Buy Hindustan Aeronautics Ltd For Target Rs. 5,570 By Choice Broking Ltd

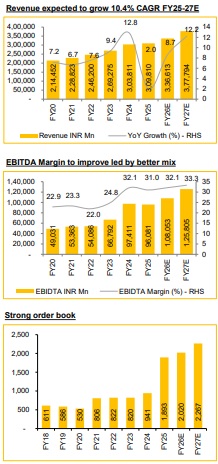

Business Overview: HNAL, is India’s premier aerospace and defense company under the MoD, specializing in the design, development, production, and MRO of fighter jets, helicopters (Dhruv, LCH), engines, avionics, and UAVs. It primarily serves the Indian Armed Forces, DRDO, and ISRO. With over 60 years of expertise. The company holds a robust unexecuted order book of INR 1,893 billion (~6.1x FY25 revenue), offering strong revenue visibility. HNAL’s diversified portfolio and capabilities reinforce its leadership in the defense sector.

Should Investors be concerned about this dependence on engine technologies, and how MoD will address these challenges?

Investor concerns about HNAL’s dependence on imported engine technologies are valid but should be viewed in the context of India’s evolving defense strategy. Historically, HNAL has relied on licensed production and imported components, which exposes it to supply chain risks, cost escalations, and geopolitical uncertainties. However, India’s evolving defense strategy under the “Aatmanirbhar Bharat” initiative marks a structural pivot toward selfreliance. HNAL is actively aligning with this shift—investing in indigenous platforms like LCA Tejas Mk2, AMCA, LCH, HTT-40, and UAVs, while also partnering with DRDO and private players to localize high-value components. The MoD’s renewed push behind the Kaveri engine program, along with its pursuit of JV’s with global engine OEMs, underscores a dual-track strategy, building domestic capability while leveraging foreign collaboration to bridge current gaps. Over time, this is expected to de-risk HNAL’s platform development through greater indigenization.

Should private players participation for fighter aircraft be a concern for HNAL’s Investors?

Private participation to strengthen, not threaten, HNAL’s strategic leadership

We believe the entry of private players into the fighter aircraft manufacturing space is unlikely to materially impact HNAL strategic position. While private sector participation may increase and take on a significant share of project components or sub-systems, HNAL is expected to retain its role as the principal integrator and nodal agency for final assembly, certification, and delivery. In fact, deeper private sector involvement may enhance execution efficiency and de-risk timelines, ultimately supporting HNAL’s ability to scale production. Sharing margins with private partners is a reasonable trade-off, as HNAL’s central role in program management and system integration ensures that profitability remains intact and the company continues to be the primary beneficiary of defense indigenization efforts.

What makes HNAL a strong investment opportunity in India's defense sector?

Our research indicates that a significant portion of HNAL’s revenue comes appx. 70–75% is derived from its MRO business, rather than aircraft manufacturing alone. While direct revenues from aircraft production may not dominate the topline, we believe overall revenue visibility remains strong. This is supported by HNAL’s diverse mfg. portfolio. Additionally, HNAL’s strong unexecuted order book, estimated at ~6.1x of FY25 revenue and executable over the next 5–6 years, provides long-term comfort and earnings visibility. While near-term execution challenges persist, we believe HNAL remains strategically aligned with the MoD’s long-term indigenization agenda under the Atmanirbhar Bharat initiative.

In summary:

* Short-term tech dependence is a concern, but not a deal breaker.

* MoD is actively mitigating this via ToT, localization policies and funding.

* HNAL is well-positioned to benefit as the domestic defense ecosystem matures.

Near term catalyst: 1) Finalize Tejas Mk2 & AMCA engine deal, 2) 97 Tejas Mk-1A order, 3) Potential acquisition SU-57E

Valuation: Currently we have a “ADD” rating on the stock with a Target Price of INR 5,570.

Key Risks: 1) Dependence on engine, critical components and Changes in defense policies, economic downturns, & shifting government priorities can reduce demand for defense products and services.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131

.jpg)