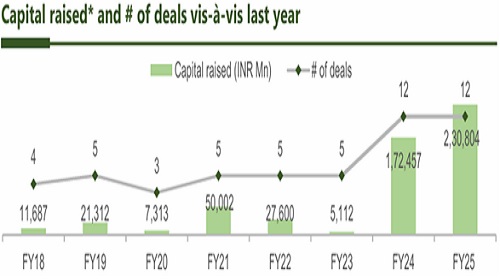

Capital raised by the Indian real estate sector highest in the past 7 years: Equirus Capital

Equirus Capital – Mumbai based full-service investment banking firmhas released a press note on thedevelopment in the real estate sector. As per the press note, the capital raised are at a 7-year high at Rs 23,080 crores, the number of deals were 12. Category wise the total fund raised since FY18 was Rs 72,331 crore, out of which largestcomposition was that of REITs at Rs 31,241 crore, large cap real companies raised Rs 20,437 crores,midcap at 12,496 crores, and smallcap real estate companies stood at Rs 8156 crores.

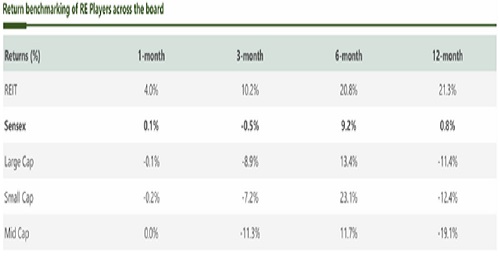

Sectoral performance

Small Cap real estate stocks are the best performing segment since March 2021 followed by Mid Cap. Larcap real estate stocks’ performance has been lower than mid and smalcap realty stocks. REITs have been the lowest performing equity instrument in the real estate universe.

Return benchmarking of RE Players across the board

However, if we see returns from a 12-month perspective, REITs have been the best performing real estate asset class, the returns garnered have been 21.3%, Large, mid and small cap real estate stocks have posted negative returns in the past 12 months.

Above views are of the author and not of the website kindly read disclaimer