Commodity Weekly Insights 13th January 2026 : Aluminium Report by Geojit Investments Ltd

Aluminium prices hovered near a 3½-year high in recent weeks, underpinned by strong demand signals from China and tightening supply conditions. The rally was further fuelled by hopes of improved retail demand after Chinese government planned on implementing a package of fiscal and financial measures to boost household spending.

* LME Aluminium futures surged to their highest level since April 2022, gaining over 10% in the past monthly period to reach USD 3,172.50 per MT.

* MCX most active aluminium futures gained more than 10% over the last monthly period.

* India aims to increase bauxite production to 50 million MT per annum by 2030, to meet ambitious aluminum production targets.

* Global primary aluminium output in November rose 0.5% yoy to 6.086 MT.- International Aluminium Institute.

* China’s aluminium output in November rose 2.5% yoy to 3.79 million metric tonnes, while aluminium imports fell 14% yoy in to 240,000 metric tonnes.

* U.S. aluminium prices have surged 40% to over USD5,200 per metric tonne following President Donald Trump’s decision to impose 50% tariffs on imports.

* Global equities largely traded in positive territory last week, while India’s Sensex slipped.

* The U.S. dollar strengthened against a basket of six major currencies and hovered around 99 marks.

* Euro, Japanese yen slipped lower while Chinese yuan edged up against USD last week.

* Indian rupee settled near all time low of 90.21 marks against the USD last week.

LME Aluminium hovered at 3-1/2 year peak

Aluminium prices climbed to their highest level in more than three and a half years in early January, driven by strong Chinese import demand, improved trade sentiment, and supply disruptions at several production facilities. The rally was further supported by expectations of stronger consumption as China, the world’s largest buyer, prepares to introduce a series of policies aimed at boosting domestic demand. Earlier this month, China’s cabinet, led by Premier Li Qiang, discussed implementing a package of fiscal and financial measures to stimulate household spending and ensure a solid start for the economy in 2026. In December, the government announced an initial allocation of CNY62.5 billion in special treasury bond funds to back its 2026 consumer trade-in program, which provides subsidies for replacing home appliances and purchasing new energy vehicles.

Looking ahead, Anglo-Australian miner Rio Tinto plans to cut output at its alumina refinery by 40% starting October 2026 to extend the plant’s lifespan. The reduction aims to prolong operations until 2035 by curbing waste generation, as current disposal facilities are expected to reach capacity by 2031. Meanwhile, the U.S. has raised tariffs on aluminium imports by 50%, triggering a sharp decline in containerized shipments from China.

China’s Aluminium output surged, Imports remain strong in October

China’s domestic aluminium output remained robust in November, rising 2.5% year-on-year to 3.79 million tonnes. In contrast, imports of unwrought aluminium and aluminium products dropped 14% from a year earlier, totaling 240,000 metric tonnes for the month. Over the first 11 months of 2025, however, China imported 3.60 million tonnes of unwrought aluminium and related products, marking a 4.4% increase compared to the same period last year.

Primary aluminium market at deficit at January-October 2025

Primary aluminium production between January and October totalled 61,217,547 tonnes, while apparent consumption reached 62,101,809 tonnes, resulting in an implied market deficit of 884,262 tonnes for the first ten months of 2025. This shortfall compares with a deficit of 737,230 tonnes during the same period in 2024 and a full-year deficit of 350,785 tonnes for 2024.

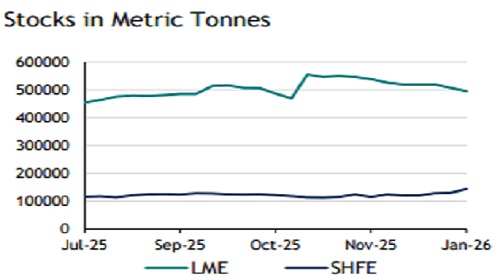

Warehouse stock level

Aluminium inventories in LME registered warehouses declined by 10925 MT and totalled 495825 MT in the last week. At the same time, the inventory level in SHFE registered warehouses increased by 14010 MT and totalled 143828 MT.

Outlook

Shanghai Futures Exchange: Prices are expected to remain positive with intermittent pullbacks. A break below CNY 23390/MT could trigger a downward move, while a solid trades above CNY 25250/MT may accelerate bullish momentum.

MCX: A bullish divergence in the MACD signals potential for continued upward momentum. Sturdy move above Rs.325/kg would reinforce the uptrend, while a drop below Rs.285/kg could trigger mild downside pressure.

For More Geojit Financial Services Ltd Disclaimer https://www.geojit.com/disclaimer

SEBI Registration Number: INH20000034

.jpg)