Daily Derivative Report - 17th February` 2026 by Religare Broking Ltd

Market Outlook

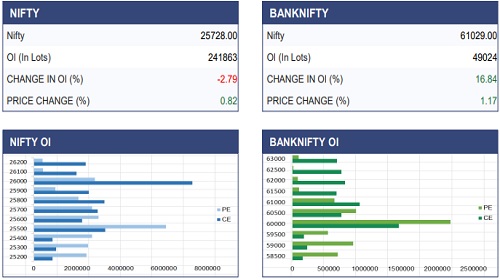

The Nifty 50 witnessed a relief rally after last week’s sharp sell-off, advancing 0.83% to settle the day at 25,682. On the daily chart, the index reclaimed its key 50-DEMA, signalling an improvement in near-term sentiment. From a derivatives perspective, significant call writing has placed at the 25,700 and 25,800 strikes, which are likely to act as immediate resistance zone and may attract selling pressure if the index fails to decisively close above this zone. On the downside, significant put writing at the 25,500 strike indicates an immediate support zone.

Rationale

* On the daily chart BEL is trading above its key moving averages and after narrow range consolidation, prices are recently witnessed a rebound from 20-DEMA indicating that bullish bias remain intact for the near term

* 14-Day RSI hover near 60 mark, suggests that prices are traded on a stronger note with the ample room to run upwards before reaching overbought territory.

* On the weekly timeframe MACD histogram placed in a positive trajectory with the recent bullish crossover, which confirms that the primary trend remains positive.

* On the technical front prices are traded with the higher lows structure with gradual increment in trading volume, indicating potential for the upwards journey towards recent swing high of 460 level.

Please refer disclaimer at https://www.religareonline.com/disclaimer

SEBI Registration number is INZ00017433

More News

Daily Technical Outlook by Axis Securities Ltd

.jpg)