CD Ratio Moderates Slightly but Continues to Stay Over 80% for the Fortnight by CareEdge Ratings

Synopsis

• On a sequential basis, deposit growth outpaced credit offtake as credit momentum eased, marking the first instance in the past two months when deposits have grown faster than credit. However, deposit growth has remained below the double-digit threshold for the last three months.

* As of October 31, 2025, total credit off-take rose to Rs 193.9 lakh crore, up 11.2% year-on-year (y-o-y). Festive-season demand, GST rate cuts, sustained retail and MSME activity, and some corporate borrowing amid rising bond yields all contributed to the increase. Strong vehicle financing during the festive period is also expected to aid credit growth further. Meanwhile, this growth was lower than the 11.8% growth in the same period last year due to weaker corporate demand and reduced lending to certain segments.

* Bank deposits rose 9.7% y-o-y to Rs 241.7 lakh crore, moderating from the 11.0% growth seen a year earlier (ex-merger). The softer expansion reflects the impact of the ongoing rate-cut cycle, which has made alternative investment avenues relatively more attractive than traditional bank deposits.

• As of October 31, 2025, the weighted average call rate (WACR) rose to 5.58%, up from 5.53% in the previous fortnight, standing eight bps above the 5.50% repo rate. The uptick highlights tighter system liquidity amid firm credit demand, even as the RBI manages liquidity through VRR operations.

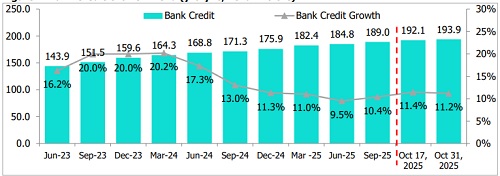

Bank Credit Growth Rate Softens Marginally

Figure 1: Bank Credit Growth Trend (y-o-y%, Rs lakh crore)

• Bank credit off-take rose 11.2% y-o-y to Rs 193.9 lakh crore as of the fortnight ending October 31, 2025, marking a 0.9% uptick over the previous fortnight. The improvement was fuelled by festive-season demand, the boost from recent GST rate cuts, and sustained traction in the retail and MSME segments. Corporate borrowing also picked up amid elevated bond yields. Strong vehicle financing during the festive period is expected to provide additional support to overall credit growth in the near term.

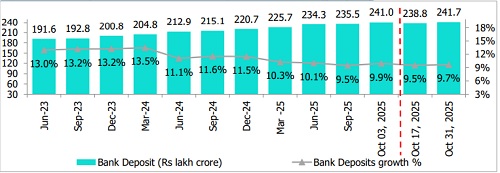

Figure 2: Bank Deposit Growth Rate Inches Up for the Fortnight (y-o-y, %)

• As of October 31, 2025, aggregate bank deposits stood at Rs 241.7 lakh crore, registering a 9.7% y-o-y increase and a 1.2% rise over the previous fortnight. Despite the sequential improvement, deposit growth continued to trail the 11.0% (ex-merger) expansion recorded a year earlier, attributed to investments into alternative avenues yielding higher returns. The latest fortnightly uptick was supported largely by a rise in demand deposits, which grew 21.0% y-o-y, higher than the 12.0% growth seen a year ago, driven by festive season business collections. Demand deposits now stand at Rs 31.0 lakh crore, accounting for 12.8% of total deposits. Meanwhile, time deposits, which form 87.2% of the deposit base, expanded by 8.2% y-o-y to Rs 210.7 lakh crore, moderating from 11.8% in the corresponding period last year.

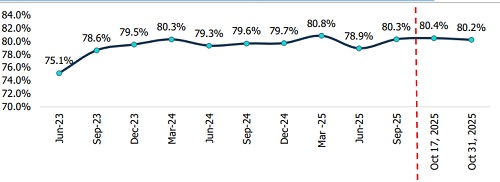

Figure 3: CD Ratio Softens in Late October, Yet Stays Above 80% - incl. merger impact

• The credit-to-deposit (CD) ratio eased slightly to 80.2% in the fortnight ending October 31, 2025, though it continued to stay above the 80% mark. The slight moderation was driven by a stronger increase in deposits, which rose by Rs 2.91 lakh crore during the fortnight, compared with a smaller rise in credit offtake of Rs 1.8 lakh crore. The relatively higher deposit accretion diluted the pace of credit expansion, resulting in a mild softening of the CD ratio.

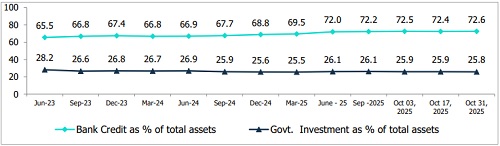

Bank Credit Share Edges Up, While Government Investments See a Mild Dip

Figure 4: Proportion of Govt. Investment and Bank Credit to Total Assets (%)

• The bank credit-to-total-assets ratio inched up by two basis points to 72.6% in the fortnight ending October 31, 2025. In contrast, the government investment-to-total-assets ratio eased slightly to 25.8%. Total government investments stood at Rs 68.9 lakh crore, reflecting a 5.1% y-o-y increase and a modest sequential rise of 0.1%.

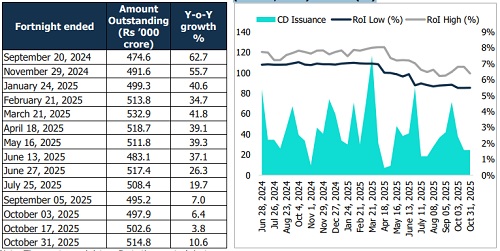

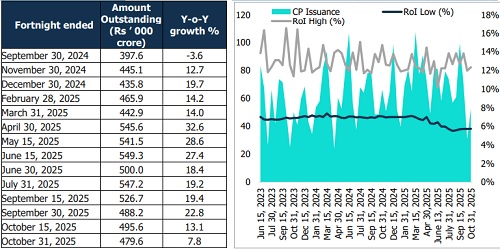

Certificates of Deposit (CDs) Increase while O/s Commercial Papers (CPs) Decline Sequentially

Figure 5: Certificate of Deposit O/s Figure 6: Trend in Certificates of Deposit Issued (Rs ’000, crore) and RoI (%)

Figure 7: CP Outstanding Figure 8: Trend in CP Iss. (Rs ’000, crore) and ROI (%)

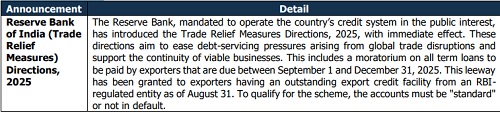

RBI Announcements

Above views are of the author and not of the website kindly read disclaimer