Daily Derivatives Report 10 June 2025 by Axis Securities Ltd

The Day That Was:

Nifty Futures: 25,181.8 (0.3%), Bank Nifty Futures: 56,999.2 (0.4%).

Nifty futures ascended by a notable 86 points on Monday, achieving its highest closing level of the year and contributing to a fourth consecutive session of gains for Indian equity benchmarks. This upward trajectory was significantly propelled by the Reserve Bank of India's unforeseen policy easing and robust global cues. Similarly, Bank Nifty futures surged an impressive 229 points, also extending its winning streak. Despite an initial strong opening, the broader index traded within a constricted range throughout the day, indicating a degree of market indecision. Concurrently, the India VIX, a key barometer of near-term market volatility, edged up by 0.43% to 14.69, suggesting a slight increase in anticipated price fluctuations. In the foreign exchange market, the domestic unit experienced a volatile session against the American dollar, fluctuating between 85.45 and 85.72 before ultimately settling 4 paise higher at 85.64. Notably, the Nifty futures premium compressed to 79 from 93 points, and the Bank Nifty premium narrowed from 192 to 160 points, signalling a potential tempering of bullish expectations in the derivatives segment.

Global Movers:

US stocks rose yesterday, with the S&P 500 gaining 0.1% and the Nasdaq 100 climbing 0.2%, as investors awaited the outcome of ongoing trade talks between Washington and Beijing in London. It is largely expected that the US will be willing to remove restrictions on exports in exchange for assurances that China will relax limits on shipments of rare Earth material, critical for making cell phones. In economic data, traders will be closely watching CPI numbers due tomorrow and University of Michigan sentiment on Friday which will provide a picture of inflation expectations. In markets, the VIX rose 2.3%, the dollar index and the US 10-yr trsy yield dropped, gold gained 0.5% while oil held its advance as US - China talks continued.

Stock Futures:

In Yesterday's session, IIFL, Manappuram Finance, Titagarh, and Mahanagar Gas experienced significant price fluctuations accompanied by high trading volumes, indicating heightened investor interest and robust market activity.

IIFL and Manappuram Finance evinced robust market momentum, propelled by significant price appreciation. IIFL surged by 7.8%, decisively breaching its nine-month high, while Manappuram Finance ascended by 6.9%, attaining an all-time high, both underpinned by substantial trading volume in the current month. This valuation surge primarily stemmed from the continuing rally in gold loan stocks, catalysed by the Reserve Bank of India's decision to elevate the loan-to-value (LTV) ratio for small gold borrowers with a ticket size up to Rs 2.5 lakh to 85% from the prior 75%. Analysis of derivatives data reveals that IIFL experienced a Long Addition, characterized by price gains and a 10.2% increase in open interest, with its current futures open interest standing at 7,836 contracts, reflecting a new addition of 725 contracts, equating to 11.2 lakh shares. Conversely, Manappuram Finance manifested Short Covering, correlating with price gains and a 9.3% decrease in open interest, with its current futures open interest at 13,167 contracts, indicating a shedding of 1,355 contracts, equivalent to 40.6 lakh shares. This divergence in open interest dynamics suggests contrasting but positive sentiment: IIFL's ascent is driven by fresh bullish positioning, whereas Manappuram's rally is augmented by the unwinding of bearish bets, both capitalizing on the favourable regulatory shift.

Titagarh Rail Systems witnessed a modest 1.3% advance, achieving its highest close in three months, on its highest single-day trading volume in the current series, underscoring robust conviction. This positive price action coincided with the company's Q4 and full-year FY25 earnings call, where it reported record freight and foundry output despite wheelset shortages. Management expressed confidence in supply normalization by June 2025 and outlined aggressive expansion across rail, metro, propulsion, and shipbuilding segments, supported by strong order books, while also addressing concerns regarding margins and execution. In derivatives, Titagarh experienced a Long Addition, evidenced by a marginal price gain coupled with a significant 30.7% surge in open interest. Its current futures open interest stands at 12,561 contracts, the highest since its F&O segment entry, reflecting a new addition of 2,950 contracts, equating to 18.4 lakh shares. Option positioning reveals a put-call ratio of 0.44, with total call option open interest at 15,268 contracts (the highest since inception) versus 6,643 contracts in put options. This includes an addition of 6,843 call option contracts against 2,112 put option contracts, signalling strong bullish sentiment and anticipation of further upside.

Mahanagar Gas (MGL) equity experienced a significant rally, surging 6.7% and extending its gains for the third consecutive session to decisively close above its six-month high, underpinned by robust trading volumes. This positive price action was driven by Citi analysts reaffirming their "Buy" rating, citing the company’s positive outlook on volume growth, with management projecting a robust compound annual growth rate of over 10% in volume over the next two to three years. MGL witnessed a Long Addition, characterized by price gains and a 7.8% increase in open interest. Its current futures open interest is at 9,559 contracts, reflecting a new addition of 691 contracts, equal to 2.7 lakh shares. While call option open interest stands at 4,441 contracts and put option open interest at 3,748 contracts, the marginal addition of 147 call options contrasts with a more substantial addition of 1,020 put option contracts. This suggests that while underlying bullish sentiment is present, some investors are also hedging or taking cautious positions, perhaps anticipating potential short-term volatility despite the positive long-term outlook.

Put-Call Ratio Snapshot:

The Nifty put-call ratio (PCR)fell to 1.01 from 1.05 points, while the Bank Nifty PCR rose from 1.02 to 1.04 points.

Implied Volatility:

Dabur India and Blue Star have experienced notable fluctuations in their stock prices, with Dabur India achieving an implied volatility (IV) ranking of 100 and Blue Star at 90. Currently, Dabur India’s IV is at 38%, closely followed by Blue Star at 37%. This rise in IV has led to higher option premiums, encouraging traders to refine their risk management strategies in response to changing market conditions. In contrast, IOC and Bank of Baroda have the lowest IV rankings, with IV levels of 23% and 24%, respectively. Their relative stability in volatility makes them attractive options for investors seeking to adopt long positions in a dynamic market environment.

Options volume and Open Interest highlights:

CESC and BDL are displaying robust bullish signals, each boasting call-to-put volume ratios of 6:1. This underscores a strong preference for call options, reflecting investors' confidence in anticipated price rises. However, this notable inclination towards calls could also imply a potential overvaluation in options pricing, suggesting traders exercise caution before entering the market. Conversely, Eternal and Sail show a more conservative approach. Their high put-to-call volume ratios and increased activity in put options reveal investor concerns regarding potential price declines. This uptick in put volume may suggest an oversold scenario, possibly presenting contrarian trading opportunities. From a positioning viewpoint, Mazagon Dock is experiencing substantial open interest in both call and put options, indicating heightened volatility, closely followed by RVNL and BDL. These levels of open interest can represent crucial resistance points or catalysts for price movements, thereby creating avenues for volatility-driven trading strategies. (This data considers only those stock options that saw a minimum of 500 contracts traded on the day for both calls and puts).

Participant-wise Open Interest Net Activity:

In the index futures segment, a total of 8,107 contracts saw a change in open interest. Retail clients significantly increased their long positions by adding 5,047 contracts. Conversely, Foreign Institutional Investors (FIIs) demonstrated a bearish stance by decreasing their exposure by 3,142 contracts, while Proprietary traders also reduced their positions by 4,965 contracts, indicating a reduction in their overall market exposure. Shifting to stock futures, a substantial 12,374 contracts changed hands. Retail clients continued to build bullish positions, adding 3,515 contracts. FIIs exhibited a largely neutral stance with a marginal decrease of just 11 contracts. In stark contrast, Proprietary traders aggressively shed positions, decreasing their open interest by a significant 12,363 contracts, suggesting a broad unwinding of their stock-specific exposures. Overall, the derivatives data highlights a divergence in participation across segments. Retail clients are exhibiting strong conviction by consistently adding long positions in both index and stock futures. Conversely, institutional players, particularly Proprietary traders, are observed to be reducing their risk exposure, especially in stock futures, while FIIs are taking a more cautious, net-short stance in index futures. This dynamic indicates that retail optimism is currently counterbalanced by a reduction in institutional activity in the futures market.

Securities in Ban for Trade Date 10-June-2025:

1) ABFRL

2) CHAMBLFERT

3) HINDCOPPER

4) TITAGARH

Nifty

Bank Nifty

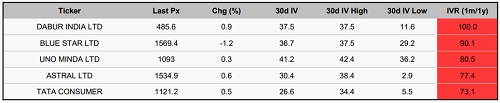

Stocks with High IVR:

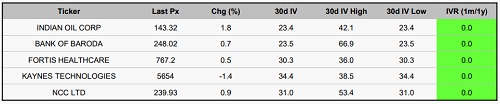

Stocks with Low IVR:

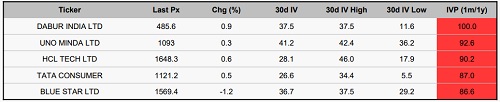

Stocks With High IVP:

Stocks With Low IVP:

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633

More News

Quote on Nifty 14th October 2025 from Rupak De, Senior Technical Analyst at LKP Securities