Commodity Morning Insights 09th October 2025 by Axis Securities Ltd

Commodity Derivatives Snapshot

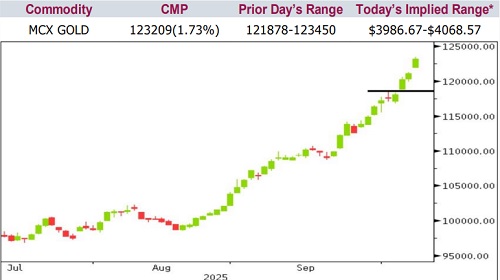

* Comex Gold surged by nearly 1.5% in the previous session, driven by renewed safe-haven demand amid the ongoing U.S. government shutdown, rising geopolitical tensions, and a weaker dollar index. Spot prices edged closer to the historic $4,100 mark for the first time. The short-term outlook remains constructive as long as the $3,900 level provides strong support

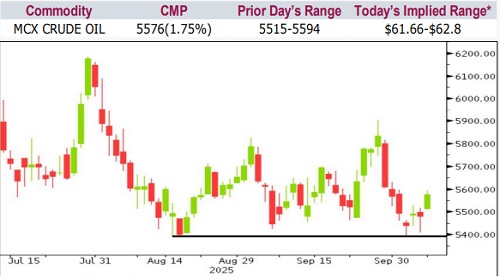

* Nymex Crude Oil settled marginally lower by around 0.5% in the last session. A modest output hike by OPEC+ helped limit the downside and stabilise prices at lower levels. Persistent supply concerns stemming from the Russia–Ukraine conflict also provided a cushion. However, higher inventory data and reports of a potential peace plan between Gaza and Israel triggered profit booking near the day’s high. Key support is seen around the $60 mark, and as long as this level holds, prices are likely to trade in a sideways range

* Comex Copper ended flat in the previous session but continues to sustain near multi-week highs, supported by ongoing supply disruptions in major producing nations such as Indonesia and Chile. Following last month’s accident at Indonesia’s Grasberg mine, all missing workers have now been confirmed dead, with operator Freeport-McMoRan indicating that full-scale production may not resume until early 2027. This development has prompted the company to slash its 2026 sales outlook by 35%, lending fundamental support to prices

* Nymex Natural Gas declined sharply by nearly 4% in the last session after a strong rally earlier in the week. Traders now await the U.S. natural gas inventory data due later today, which could set the tone for the next directional move if the numbers deviate from expectations

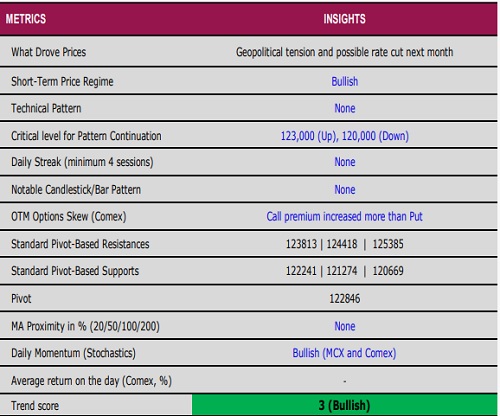

Gold

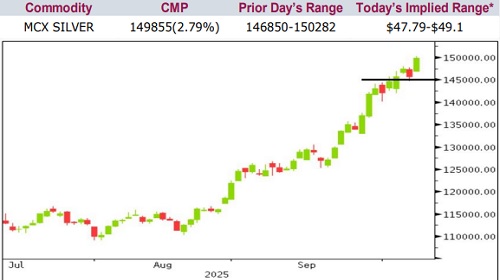

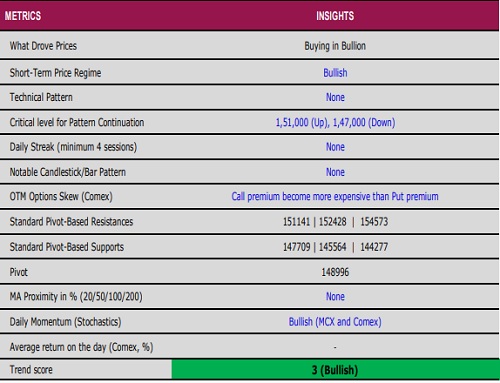

Silver

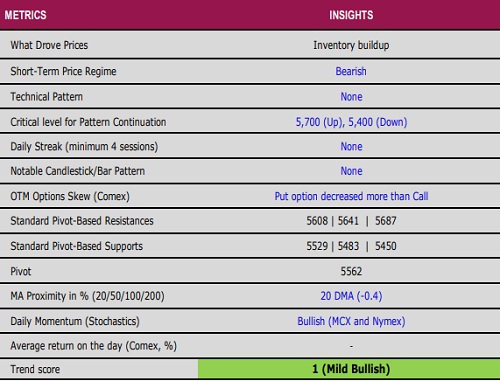

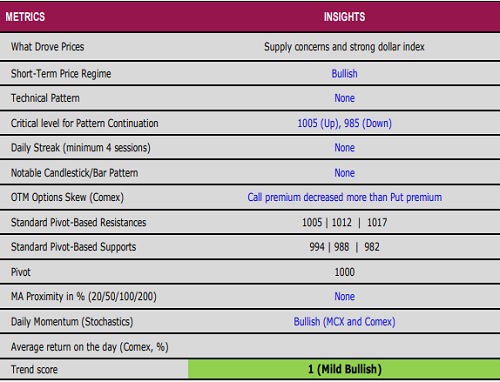

Crude Oil

Copper

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633