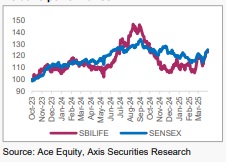

Buy SBI Life Insurance Ltd for the Target Rs. 1,900 by Axis Securities Ltd

VNB Margins Surprise Positively, Focus on Agency Channel Continues

Est. Vs. Actual for Q4FY25: NBP – MISS; APE – INLINE; VNB/VNB Margins (%) – BEAT

Changes in Estimates post Q4FY25

FY26E/FY27E (in %): NBP -9.0/-9.6; APE -4.4/-5.3; VNB -3.0/-5.1

Recommendation Rationale

* Agency channel ramp-up to continue: In line with the company’s renewed focus on the agency channel, the focus during the quarter was on improving agency activation through traditional and protection products, which have been selling ULIP products until now. SBILIFE remains committed to strengthening the agency channel, with plans to open 87 new branches, expand into Tier 2/3 cities, onboard more agents, and enhance agent productivity and activation. The company is streamlining its agency network by weeding out underperforming agents. The management has guided for a strong ~25% growth through the agency channel in FY26. Driven by strong growth in the agency channel and sustained growth in the banca channel, SBILIFE expects to deliver a 13-14% individual APE growth, marginally better than industry growth, which is pegged at 12-13%.

* VNB margins to remain range-bound: In Q4FY25, VNB margins (calc.) surprised positively and stood at 30.5%, significantly higher than our expectations. This improvement was driven by a favourable product mix coupled with an improvement in product-level margins. The share of ULIP business was lower primarily owing to volatile equity markets. The management has highlighted that SBILIFE is making a conscious effort to diversify its product mix away from ULIP. Going forward, SBILIFE will look to maintain ULIP vs Traditional product mix (in terms of IRP) at 65:35 vs 70:30 currently. The management has guided for VNB margins to be maintained between 27-28% in FY26. SBILIFE highlighted that the shift in the product mix towards Par from ULIP may not have a meaningful bearing on blended margins, as the margin profile for both these categories is identical.

* Banca Channel growth to complement agency growth: Along with growth in the agency channel, the management expects the banca channel to deliver a ~10% (low-double digit) growth in FY26. The management also highlighted that the banca channel offers a fairly large growth opportunity and SBILIFE will continue to harness these opportunities from the parent as well as other banca partners. Currently, activation rates in SBI are better vs other banca partners.

* No clarity on banca restrictions: SBILIFE has stated that it has not been informed of any restrictions on the banca channel business either from the regulator or government agencies.

Sector Outlook: Positive

Company Guidance and Outlook: The management has guided for individual APE growth of ~13-14% for FY26, mainly driven by strong growth in the agency channel. The renewed focus on the agency channel could act as a key growth driver, especially given that growth in the banca channel is expected to remain modest. Despite the product mix shift towards non-ULIP products, the management has guided for VNB margins of 27-28%. We factor in healthy APE/VNB growth of 16/15% CAGR over FY25-27E, with VNB margins remaining within the guided range of 27-28%.

Current Valuation: 2.1x FY27E EV Earlier Valuation: 2.1x FY26E EV

Current TP: Rs 1,900/share, Earlier TP: Rs 1,850/share

Recommendation: We maintain our BUY recommendation on the stock

Financial Performance

* In Q4FY25, SBILIFE’s NBP growth was weak at -24/-11% YoY/QoQ and stood at Rs 93.2 Bn. APE stood at Rs 54.5 Bn (+2%/-22% YoY/QoQ), mainly driven by non-par and group protection business. In FY25, APE stood at Rs 214.2 Bn (+9% YoY). APE product mix (%) for PAR/Non-PAR/ULIP stood at 3/33/64% vs 4/29/67% in FY24.

* VNB stood at Rs 16.6 Bn for Q4FY25 and Rs 59.5 Bn in FY25. VNB Margin for FY25 was at 27.8%. In Q4FY25, VNB Margin (calc.) stood at 30.5%, owing to a favourable product mix as the share of ULIP declined, while non-par growth was healthy.

* The agency channel delivered a healthy growth of 21% YoY in FY25. Banca channel growth was modest at 8% YoY during the year. During Q4FY25, the banca growth was better than agency growth, primarily due to weaker ULIP sales in the agency channel.

• Gross Premium earned was in line with estimates at Rs 240 Bn (-5/-4% YoY/QoQ). Commission ratio stood at 4.2% vs 4.1% QoQ. Total Opex ratio stood at 9.3% vs 6.7/8.7% YoY/QoQ.

Valuation & Recommendation:

We value SBILIFE at 2.1x FY27E EV vs its current valuations of 1.6x FY27E EV, to arrive at a target price of Rs 1,900/share. This implies an upside of 18% from the CMP. We recommend a BUY on the stock.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633