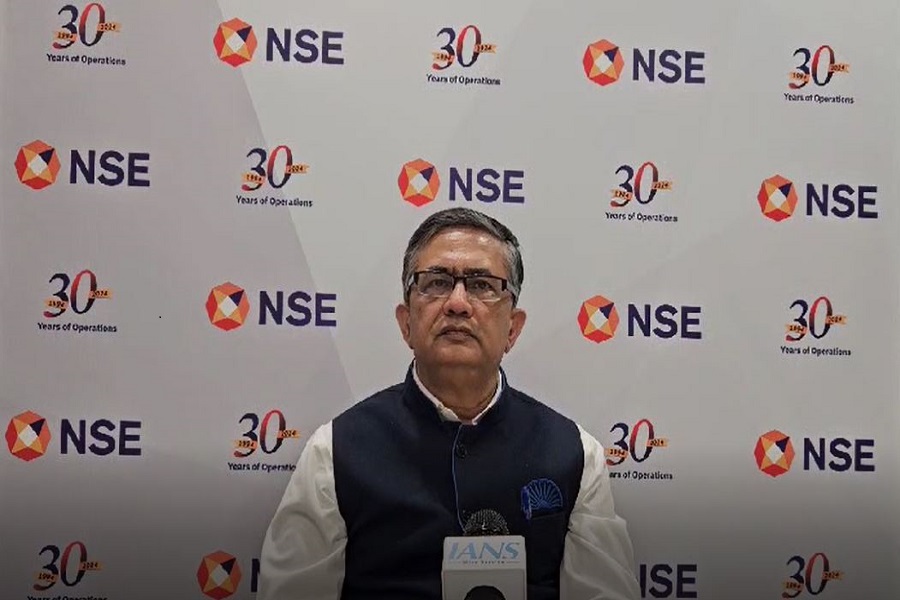

Comment on AMFI Feb data by Ajay Garg, CEO, SMC Global Securities

Below the Comment on AMFI Feb data by Ajay Garg, CEO, SMC Global Securities

In February 2025, the mutual fund industry showed mixed signs of caution and optimism amidst market volatility. The total AAUM (Average Assets Under Management) for the month was at ?67.58 lakh crores, reflecting a marginal drop of 0.68% from January 2025. The total net inflow in February 2025 was at ?40,063.36 crores, with a sharp fall of 79% from the previous month. This fall indicates that investors are being more careful amidst broader market weakening and global uncertainties.

Equity-oriented funds, which typically invest in stocks, saw a net inflow of ?29,303.34 crores in February 2025, which was a 26% fall from January's net inflows. It highlights that the high-risk taking investors are still holding in the market but choose to remain cautious.

Out of all the types of equity funds, focused funds saw a 64% increase in net inflows from January to ?1,287.72 crores in February 2025. It means that even in a volatile market, investors are still confident in these funds that concentrate on a smaller number of stocks (maximum 30) with the potential for higher returns.

The gold ETFs’ net inflows have decreased, but their AAUM grew by 15% to ?55,001.75 crores. This rise is due to a sharp rally in gold prices, which can also fuel the investor’s interest in the gold ETFs in the near future.

The number of schemes in the mutual fund industry rose to 1,739, with 28 new schemes introduced only in February. This shows that mutual fund houses are offering new options to investors and remain optimistic, even during challenging times.

To boost investor participation and promote financial inclusion, AMFI is actively working with initiatives like Chhoti SIP of ?250 to promote investment among small investors. For ease of access and to ensure transparency, SEBI has also launched the MITRA platform to help investors track and recover their forgotten or inactive mutual fund holdings.

Overall, February 2025 saw a cautious approach from investors in the mutual funds space. India’s steady economic growth amidst global uncertainty and cooling inflation will drive the future growth of the broader market, which can also turn beneficial for the mutual fund industry in the long run.

Above views are of the author and not of the website kindly read disclaimer

Tag News

Quote on Markets 02nd March 2026 by Mr. Vikram Kasat, Head Advisory, PL Capital