Daily Derivatives Report 14 July 2025 by Axis Securities Ltd

The Day That Was:

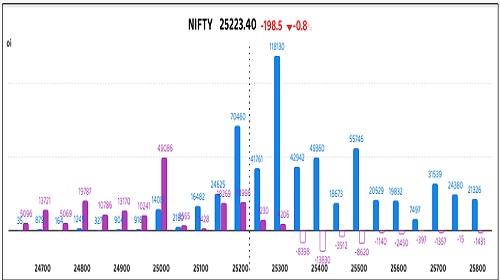

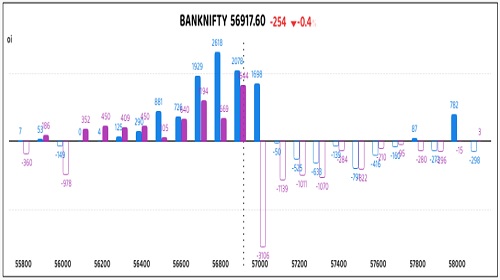

Nifty Futures: 25,223.4 (-0.8%), Bank Nifty Futures: 56,917.6 (-0.4%).

On Friday, Nifty futures plummeted 199 points, while Bank Nifty futures receded 254 points, extending their losses as equity benchmarks succumbed to a pronounced downturn. This marked their third consecutive session of decline, ultimately concluding the week firmly entrenched in the red. The significant market contraction was primarily propelled by pervasive profit-taking activities and intensifying global trade tensions, ignited by fresh US tariffs imposed on Canada, which cast a long shadow over investor sentiment. Pervasive uncertainty surrounding international trade relations, combined with disappointing Q1FY26 earnings from key domestic companies, notably IT giant Tata Consultancy Services (TCS), contributing to the market's nervous undercurrent. This was further evidenced by a 1.2% surge in India VIX, a critical barometer of near-term volatility, reaching 11.82. While the IT, Auto, and Media sectors bore the brunt of this decisive sell-off, defensive plays in the Pharma and FMCG sectors demonstrated resilience, providing a modest counterpoint to the broader market's retreat. The Nifty futures premium increased to 74 from 67 points, while the Bank Nifty premium decreased from 216 to 163 points.

Global Movers:

US stocks ended down, as President Trump threatened Canada with tariffs of 35% on some goods starting August 1 and warned other countries about increased duties. The S&P 500 fell 0.3% while the Nasdaq 100 dropped 0.2%. Still, as US indexes continue to make record highs, some studies show that selling volume is steadily decreasing in a sign that plenty of hope is already built in. Earnings season begins this week, with the six biggest US banks due to announce results. In related markets, the VIX rose nearly 4%, the dollar index completed a six-day rally while the 10-year trsy yield climbed past 4.4%. Meanwhile, gold rose around 1% to $3355/ounce and brent jumped 2.5% to close above $70 even as hedge funds increased their short-bets to the highest in five weeks.

Stock Futures:

Glenmark, Hindustan Unilever, IREDA, and BSE Ltd. saw a surge in market activity yesterday, with notable spikes in both trading volumes and price volatility. The increased momentum around these stocks points to a shift in investor sentiment, suggesting that market participants are actively positioning themselves ahead of potential sector-driven catalysts or upcoming earnings reports.

Glenmark Pharmaceuticals Ltd. experienced a dramatic ascent, hitting a 20% circuit and reaching new 52-week and all-time highs, propelled by a landmark global licensing agreement. Its innovation arm, Ichnos Glenmark Innovation (IGI), forged a monumental deal with AbbVie for the cancer treatment ISB 2001. This transformative partnership is valued at up to $2 Bn, comprising a $700 Mn upfront payment, potential milestone payments reaching $1.2 Bn, and tiered, double-digit royalties on net sales. The stock's rally was underscored by significant short covering, evidenced by a 14.1% price gain alongside a 12.7% decrease in open interest, with current futures open interest at 29,571 contracts, shedding 4,306 contracts. In the options market, the put-call ratio surged to 0.92 from 0.54 in the prior session, indicating a shift in sentiment. Both call and put options witnessed their highest open interest in the last three series, with call options totalling 25,909 contracts and put options at 23,776 contracts. This dynamic reflects substantial additions to put options (9,989 contracts) compared to call options (587 contracts), suggesting aggressive hedging by option buyers or profit-booking by call writers, while put writers brace for potential volatility despite the current bullish momentum.

Hindustan Unilever Ltd. (HUL) witnessed a robust upward trajectory in its stock price, reaching a nine-month high on substantial volumes, propelled by the pivotal announcement of Priya Nair's appointment as the new CEO and MD, effective 1st August, 2025. This historic leadership transition, marking the first time a woman will helm the FMCG behemoth in its 92-year legacy, was met with immediate market enthusiasm. The positive sentiment translated into a significant "Long Addition" for HindUnilvr, with its price appreciating by 4.6% and open interest expanding by 3.6%. Current futures open interest stands at 58,970 contracts, reflecting a fresh influx of 2,067 contracts. In the options arena, the total open interest for the series reached unprecedented levels, with call options at 33,701 contracts and put options at 25,954 contracts. This positioning reveals a discernible trend: while call options saw an addition of 3,356 contracts, the put options witnessed a more pronounced surge of 7,870 contracts. This differential in additions suggests that despite the underlying bullish conviction driving the stock price, option buyers are actively seeking downside protection by accumulating put options, or conversely, put writers are confidently entering positions, anticipating the current upward momentum to persist.

Indian Renewable Energy Development Agency Ltd. (IREDA) saw its stock plummet, recording its sharpest single-day decline in five months on heavy volumes, following a disappointing Q1FY26. Consolidated net profit for the quarter contracted 36% to Rs 247 Cr from Rs 384 Cr YoY, despite a 29% revenue increase, primarily due to a sharp escalation in total expenses, notably financing costs, and a significant rise in impairment on financial instruments. The market's adverse reaction manifested as "Short Addition" for IREDA, with the stock price plummeting by 6.2% and open interest significantly expanding by 20.6%. The current futures open interest stands at 12,868 contracts, reflecting a considerable new addition of 2,197 contracts, indicative of aggressive short-selling. In the options segment, the total open interest for call options is 11,264 contracts, while put options register 5,437 contracts. Notably, call options witnessed an addition of 2,322 contracts, yet put options saw a comparatively modest addition of 1,378 contracts. This dynamic suggests that while some option writers might be covering existing positions or new ones are being initiated with a bearish outlook on the price increase, the dominant narrative points to a surge in short interest in the futures market, with option buyers potentially hedging against further declines or call writers initiating positions to capitalize on the anticipated downward trajectory.

BSE Ltd. is facing a significant market downturn, with its stock price plummeting over 4% today and extending its weekly losses beyond 10%. This sustained decline stems from ongoing regulatory scrutiny by SEBI concerning alleged market manipulation by the US-based trading firm Jane Street. While Jane Street's direct impact on BSE's derivatives turnover is deemed minor (around 1% of FPI contribution to 3-4% of total turnover), the prevailing fear of heightened regulatory tightening and potential restrictions on options trading is impacting overall trading volumes and profitability across the capital markets. This bearish sentiment is evident in a "Short Addition" for BSE, with the stock's price falling 4.1% and open interest rising sharply by 7.6%. Futures open interest now stands at 41,915 contracts, a notable addition of 2,965 contracts, reflecting increased short positions. In the options segment, call option open interest is at 60,745 contracts, while put options are at 33,146 contracts. Call options saw an addition of 2,554 contracts, but significantly, put options experienced a decrease of 931 contracts. This suggests that while there's a build-up of short positions in the futures market, in the options market, call writers are actively increasing their positions, indicating a belief that the stock's upside is limited or further declines are likely. Conversely, the reduction in put option open interest implies that some put buyers are unwinding their protective positions, or put writers are reducing their exposure, perhaps anticipating a potential stabilisation or short-term rebound despite the prevailing bearishness.

Put-Call Ratio Snapshot:

The Nifty put-call ratio (PCR) fell to 0.76 from 0.76 points, while the Bank Nifty PCR fell from 0.92 to 0.88 points.

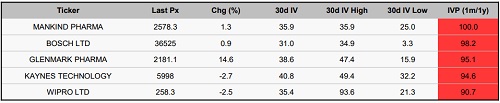

Implied Volatility:

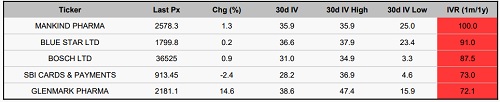

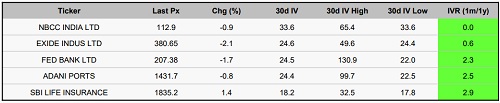

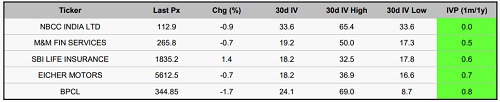

Mankind Pharma and Blue Star have exhibited considerable stock movement, as evidenced by their high implied volatility (IV) rankings of 100 and 91, respectively. Mankind Pharma's IV stands at 36%, with Blue Star close behind at 37%, indicating heightened market uncertainty and increased option premiums. This surge in implied volatility has led traders to reassess their risk management strategies accordingly. Conversely, NBCC and Exide Industries represent more stable equities within the sector, with IVs of 34% and 25%. Their comparatively lower volatility and steady price trajectories position them as attractive options for traders seeking short-term exposure amid elevated market turbulence.

Options volume and Open Interest highlights:

Bosch Ltd and Mankind Pharma display strong bullish signals, each with call-to-put ratios of 4:1, indicating high optimism for short-term gains. However, such high ratios might also suggest overvaluation in the options market, so caution is advised when opening new long positions. In contrast, Tata Elxsi and Amber Ltd show signs of weakness with higher put-to-call ratios and increased put volumes, reflecting growing investor concerns about potential downside risks. Although this indicates bearish sentiment, the rise in put activity could also point to oversold conditions, presenting contrarian trading opportunities for those expecting a reversal. Additionally, Glenmark Pharma and Amber Ltd exhibit notable interest in both calls and puts, along with Mankind Pharma (call side) and Hindustan Unilever (put side), suggesting strong expectations for price movements and possible support levels. Overall, these options' activity patterns indicate increased market volatility, favouring strategies that capitalise on price fluctuations. (This data covers only stock options with at least 500 contracts traded on the day for both calls and puts).

Participant-wise Open Interest Net Activity:

In index futures, a net change of 18,511 contracts was observed. A significant bullish bias from retail clients is evident, as they aggressively added 13,834 contracts, indicating an expectation of upward market movement. Conversely, Foreign Institutional Investors (FIIs) exhibited a profoundly bearish stance, liquidating all 18,511 contracts, suggesting a strong conviction for potential downside or a reduction in long exposure. Proprietary traders, often nimble and opportunistic, also leaned bullish by adding 2,067 contracts, albeit with less conviction than retail. This stark divergence between retail optimism and FII pessimism in index futures presents a critical point of contention for assessing overall market direction. Similarly, in stock futures, a total of 30,712 contracts underwent position changes. Retail clients maintained their bullish inclination, adding 12,230 contracts, signaling selective optimism towards individual equities. However, FIIs demonstrated an equally decisive bearish outlook, offloading all 30,712 contracts, which implies a broad-based reduction in their stock-specific long positions or an increase in short bets. Proprietary traders, in contrast to their more measured stance in index futures, displayed a considerably stronger bullish bias in stock futures, accumulating 15,819 contracts

Nifty

Bank Nifty

Stocks with High IVR:

Stocks with Low IVR:

Stocks With High IVP:

Stocks With Low IVP:

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633