Commodity Morning Insights 17th October 2025 by Axis Securities Ltd

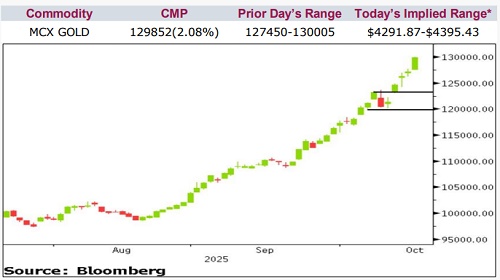

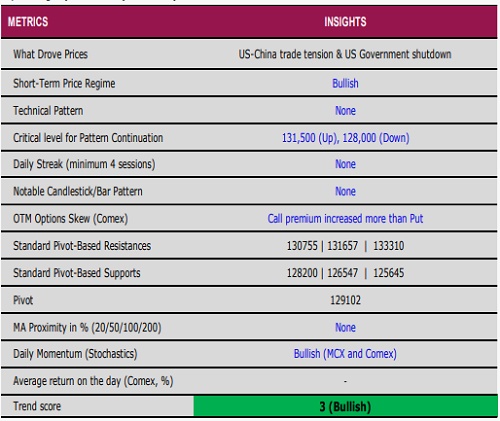

Comex Gold extended gains for the fifth straight session, scaling above the $4,300 mark for the first time and closing nearly 3% higher. Mounting concerns over the U.S. government shutdown, rising expectations of monetary easing, and renewed U.S.-China trade frictions prompted investors to seek refuge in safe-haven assets, driving strong demand for bullion

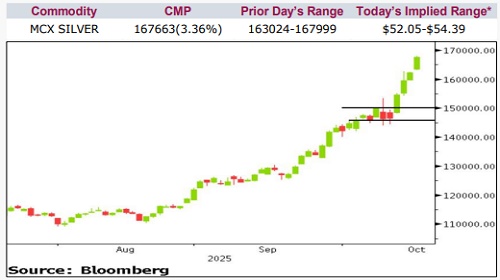

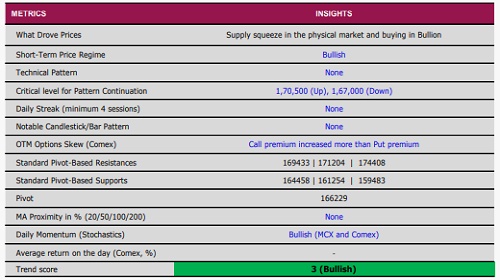

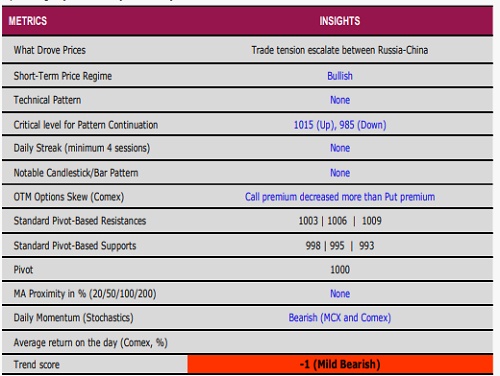

Comex Silver advanced over 2% in the previous session, surpassing the $54 mark for the first time. A tightening physical market, especially across London and India, further fueled bullish sentiment. The near-term outlook remains positive as long as the $50 support area continues to hold firm

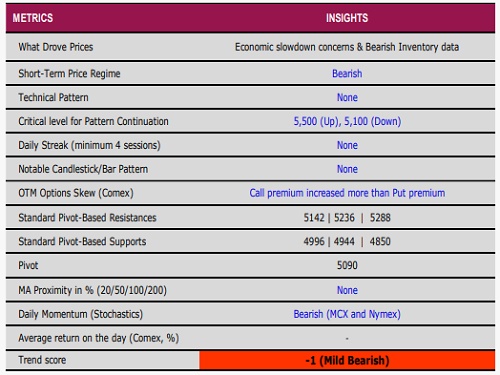

Nymex Crude Oil settled lower by more than 2%, breaking below the critical $60 level as bearish inventory data weighed on sentiment. The short-term bias remains negative while prices trade below the $61 resistance zone

Comex Copper ended the session largely unchanged, pausing a two-day slide as declining treatment and refining charges raised concerns over potential supply constraints by squeezing producer margins. The metal also found support from expectations of further Federal Reserve rate cuts, after Governor Stephen Miran highlighted that rising trade tensions have increased economic uncertainty, which strengthens the case for faster policy easing.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633