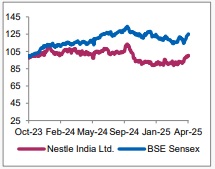

Buy Nestle India Ltd for the Target Rs. 2,675 by Axis Securities Ltd

Long-term Outlook Remains Intact; Maintain BUY

Est. Vs. Actual for Q4FY25: Revenue –INLINE; EBITDA – BEAT ; PAT – BEAT

Changes in Estimates post Q4FY25

FY26E/FY27E – Revenue: -2%/0%; EBITDA 1%/3%; PAT 3%/5%

Recommendation Rationale

* Beat on operating front: Nestlé reported a 3.7% YoY revenue growth, slightly below expectations (missed by 1% YoY), driven by double-digit growth in beverages and confectionery, alongside improved volumes. EBITDA rose 3% YoY (beat on estimates) while margins contracted marginally 17bps to 25.5% due to a 97bps decline in gross margins, impacted by inflation in coffee and cocoa prices. PAT declined 5.2% YoY. On the distribution front, the company’s RURBAN strategy continues to scale, with touchpoints now at 27,730 and coverage extending to approximately 208,500 villages.

* Margins Headwinds: The company continues to face significant cost challenges, with prices for coffee and cocoa remaining elevated. Meanwhile, edible oil prices remain stable, whereas Milk prices have firmed up with the onset of summer.

Sector Outlook: Positive

Company Outlook: Positive.

A key downside risk to our call is continued volatility in raw material prices and subdued demand

Current Valuation: 65x Mar-27 EPS (Earlier: 66x Dec-26 EPS)

Current TP: Rs 2,675/share(Earlier TP: Rs 2,520/share)

Recommendation: We remain optimistic about the company’s long-term prospects. With a 10% upside potential from the CMP, we maintain our BUY rating on the stock.

Financial Performance

Nestlé India reported revenue of Rs 5,448 Cr in Q4FY25, marking a 3.7% YoY growth driven by improved volumes at 2% YoY. Gross profit rose ~2% YoY to Rs 3,035 Cr, though gross margins contracted by 97bps due to elevated coffee and cocoa costs. EBITDA increased 3% YoY to Rs 1,389 Cr, but margins slipped 17bps owing to gross margin pressure. PAT stood at Rs 885 Cr, down by 5.2% YoY.

Outlook

The outlook on Nestlé remains positive from a long-term perspective, as current challenges such as lower volume growth and volatility in raw material prices are expected to be short-term in nature. With the rural market anticipated to recover in the coming quarters, the company is well-positioned to benefit, given its substantial expansion in rural presence over the last three years, increasing its reach from 110k to 200k villages. Additionally, its long-term initiatives include: 1) efforts toward rural penetration and market share gains through the RURBAN strategy, 2) constant focus on innovation (launching 125 products in the last seven years), thereby driving growth, 3) driving premiumisation in core categories (e.g., Maggi noodles range) and launching differentiated products, 4) entering new categories of the future (e.g., Nespresso, Purina Pet Care, and Gerber’s for toddler nutrition), 5) introducing a D2C platform to engage consumer attention, and 6) renewed focus on its fastgrowing nutraceutical portfolio. The company is viewed to have all the right levers for long-term growth.

Valuation & Recommendation

We expect Nestle's Sales, EBITDA, and PAT to grow at 11%, 13%, and 14% CAGR over CY22- FY27E, respectively. We maintain our BUY stance with a TP of Rs 2,675/share, representing a 10% upside from the CMP.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633