Crude Oil Steadies as Glut Fears, Trade War Hit Demand Outlook - HDFC Securities Ltd

GLOBAL MARKET ROUND UP

* Gold rose to a new record high above $3,275 an ounce in the Asian trading hours on Wednesday, surpassing the previous all-time peak set on Monday. Traders were whiplashed again by a slew of tariff headlines; in the latest, US President Donald Trump ordered a probe into critical minerals, sparking a move toward haven assets.

* Meanwhile, exchange-traded funds added 400,152 troy ounces of gold to their holdings in the last trading session. Total gold held by ETFs rose 7.5 percent this year to 89.1 million ounces, the highest level since Sept. 12, 2023. ETFs also added 2.69 million troy ounces of silver to their holdings in the last trading session, bringing this year's net purchases to 9.91 million ounces.

* Crude oil steadied after a modest decline on Tuesday as expectations for a glut and the trade war between the world’s two biggest economies weighed on the demand outlook. In its monthly report, the IEA slashed its forecasts for global oil consumption this year and next as trade frictions rise. Supply additions are likely to be more than enough to satisfy demand. Constructive nuclear talks between the US and Iran also weighed down oil prices, raising the possibility of increased Iranian oil volumes.

* Base metals declined on Tuesday as the escalating trade war between the US and China continued to weigh down on the market. Meanwhile, China's economy showed surprising strength in early 2025, with GDP growing 5.4% in the first quarter, driven by a sharp uptick in March. Industrial output expanded 7.7% in March from a year ago, the fastest growth since June 2021. Retail sales increased 5.9%, the best pace since December 2023 and much stronger than the 4.3% gain expected by economists.

Gold

Trading Range: 93450 to 95080

Intraday Trading Strategy: Buy Gold Mini May Fut at 93980-94050 SL 93650 Target 94450/94700

Silver

Trading Range: 94300 to 96480

Intraday Trading Strategy: Buy Silver Mini Apr Fut at 94980 SL 94200 Target 95955

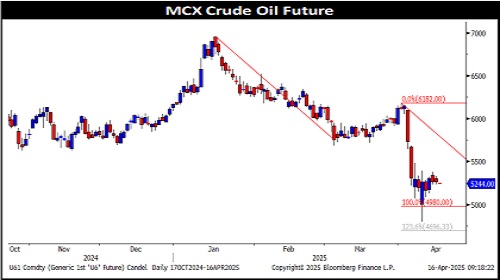

Crude Oil

Trading Range: 5120 to 5350

Intraday Trading Strategy: Sell Crude Oil Apr Fut at 5305 SL 5385 Target 5180

Natural Gas

Trading Range: 266 to 294

Intraday Trading Strategy: Sell Natural Gas Apr Fut at 288 SL 294.0 Target 275

Copper

Trading Range: 819 to 845

Intraday Trading Strategy: Sell Copper Apr Fut at 836 SL 842.0 Target 826

Zinc

Trading Range: 245-256

Intraday Trading Strategy: Sell Zinc Apr Fut at 251.0 SL 254.80 Target 245.0

Please refer disclaimer at https://www.hdfcsec.com/article/disclaimer-1795

SEBI Registration number is INZ00017133