Commodity Research - Evening Track - 24 Sep 2024 by Kotak Securities Ltd

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

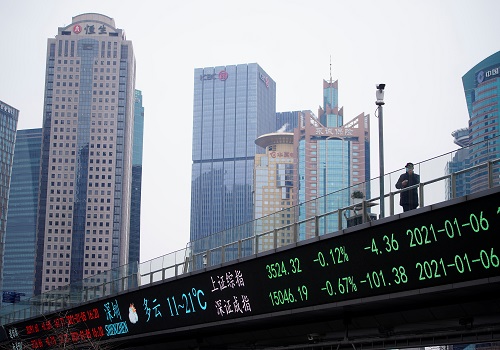

Commodities rise on Dovish Fed comments, China stimulus package

Comex gold reached a new all-time high for the third successive session as it climb to $2,664.6 today as investors carefully analyzed comments from Federal Reserve officials regarding potential future rate cuts. Chicago Fed President Austan Goolsbee suggested that with inflation approaching the central bank's 2% target, the focus should shift towards supporting the labor market, which might necessitate multiple rate reductions over the coming year. Minneapolis Fed President Neel Kashkari echoed Goolsbee's concerns about the job market, while Atlanta Fed President Raphael Bostic adopted a more cautious approach. The market's reaction to these comments was evident in the pricing of threequarters of a point of additional easing by the end of the year, implying another 50-basis-point rate cut is anticipated. WTI Crude Oil rose above $72 per barrel or 2.50% in today’s trade driven by escalating tensions in the Middle East, following Israeli airstrikes on Lebanon, increased fears of a broader conflict in the region coupled with the announcement of a stimulus package by the People's Bank of China injected optimism into global markets, boosting crude oil prices. Investors also remained cautious about the potential impact of a hurricane strike on the US Gulf Coast, which could disrupt oil production. LME base metals pushed higher as China's economy has received a significant boost after central bank governor, Pan Gongsheng, outlined plans to encourage banks to increase consumer lending, reduce the key short-term interest rate, and lower mortgage rates. The combination of China's stimulus measures and global monetary easing has created a favorable environment for the metals market. LME Copper jumped by 1.71% to trade at $9,712 a ton , other base metals also up, with zinc up by 2.84% to $2,9677 per ton and Aluminium up 2.1% to $2,547 per ton. European natural gas futures stabilized on Tuesday after a significant surge on Monday, driven by concerns over a potential hurricane in the Gulf of Mexico threatened to disrupt energy production in the region, affecting both offshore platforms and export sites. Today, attention will be on CB Consumer Confidence, CS Composite-20 HPI, alongside speeches from key officials for insights into the monetary policy outlook.

Above views are of the author and not of the website kindly read disclaimer

Tag News

Quote on Market Wrap by Shrikant Chouhan, Head Equity Research, Kotak Securities

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">