Commodity Research - Morning Insight - 02 December 2025 by Kotak Securities

Bullion

Spot gold climbed to a 6-week high of $4,264/Oz on Monday, supported by mounting expectations of a U.S. interestrate cut and sustained dollar weakness. Meanwhile, Silver surging to a record $58.85, as the dollar slipped to a 2-week low amid renewed yen strength following BOJ Governor Ueda’s signal of a potential rate hike this month. Gold ETFs adding 28,905 oz in the latest session, pushing YTD inflows to 14.1 m Oz, the strongest fourday streak since late October. Silver ETFs accumulated 189,235 ounces, taking annual inflows to 113.4 m Oz. On the macro front, the ISM reported that U.S. manufacturing contracted for the 9 th straight month, with the PMI easing to 48.2. Markets now price in an 88% probability of a 25-bps Fed rate cut. Today, gold retreats to $4,220 on profit booking & progress toward a Russia–Ukraine resolution could temper bullion’s upside in the near term as investors focus key data releases later this week.

Crude Oil

WTI crude oil jumped to $60/bbl yesterday after OPEC+ chose to keep production plans unchanged and stuck to its threemonth pause on output hikes for early 2026. Geopolitical tensions added to the rally, as continued Russia-Ukraine strikes despite ongoing diplomacy kept markets skeptical of a ceasefire. Ukraine’s attack on Caspian Pipeline Consortium terminal, the main export route for Kazakhstan’s crude, along with recent drone strikes on a Russian refinery and the Beriev aviation plant, introduced a fresh risk premium. Also, remarks by Trump suggesting airspace over and around Venezuela should be considered closed, heightened concerns about possible supply disruptions. Today, oil prices are holding gains as markets assess renewed geopolitical risks, including Ukraine’s intense targeting of Russian oil infrastructure and potential U.S. military action in Venezuela.

Natural Gas

Nymex natural gas futures surged to fresh three year high of $4.95/mmBtu as cold-weather forecasts for early December boosted heating demand prospects.

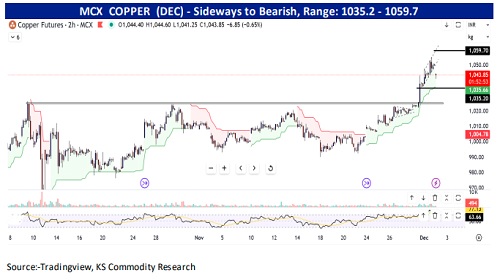

Base metals

Base metals extended their positive start to the week, with zinc outperforming and copper holding above $11,250/ton after briefly setting fresh highs. The upward momentum was supported by persistent supply constraints, elevated physical premiums, and continued uncertainty surrounding mine output in Chile alongside planned smelter reductions in China. Stronger U.S. demand amid speculation over potential future copper tariffs, further widened regional pricing spreads between Comex and the LME. Industry participants at Shanghai copper conference flagged limited ore availability and warning of potential shortages in 2025. Base metals may face pressure today, with copper vulnerable to profit-taking after record highs as markets reassess supply risks tied to China’s planned output cuts and Codelco’s premium hike.

RATING SCALE FOR DAILY REPORT

BUY We expect the commodity to deliver 1% or more returns

SELL We expect the commodity to deliver (-1%) or more returns

SIDEWAYS We expect the commodity to trade in the range of (+/-)1%

Please refer disclaimer at https://www.kotaksecurities.com/disclaimer

SEBI Registration No. INZ000200137