Company Update : CreditAccess Grameen Ltd By Motilal Oswal Financial Services Ltd

Improved business momentum coupled with stabilizing asset quality

Transient impact of Karnataka Ordinance on asset quality

* CREDAG’s AUM stood at INR254b as of Feb’25 vs. INR248b as of Dec’24. The share of Karnataka in AUM stood at INR80.1b as of Feb’25 vs. INR79.3 as of Dec’24. AUM in other states stood at INR174b as of Feb’25 vs. INR169b as of Dec’24.

* The company witnessed positive business momentum, led by healthy portfolio growth across all geographies, partially offset by lower growth in Karnataka.

* CREDAG added ~150k new customers in Jan’25 and Feb’25.

* PAR 90+ increased ~80bp to ~3.4% as of Feb’25, whereas PAR 90+ (excl. Karnataka) increased ~60bp to 3.9% vs. 3.3% as of Dec’24.

* PAR 0+ increased ~70bp to 7.5% as of Feb’25 vs. ~6.8% as of Dec’24; however, PAR 0+ (excl. Karnataka) improved ~70bp to 7.3% as of Feb’25 vs. ~8% as of Dec’24.

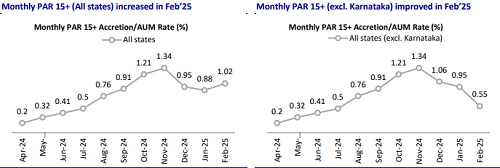

* There was a transient increase in PAR 15+ in Tamil Nadu in Jan’25 due to the delayed impact of heavy rains/cyclones in Nov’24/Dec’24; however, corrective measures have been taken in Feb’25.

* There was a significant reduction in PAR 15+ accretion across other operating geographies in Feb’25.

* X bucket collection efficiency in Karnataka declined from ~99.4% in Dec’24 to ~95.1% in early Feb’25 but later improved to 98.0% in the last week of Feb’25.

Impact of Karnataka Ordinance – effective from 12th Feb’25

* The increase in delinquencies during Jan’25 and early Feb’25 was due to various operational ambiguities in anticipation of the ordinance, on-ground sensitivities, and collections being limited to center meetings while avoiding house visits.

* The situation has been gradually stabilizing after the release of the ordinance, as reflected in a gradual decline in weekly PAR addition trends after 12th Feb’25.

* Collections beyond center meetings have resumed as per the RBI guidelines, alongside awareness drives to educate borrowers.

* Despite the transient increase in delinquencies, Karnataka PAR 0+ remains lower than that in certain other operating geographies. The situation is expected to gradually normalize over 1-2 months.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

Tag News

Automobiles Sector update : Strong demand momentum sustained across segments by Motilal Oswa...