Commodity Research - Evening Track - 15 Jul 2024 by Kotak Securities Ltd

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Commodities mostly down seeking more cues on Fed’s rate path

COMEX Gold held steady after an assassination attempt on former US president and presumptive Republican nominee Donald Trump over the weekend. The market also has its eye on comments from the chairman of the Federal Reserve later in the day. Spot bullion traded near $2,410 an ounce, not far off the recordhigh $2,450/oz reached in late May. The precious metal has so far shown little price reaction to the shooting at a rally in Pennsylvania over the weekend, despite some markets showing signs of a so-called Trump trade. (Bloomberg) As per WGC data, global physically backed gold ETFs witnessed their second consecutive monthly inflows, attracting US$1.4bn in June. Inflows were widespread, with all regions seeing positive gains except for North America, which experienced mild losses for a second month.

In June, China’s wholesale gold demand remained weak, ending H1 with little changes compared to 2023. Chinese gold ETFs saw their seventh consecutive monthly inflow, pushing both of their assets under management and holdings to record highs.

WTI crude Oil trading in a range after an assassination attempt on Republican presidential contender Donald Trump, while more lackluster economic data from China piled the pressure on Beijing to boost confidence at a major policy meeting this week. Brent traded near $85 a barrel, while West Texas Intermediate was above $82.

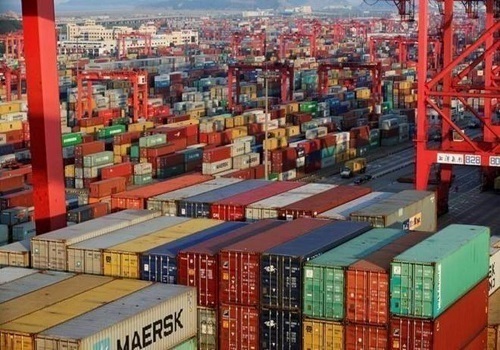

China’s appetite for raw materials including crude has shrunk over the first six months of the year, raising concerns over demand. LME metals are trading sideways to lower as China’s economy grew less than expected in the second quarter amid a persistent property downturn, weak domestic demand and rising trade tensions with the West.

Investors now await the outcome of the Third Plenum this week where top Chinese officials will discuss reforms and modernization plans. LME Copper prices eased onas weak demand prospects in top consumer China were emphasised by slow economic growth, weak lending numbers and rising inventories. Three-month copper on the LME down 0.50% at $9,801 per metric ton. LME Aluminium and Nickel is down by 0.40% and 0.92% respectively.

European natural gas prices fluctuated, as traders weigh the supply impact of an outage in Texas against weak economic data from China. Benchmark futures edged lower after earlier climbing as much as 1.3%. Prices remain near €32 a megawatt-hour, a level where they traded for most of the past week. Europe is relying on the global market to replenish its inventories before the coming winter, with traders alert to potential disruptions. (Bloomberg) Today, investors will look for the Empire State Manufacturing Index and Fed Chair Powell Speech for more direction.

Above views are of the author and not of the website kindly read disclaimer

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">