Daily Derivatives Report 09th October 2025 by Axis Securities Ltd

The Day That Was:

Nifty Futures: 25,120.4 (-0.4%), Bank Nifty Futures: 56,218.0 (-0.4%).

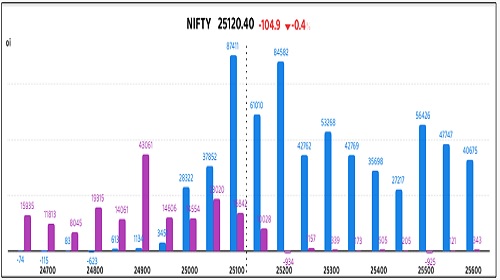

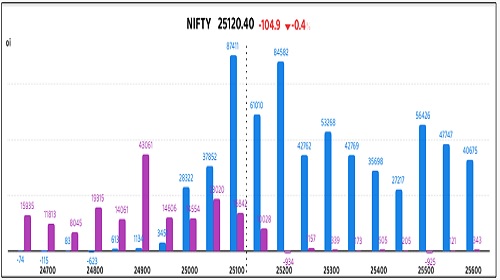

Nifty Futures and Bank Nifty Futures, breaking a four-day winning streak, closed lower amid high volatility, reflecting broad-based profit booking driven by cautious sentiment ahead of the quarterly earnings season. This risk-off sentiment was exacerbated globally by a surge in gold prices to over $4,000 per ounce, supported by geopolitical and economic uncertainties, including the ongoing US government shutdown and expectations of future Fed rate cuts. Consequently, Nifty Futures, falling 104.9 points, confirmed a Long Unwinding with Open Interest decreasing by 1.4% (2,64,675 shares) to 191 Lc, as the futures premium narrowed significantly from 117 to 74 points, Bank Nifty Futures, declining 250.6 points, also signalled Long Unwinding, as Open Interest decreased by 3.5% (68,145 shares) to 18.7 Lc, highlighting a cautious market disposition indicated by the futures premium narrowing from 229 to 200 points. Sectorally, most indices ended the day in the red, with Realty, Oil & Gas, Auto, and PSU Banks leading the decline, although IT and Consumer Durables sectors offered some support and were among the few gainers. Market volatility, as measured by the India VIX, advanced 2.6% to 10.31, indicating a rise in near-term market expectation of price swings. The USD-INR exchange rate remained largely stable, closing around 88.79 per US dollar, with the rupee expected to stay in a narrow range, supported by domestic triggers like IPO-related inflows and potential progress in US–India trade talks.

Global Movers:

US stocks advanced to yet another record, as investors rotated back into tech stocks. The S&P 500 rose 0.6% to 6754, while the Nasdaq 100 gained 1.2%. Yet again, it was the Mag 7 basket that made notable gains. Still, the back-and-forth action has kept the S&P in a tight range over the last five sessions, with the US government shutdown impacting data releases which otherwise could have provided economic cues. Meanwhile, a study undertaken over 75 years of history showed that when markets have hit record highs in September, they have gone on to rally 4.8% on average during Q4. This means history supports further gains before year-end. In related markets, the VIX dropped 5.5%, the dollar index rose and the US 10-year treasury yield fell. Elsewhere, spot gold climbed above the $4000 mark for the first time ever as they hit an intraday record of $4059/ounce even as momentum got more overextended, while brent prices settled above $66/barrel.

Stock Futures:

Titan Company Ltd. (TITAN) shares surged 4.2% on a wave of short covering, which concurrently saw a decrease in open interest (OI) of 4.7%, settling the futures OI at 64,229 contracts after the shedding of 3,155 contracts. This bullish eruption was ignited by a strong provisional Q2FY26 Business Update, showcasing a 20% YoY growth in consumer businesses. The core domestic jewellery segment registered an impressive 19% YoY expansion, overshadowed only by a massive 86% jump in the international business. Options positioning reveals a total call OI of 28,874 contracts versus 19,997 contracts in put OI, with new activity showing an addition of 6,867 call contracts compared to an addition of 6,325 put contracts. The Put-Call Ratio (PCR) climbed to 0.69 from 0.62, reflecting increasing hedging or a relatively more cautious stance in put options following the sharp rally, while call option writers currently hold a dominant positional edge in the total open interest.

RBL Bank Ltd. (RBLBANK) maintained a strong upward trajectory, defying an F&O ban period and trading near its 52-week high, propelled by a sustained positive trend in its core operational metrics and favourable institutional outlook. The bank's improving fundamentals, marked by falling Gross NPA and Net NPA percentages alongside an uptrend in its Net Interest Margin (NIM), signalled an enhancement in asset quality and profitability. The stock witnessed short covering with a price gain of 3.9% and a significant 8.5% decrease in open interest, leaving the futures OI at 25,674 contracts after shedding 2,384 contracts. In options, the total call OI stands at 7,085 contracts and the put OI at 3,071 contracts, with activity showing a decrease in call options of 873 contracts and a decrease in put options of 305 contracts. The continuation of the rally amidst declining open interest and heavy short covering points to a conviction-led move, although the total call OI remains more than double the put OI, suggesting option writers anticipate the current highs as a stiff resistance zone.

Rail Vikas Nigam Ltd. (RVNL) experienced a sharp correction, declining 4.7% despite securing new project orders, most recently emerging as the Lowest Bidder (L1) for a Western Railway project on 2nd October, 2025, and benefiting from the government's sustained capital expenditure push. The downward pressure is likely attributable to investor concerns over the stock's expensive valuation, triggering a price correction and cautious sentiment. This descent was accompanied by a short addition, evidenced by a 20% increase in open interest concurrent with the price drop, establishing the futures OI at 28,287 contracts with a new addition of 4,714 contracts. Options positioning highlights a total call OI of 15,727 contracts versus 5,812 contracts in put OI, fueled by the addition of 4,546 call contracts compared to only 482 added put contracts. The Put-Call Ratio (PCR) collapsed to 0.37 from 0.48, and implied volatility soared to 40.9%, increasing 6.2% or 2.4 points, confirming that option writers are aggressively building short positions via call writing as they anticipate further price depreciation, indicated by the falling PCR and high OI concentration in calls.

Kaynes Technology India Ltd. (KAYNES) underwent a sharp downward correction, plummeting 5.7%, with the primary catalyst being news of the company’s Managing Director (MD) receiving a show-cause notice from the Securities and Exchange Board of India (SEBI), immediately raising regulatory compliance concerns and eroding investor sentiment. The negative momentum facilitated short addition, reflected in a 4.9% increase in open interest alongside the price slide, setting the futures OI at 12,436 contracts with a new addition of 577 contracts. Options activity saw the total call OI stand at 13,011 contracts and put OI at 6,842 contracts, with an addition of 4,997 call contracts significantly outweighing the addition of 1,995 put contracts. The Put-Call Ratio (PCR) decreased to 0.53 from 0.60, indicating a pronounced bearish bias and risk aversion, where option writers are actively selling call options to capitalise on the expected downside continuation, as shown by the high OI in calls and the declining PCR.

Put-Call Ratio Snapshot:

The Nifty put-call ratio (PCR) fell to 0.8 from 1.04 points, while the Bank Nifty PCR fell from 1.11 to 1.05 points.

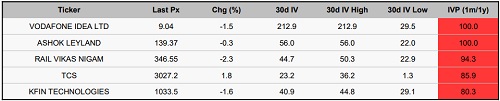

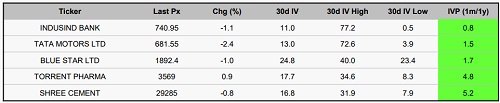

Implied Volatility:

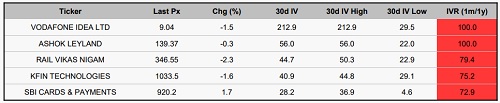

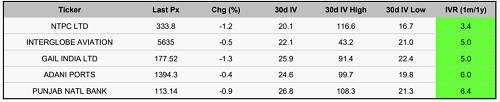

Vodafone Idea (IDEA) and Ashok Leyland (ASHOKLEY) are exhibiting elevated market volatility as reflected by their maximum Implied Volatility (IV) rank of 100% each. This high percentile strongly correlates with their respective Annualized Expected Volatility figures of 213% and 56%. This significant market expectation of future price dispersion has resulted in the inflation of option premiums, leading to heightened capital requirements for initiating both hedging (risk mitigation) and speculative (directional) exposures. Consequently, option strategies for these underlying assets are currently capital-intensive. In sharp contrast, NTPC (NTPC) and InterGlobe Aviation (INDIGO) are situated within a low-volatility regime relative to their peers. Their subdued Expected IVs of 20% and 22% have driven a marked compression in option premiums. This environment presents a favourable risk-reward profile for executing directional strategies via the purchase of long Call or Put options, owing to the lower initial capital outlay required. Furthermore, this stable price action enhances the viability of premium-collecting strategies such as short options (selling options).

Options volume and Open Interest highlights:

Titagarh Rail Systems (TRSL) and RVNL are exhibiting a pronounced bullish bias, as evidenced by their significantly elevated Call-to-Put Volume Ratios of 5:1. This substantial skew toward call options activity signals robust positive sentiment, with market participants aggressively initiating long positions in anticipation of a potential upside trajectory in the underlying equities. The subsequent surge in call demand has led to an uptick in option premiums, thereby increasing the cost of directional exposure via the derivatives route for new entrants. Dixon Technologies and JSW Steel, in contrast, are currently displaying a bearish sentiment, underscored by a higher Put-to-Call Volume Ratio. This positioning indicates heightened trading interest in put contracts relative to calls, typically associated with downside protection strategies or speculative short bets. However, the concentrated build-up of bearish positions (i.e., Put OI accumulation) may concurrently suggest that these stocks are nearing oversold territory, potentially creating contrarian buying opportunities for value-focused investors. Tata Motors and Crompton Greaves Consumer Electricals are witnessing a balanced yet marginally bearish derivative setup. The concurrent rise in Open Interest (OI) across both call and put strikes implies market expectations of elevated near-term volatility. While directional clarity remains ambiguous, this positioning suggests that traders are bracing for a significant price movement, even with prevailing uncertainty regarding its trajectory. Fortis Healthcare is recording increased activity on the call side, potentially denoting a bullish tilt and upside expectations. However, this dynamic could also be indicative of aggressive call writing (i.e., short-covering or hedging), suggesting a more nuanced interpretation of market positioning is required. Trent Ltd continues to show accumulation in put option OI, which reinforces a cautious stance among market participants. Although directional conviction remains subdued, the build-up in protective puts highlights prevailing concerns regarding short-term volatility and downside risk exposure. (This data covers only stock options with at least 500 contracts traded on the day for both calls and puts).

Participant-wise Open Interest Net Activity:

In index futures, the net change of 6,400 contracts was predominantly driven by a robust accumulation of 4,297 contracts by Clients, supported by a further 854 added by Foreign Institutional Investors (FIIs), collectively underscoring a clear bullish bias from these segments. In stark contrast, Proprietary traders aggressively reduced their exposure by 6,400 contracts, completely offsetting the combined additions and signifying a strong bearish hedge or profit-booking stance. Conversely, the stock futures segment, with a total change of 42,667 contracts, reveals a markedly different dynamic: a substantial addition of 16,697 contracts by Clients suggests isolated stock-specific optimism, which was overwhelmed by the massive liquidation of 36,454 contracts by FIIs and a further 6,213 contracts diminution by Proprietary traders, collectively pointing to a pronounced institutional bearish outlook on individual stocks.

Nifty

Bank Nifty

Stocks with High IVR:

Stocks with Low IVR:

Stocks With High IVP:

Stocks With Low IVP:

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633

More News

Quote on Pre-Market Comment 16 July 2025 by Aakash Shah, Technical Research Analyst, Choice ...