Buy JSW Infrastructure Ltd For Target Rs.336 by Prabhudas Liladhar Capital Ltd

Building a stronger backbone for logistics

Quick Pointers:

* The management expects EBITDA to reach ~Rs1.5bn by FY27 and Rs2.5bn by FY28E with the acquisition of 3 rail logistics entities.

* The acquisition adds scarce rail licenses and strengthens JSWINFRA’s multimodal logistics platform.

We upgrade the stock to ‘BUY’ on account of correction in stock price and company’s efforts to achieve the planned volume growth. JSWINFRA has announced a strategic transaction to scale-up of its multimodal logistics capabilities through the acquisition of JSW Rail, JSW Minerals and JSW (South) Rail from the promoter group company at an EV of Rs12.12bn. This move is expected to strengthen the company’s presence in inland transportation, by providing immediate access to scarce GPWIS/LSFTO licenses and adding an operational rake fleet that will support long-term cargo movement across steel, cement and other bulk industries. With rail freight volumes in India expected to nearly double by FY30 and a moratorium on new GPWIS licenses limiting competitive intensity, we believe this is a well-timed acquisition.

Combined with JSWINFRA’s expanding ports portfolio and strong balance sheet, we believe this transaction positions the company to evolve into an integrated logistics platform and steadily increase the share of third-party logistics revenue. We have incorporated conservative ~30% revenue growth CAGR for the logistics business against the management’s Rs80bn target for FY30 (from Rs2.5bn in FY25). We also incorporate Oman capex of Rs19bn in estimates and expect JSWINFRA to deliver revenue/EBITDA/PAT CAGR of 23%/24%/19% over FY25-28E. The stock is trading at EV of 19.6x/15.5x of FY27E/FY28E EBITDA. With ~15% correction in stock price post Q2 results, the stock gets upgraded to ‘BUY’ from ‘Accumulate’ with TP of Rs336 (Rs338 earlier) valuing at same 21x EV of Sep’27E EBITDA.

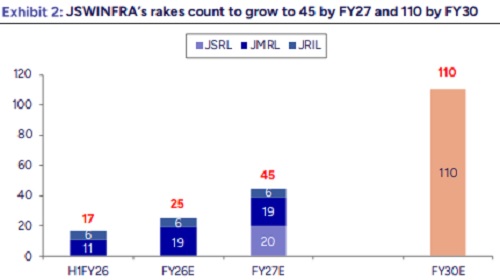

* Acquisition to strengthen rail presence: JSW Port Logistics will acquire full ownership of the 3 rail companies, giving JSWINFRA ready-made access to GPWIS and LSFTO licenses, which remain highly constrained due to the moratorium on new GPWIS issuance until Feb’27. The portfolio includes 21 operational and 4 under-delivery rakes, with a clear roadmap to scale to 45 rakes by FY27 and 110 by FY30. This immediately enhances JSWINFRA’s inland connectivity and lowers dependence on external transporters. The management expects the combined businesses to deliver annualized EBITDA of ~Rs1.5bn and Rs2.5bn by FY27E and FY28E, respectively.

* Favorable industry backdrop to aid long-term volume growth: Rail freight environment is backed by strong structural tailwinds, with the Ministry of Railways projecting volumes to increase from 1.6bnt in FY25 to 3bnt by FY30, expanding rail’s share in national freight from 27% to 45%. This shift is driven by cost efficiency, sustainability considerations, and government’s focus on increasing rail’s modal share. The rake business model benefits from dual revenue streams - railways rebates and customer-side premiums – creating stable earnings supported by long-term cargo anchors in steel, cement and minerals. JSWINFRA’s ability to integrate these rakes with its port assets should further improve cargo turnaround and strengthen customer stickiness.

* Strong balance sheet to support multimodal expansion: The acquisition is a natural extension of JSWINFRA’s integrated logistics strategy following the Navkar ICD/CFS acquisition, completing a port–rail–ICD multimodal network. With average annual CFO of ~Rs17bn and net debt/EBITDA at 0.9x in FY25, the company remains comfortably positioned to fund this expansion without letting net debt to EBITDA to cross its guided mark of 2.5x. Over time, the enhanced rake capacity, improved inland connectivity, and better control over cargo flows should help increase third-party logistics revenue, thus elevating JSWINFRA’s competitive positioning within India’s evolving logistics landscape.

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271