Commodity Morning Insights 1st July 2025 - Axis Securities Ltd

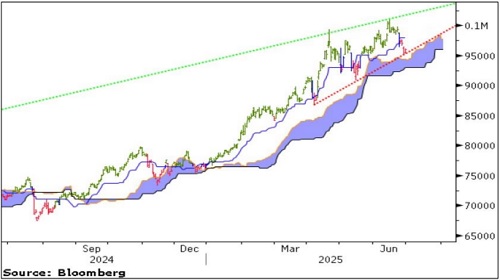

* Comex Gold rebounded in the previous session, snapping a two-day losing streak with gains of nearly 1%, as escalating geopolitical tensions between Ukraine and Russia revived safe-haven demand. Prices climbed back above the $3,300 mark, supported by a weaker dollar, with the Dollar Index slipping toward a 52-week low. Market participants now await the upcoming Fed Chair’s speech and the U.S. non-farm payroll data, which are likely to provide directional cues for the metal in the near term

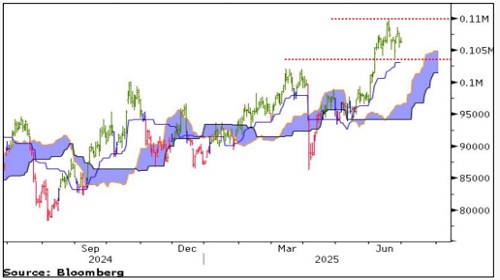

* Nymex Crude Oil closed slightly lower, down by about 0.2%, as the geopolitical risk premium continued to fade. Sentiment was further dampened by expectations that OPEC+ may raise production by an additional 411,000 barrels per day during its meeting on Sunday. Adding to the pressure were comments from U.S. President Donald Trump suggesting potential support for lifting sanctions on Iran provided it adopts a peaceful stance, which weighed on prices

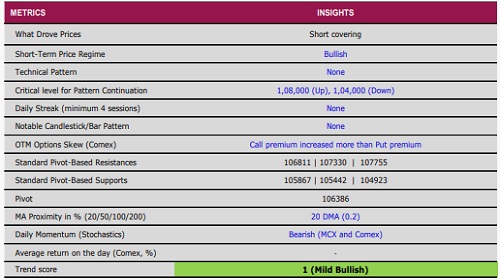

* Comex Copper ended the session flat, consolidating near its monthly highs amid growing concerns over tightening global supply. Inventories at the London Metal Exchange declined again last week, reaching 91,275 metric tons—their lowest level in nearly two years. The continued drawdown comes as traders shift shipments toward the U.S. to pre-emptively counter the impact of anticipated tariffs

* Nymex Natural Gas plunged over 7%, dragged down by mild weather conditions that have kept both heating and cooling demand muted. The subdued consumption has allowed for above-average storage builds, accelerating the recent price correction

Gold

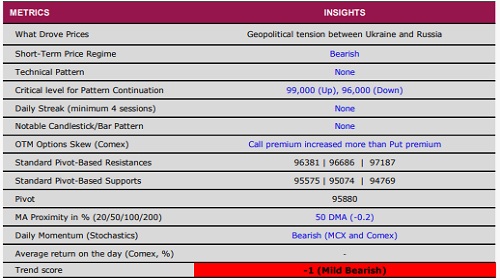

Silver

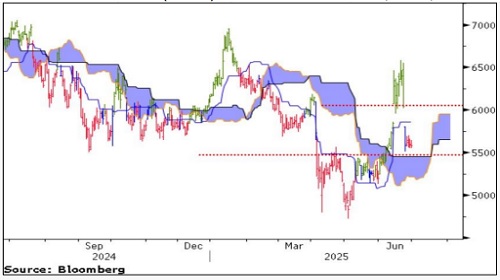

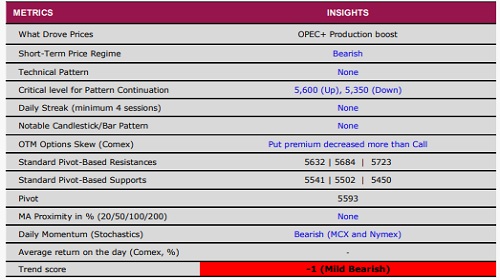

Crude Oil

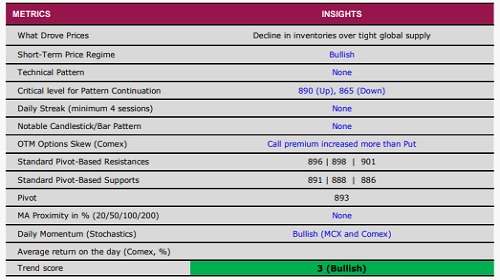

Copper

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633