 from 0.55, with call OI at 17,975 contracts after a reduction of 1,423, while put OI rose to 11,170 contracts with 507 additions. The derivatives structure suggests put buyers gaining incremental confidence, call writers covering selectively, and futures positioning reinforcing a measured but constructive long?bias.

PI Industries Ltd. (PIIND) declined 3.1%, sharply lagging a firm broader market as persistent pricing pressure and elevated inventories across global agro?chem and CDMO segments—intensified by Chinese dumping kept sentiment subdued despite no fresh company?specific triggers. The stock saw a 14% jump in futures open interest to 15,465 contracts with 1,904 new additions, confirming a pronounced short?addition phase. Futures shifted to a 43.3?point discount versus a prior 16.9?point premium, marking a 60.2?point swing that underscores bearish momentum. Options positioning showed call OI rising to 5,370 contracts with 1,601 additions, while puts increased to 3,678 contracts with 1,005 new positions. The structure signals call writers strengthening their stance, put buyers hedging more actively, and futures data validating sustained short pressure.

Hindustan Unilever Ltd. (HINDUNILVR) fell 2.2%, extending its underperformance against benchmark indices and the FMCG basket as investors continued reassessing valuations following the demerger of its Kwality Wall’s ice?cream business and weighed the near?term margin impact of recent GST cuts amid muted volume visibility. Futures open interest surged 44% to 33,193 contracts with 10,139 additions, highlighting a heavy short?addition build?up. Options activity showed call OI rising to 23,414 contracts with 7,306 additions, while put OI increased to 12,148 contracts with 4,682 new positions. The derivatives configuration points to call writers tightening control, put buyers adding protective exposure, and the sizeable futures shorts reinforcing a firmly negative near?term bias.

Put-Call Ratio Snapshot:

The Nifty put-call ratio (PCR) rose to 1.15 from 0.94 points, while the Bank Nifty PCR rose from 0.87 to 0.9 points.

Implied Volatility:

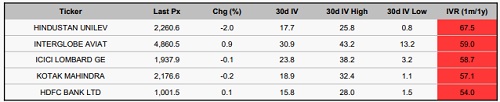

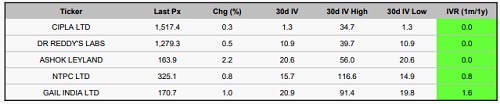

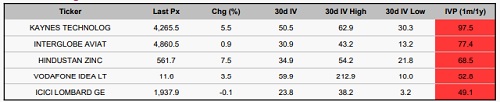

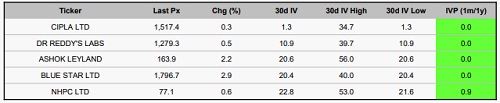

Hindustan Unilever and Interglobe Aviation are currently exhibiting elevated options premiums, evidenced by Implied Volatility Rankings (IVRs) of 68% and 59%, respectively. This pricing contrasts significantly with recent market activity, where realized implied volatilities were recorded at 18% for Hindustan Unilever and 31% for Interglobe Aviation. The disparity between high IVR and recent volatility indicates that market participants are pricing in expectations of future price fluctuations exceeding those recently observed. In contrast, Cipla Ltd and Dr. Reddy’s Laboratories occupy the lowest tier of the F&O volatility spectrum, registering the lowest IVRs. This suggests that options contracts for these entities are trading at a discount relative to historical volatility norms. With realized implied volatilities at 10% and 11%, respectively, current market sentiment reflects an expectation of minimal future price volatility for these two stocks.

Options volume and Open Interest highlights:

HDFC Life and ICICI Prudential Life are currently demonstrating extreme Call-to-Put Volume Ratios of 5:1, indicating a substantial influx of Call option buying. This intense, unilateral volume suggests that market participants perceive the recent upward price momentum as nearing exhaustion. Consequently, this peak in Call buying activity is viewed as a precursor to a phase of profit-taking, potentially precipitating a short-term price correction. Conversely, a dominant cautious or bearish sentiment is observed in Siemens Ltd and PI Industries, evidenced by a marked surge in Put option trading volumes and a significant accumulation of Open Interest at lower strike prices, which typically serve as support levels. However, as the overall volume ratios for these entities remain balanced or neutral with only a marginal bearish inclination, it is possible that the bearish trend may undergo a minor reversal or prove less severe than the immediate options flow implies. Additionally, a period of extreme price volatility is anticipated for InterGlobe Aviation Ltd, affecting both the Call and Put sides of its options chains. This high-volatility outlook extends to BEL, with a focus on the Call side, and Hind Zinc, specifically regarding the Put side. A critical commonality across these stocks is the significant, dual-sided accumulation of Call and Put Open Interest concentrated near their annual price highs. This positioning strongly suggests that a rapid, sharp directional price movement is imminent, likely triggered by the liquidation of these substantial options contracts. (This data covers only stock options with at least 500 contracts traded on the day for both calls and puts).

Participant-wise Open Interest Net Activity:

Index Futures, with a total change of 10,982 contracts, exhibited a contrasting positioning as clients (3,209 added) and DIIs (7,773 added) displayed bullish accumulation, decisively counterbalanced by the bearish unwinding from FIIs (3,432 decreased) and Proprietary desks (7,550 decreased). Stock Futures, seeing 22,010 contracts in turnover, witnessed a unified positive bias with clients (11,223 added), FIIs (7,844 added), and DIIs (2,943 added) all significantly increasing their long exposure, a move entirely absorbed by Proprietary traders who aggressively decreased their net positions by 22,010 contracts.

Securities in Ban for Trade Date 15-December-2025:

1. BANDHANBNK

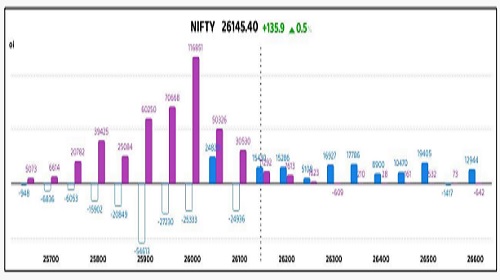

Nifty

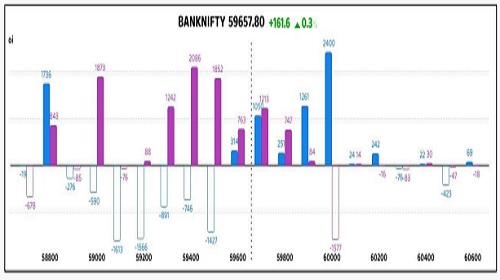

Bank Nifty

Stocks with High IVR:

Stocks with Low IVR:

Stocks With High IVP:

Stocks With Low IVP:

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633

.jpg)

More News

Quote on Morning Market Views 19th November 2025 by Dr. VK Vijayakumar, Chief Investment Str...