Buy Hero Motocorp Ltd For the Target Rs. 5,285 By the Axis securites

Recommendation Rationale

Long-term Growth Strategy: Hero MotoCorp’s (Hero) strategy for 2030 is built on four key growth pillars: strengthening its core business, excelling in the premium segment, leading in electric vehicles (EVs), and diversifying revenue streams. Anchored by the 4S mantra—speed, scale, synergy, and simplification—the strategy also focuses on creating a future-ready organisation and advancing environmental, social, and governance (ESG) initiatives. As part of its ongoing portfolio reshaping, the company introduced four new models at Bharat Mobility, positioning itself for sustained growth.

New Product Launches: Product launches in premium scooters and EVs will drive growth, with new models planned for Q4FY25 and FY26. The company is expanding its sub-Rs 1 Lc EV lineup with the Vida V2 platform, reinforcing its position in the massmarket scooter segment. New premium motorcycles like the Xpulse 210 and Xtreme 250R have received strong market feedback, while upcoming launches, including the Xoom 125, Xoom 160, and Destini 125, will further strengthen Hero’s scooter portfolio.

EBITDA Margins: Hero achieved over Rs 10,000 EBITDA per vehicle, driven by a richer product mix and judicious pricing strategies. The EBITDA margin for the ICE segment stood at 16%, down 50 bps QoQ, primarily due to higher marketing and advertisement expenses linked to the festive season. The company aims to maintain overall EBITDA margins in the range of 14-16% in the medium term, supported by a richer product mix— EVs and higher cc motorcycles, continued product premiumisation, lower material costs, and improved operational efficiencies, especially in the EV segment.

Sector Outlook: Positive on 2W.

Company Outlook & Guidance: The company has strengthened its domestic position in the 125cc segment, increasing its market share from 14% to over 21%. Hero has also enhanced its premium offerings, which are supported by a strong framework for scaling up its premium business. Additionally, its global business is rapidly expanding, with parts, accessories, and merchandise segments delivering record revenue, highlighting its continued growth potential. Hero maintains a long-term EBITDA margin guidance of approximately 14-16%.

Current Valuation: 19x on core FY27E EPS (unchanged), Ather 1.5x FY24 and Hero Fincorp 1.5x at FY24 P/B.

Current TP: Rs 5,285/share (Earlier TP: Rs 5,250/share ).

Recommendation: We maintain our BUY rating on the stock.

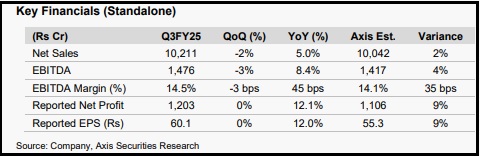

Financial Performance In Q3FY25, the company reported revenue of Rs 10,211 Cr (in line with expectations), up 5% YoY and down 2.6% QoQ, driven by flat YoY and down 3.7% QoQ volumes, along with higher ASP. EBITDA stood at Rs 1,476 Cr (beat), up 8.4% YoY and down 2.6% QoQ, with margins at 14.5%, up 45 bps YoY and nearly flat QoQ. This performance was supported by a richer product mix, increased exports (up 40% YoY), and EV sales. Reported PAT came in at Rs 1,203 Cr (8.8% beat), up 12.1% YoY and flat QoQ, primarily driven by EBITDA growth and higher other income.

Outlook We are monitoring (1) Hero’s roadmap in the EV product portfolio, including investments in Ather, the ramp-up of VIDA V2, and the launch of the sub-Rs 1 Lc Vida V2 Lite catering to mass markets; (2) Strategy in the mid-weight MC segment amidst growing competition; (3) Expansion into new international markets. Additionally, government initiatives to enhance rural income, higher disposable income (as announced in the recent Union Budget), and the marriage season are expected to drive 2W industry growth, benefiting Hero, particularly in the entry and 125cc segments. Consequently, we estimate an 8%/9%/9% CAGR in Revenue/EBITDA/PAT over FY24-27E

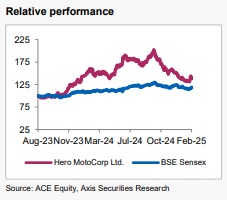

.Valuation & Recommendation We value the stock at 19x P/E on core FY27E EPS (unchanged), with Ather valued at 1.5x FY24 and Hero Fincorp at 1.5x FY24 P/B, arriving at a TP of Rs 5,285/share (from Rs 5,250/share). We maintain a BUY rating on the stock, projecting a 24% upside from the CMP.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633