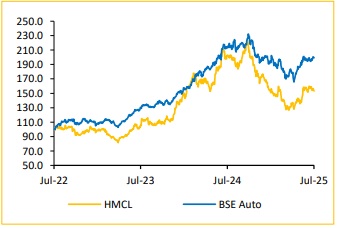

Buy Hero MotoCorp Ltd For Target Rs. 5,100 By Choice Broking Ltd

HMCL has launched the VIDA VX2 electric scooter, introducing a Battery-asa-Service (BaaS) model. We expect HMCL to see an increase in market share in the near term, but as new models are launched by other OEMs (in BaaS and without BaaS) we will see a moderation in market share. While the BaaS model may see good early adoption, we do not expect it to be a new normal unless there are changes to the plan structures to attract more consumer segments. Our analysis suggests that in the long term, the overall cost of ownership for customers with medium to high average daily usage exceeds the benefit received from the lower upfront cost

What has happened?

HMCL has launched the VIDA VX2 electric scooter, introducing a Battery-as-aService (BaaS) model to lower EV ownership costs and drive adoption. Priced from INR 59,490 (BaaS) and INR 99,490 (with battery), the VX2 offers two variants. With this move, HMCL reinforces its commitment to building India’s largest EV ecosystem, boasting 3,600+ charging stations and 500+ service pointss.

How does Hero stand to benefit?

* By offering a price difference of nearly INR 40,000 between the BaaS and battery-inclusive variants, HMCL is effectively lowering the entry barrier for electric 2W ownership, making the product highly attractive to India’s large base of price-sensitive consumers. This affordability, combined with the flexibility of pay-per-kilometre subscription plans, is likely to accelerate adoption among first-time EV buyers and daily commuters.

* This positions HMCL to rapidly expand its EV footprint and gain market share in the fast-growing electric scooter segment, a trend exemplified by MG Motor, which saw its EV market share rise from 16.5% in Sep-24 to over 41% by Dec24, following the launch of its own BaaS model in the PV segment. While HMCL may see an increase in market share in the near term, as new models are launched by other OEMs (in BaaS and without BaaS) we will see a moderation in market share.

Given the huge price difference(~40% cheaper), will BaaS be a roaring hit and become the new normal for the EV industry?

* The BaaS model offers flexibility and lower upfront costs, ideal for users who value convenience, short-term affordability and have a preference for avoiding battery maintenance. However for high average daily usage, cumulative perkilometre payments may exceed the cost of owning the battery.

* On the basis of the below table showing different plans offered by the company we can see that as the usage increases, the cost of the service increases more than the benefit received from the lower upfront cost. Also, low usage riders might find BaaS inefficient, as costs accrue regardless of usage frequency.

* While the BaaS model may see good early adoption, we do not expect the BaaS model to be a new normal unless there are changes to the plan structures to attract more consumer segments.

What can be the challenges faced by the BaaS model?

* Consumer awareness and acceptance: The concept of separating battery ownership from the vehicle is still new in India. Educating consumers and building trust around long-term subscription models, battery performance, and postownership scenarios will be critical.

* Uncertainty in residual value and resale market: Since the customer doesn't own the battery, resale valuation may be harder to determine. This can affect demand in the used EV market, limiting appeal to some buyers.

* Competitive imitation risk: While HMCL is the first OEM in the 2W industry to launch BaaS, if successful, this model may see entry of other OEM’s increasing competition and push for further innovation.

View and Valuation: We continue to maintain our ‘BUY’ rating with a target price of INR 5,100 (PE of 17x) on FY27E EPS.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131