Credit-to-Deposit Ratio Breaches 80% Mark for the First Time in FY26 by CareEdge Ratings

Synopsis

* Credit growth has continued to outpace deposits in the current fortnight, though overall credit offtake continues to trail significantly behind the levels seen during the same period last year. At the same time, deposit growth has slipped below the double-digit mark for the second fortnight in a row, after remaining above it for the past three months.

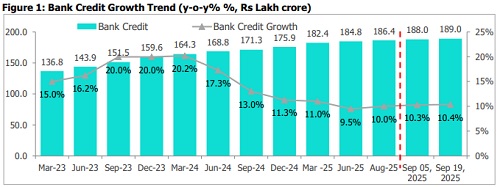

* As of September 19, 2025, credit offtake stood at Rs 189.0 lakh crore, reflecting a 10.4% year-on-year rise, majorly due to credit expansion to micro and small enterprises. This growth remains substantially lower than the 13.0% growth recorded in the previous year (excluding the merger impact), attributed to the high base effect, slower lending to corporates, and reduced lending to NBFCs.

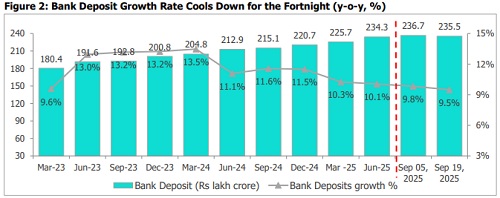

* Deposits rose by 9.5% y-o-y, totalling Rs 235.5 lakh crore as of September 19, 2025, a decrease from 11.6% the previous year (excluding merger impact). The slower growth is attributed to a likely decline in bulk deposits, as banks offer relatively lower yields and shift towards alternative instruments, while justin-time government fund releases also dampen deposit growth.

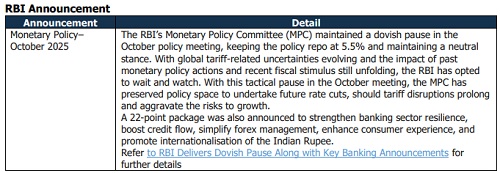

* As of September 26, 2025, the Short-Term Weighted Average Call Rate (WACR) dropped to 5.57%, compared with 5.48% in the previous fortnight and is now seven basis points (bps) above the repo rate of 5.50%. This decline follows three consecutive cuts to the repo rate and the Reserve Bank of India's (RBI) efforts to manage liquidity.

Bank Credit Growth Rate Rises for the Fortnight

* Credit offtake rose 10.4% y-o-y in the fortnight ending September 19, 2025, marking a sequential uptick of 0.5% i.e. Rs 1.02 lakh crore over the previous fortnight, attributed to credit expansion to Micro and small enterprises. Meanwhile, this growth stayed well below the 13.4% (ex-merger) seen in the same period last year, weighed down by a high base effect, weaker corporate lending, deceleration in personal loans and reduced credit flow to NBFCs.

* Deposits rose by 9.5% y-o-y and reduced by 0.6% over the past fortnight, reaching Rs 235.5 lakh crore as of September 2025. However, they remain lower than the 11.6% growth (excluding merger impact) seen last year. Time deposits grew by 8.9% year-on-year to Rs 207.0 lakh crore, accounting for 87.9% of total deposits, a slowdown from the 11.3% growth in the same period last year. This slower growth in time deposits in the current fortnight could be partially attributed to the advance tax payments. Demand deposits, on the other hand, increased by 13.4% y-o-y to Rs 28.5 lakh crore, making up 12.1% of the total deposits.

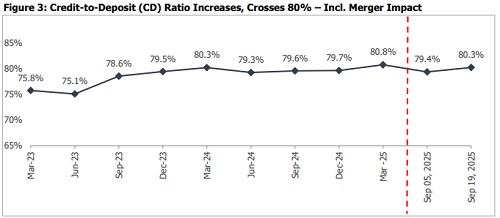

* The Credit-Deposit (CD) ratio increased to 80.3% in the current fortnight, crossing the 80% mark for the first time in six months, largely reflecting a decline of Rs 1.24 lakh crore in deposits alongside a rise of Rs 1.02 lakh crore in credit. Meanwhile, this CD ratio above 80% suggests banks are deploying a larger share of deposits into credit, supporting interest income growth. However, higher lending relative to deposits may pressure liquidity, potentially increasing reliance on costly short-term funding and compressing margin

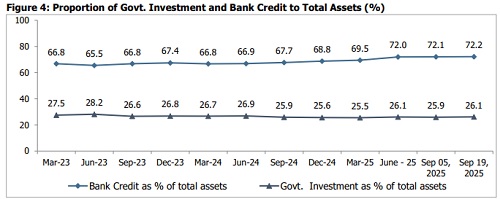

Bank Credit and Government Investments Share Increases Marginally

* The Bank credit-to-total-assets ratio and Government Investment-to-total-assets increased marginally by one and two basis points (bps), reaching 72.2% and 26.1% respectively for the current fortnight. Additionally, overall government investments totalled Rs 68.4 lakh crore as of September 19, 2025, reflecting a y-o-y growth of 6.9% and a sequential rise of 0.4%.

Above views are of the author and not of the website kindly read disclaimer