Daily Derivative Report - 21st January 2026 by Religare Broking Ltd

Market Outlook

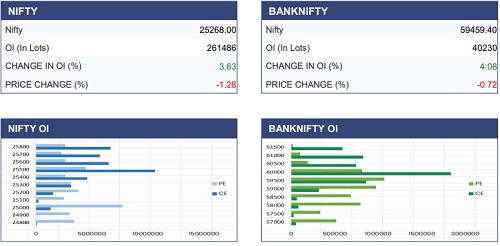

The Nifty 50 witnessed a sharp decline from the 25,600 level, dragging the index to an intraday low of 25,171 before settling at 25,232. In the derivatives segment for the January monthly expiry, fresh call writing was observed at the 25,500 strike, indicating an immediate upside hurdle. On the downside, major put OI has placed at the 25,000 level, suggesting near-term support where the index may either attempt a reversal or pause. On the daily chart, the rising trendline support is placed in the 25,100–25,200 zones, which may induce a relief rally towards the 25,450 level in the coming sessions, however “sell on rise” strategy remains advisable as long as the index stays below 25,500 marks.

Please refer disclaimer at https://www.religareonline.com/disclaimer

SEBI Registration number is INZ000174330

More News

Quote on Nifty 01st September 2025 from Rupak De, Senior Technical Analyst, LKP Securities