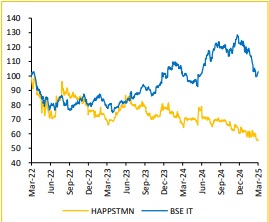

Buy Happiest Minds Technologies Ltd For the Target Rs. 750 by Choice Broking Ltd

Assessing Q3 Results amid Trump Tariffs & Macroeconomic Challenges

HAPPSTMN reported in-line Revenue, EBIT & PAT missed expectations.

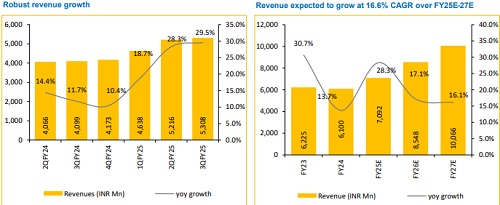

* Revenue for Q3FY25 came at INR 5.3Bn up 29.5% YoY and 1.8% QoQ (vs consensus est. at INR 5.3Bn).

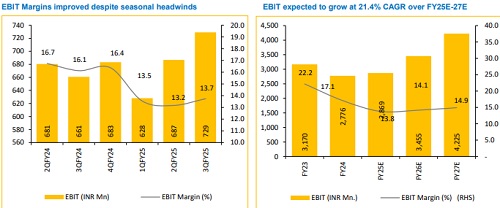

* EBIT for Q3FY25 came at INR 0.7Bn, up 10.3% YoY and 6.2% QoQ (vs consensus est. at INR 0.7Bn). EBIT margin was down 239bps YoY but up 57bps QoQ to 13.7% (vs consensus est. at 14.2%).

* PAT for Q3FY25 stood at INR 0.5Bn, down 16.0% YoY but up 1.2% QoQ (vs consensus est. at INR 0.6Bn).

Strong Q3FY25 Performance, 29.5% YoY revenue growth and 7 new logo wins:

* HAPPSTMN reported a 29.5% YoY revenue increase in Q3FY25, primarily driven by the Product Digital Engineering Services (PDES) segment, which saw a 28.2% YoY growth. PDES is poised for continued success, fuelled by advancements in engineering, AI, data analytics, cloud, and cybersecurity services.

* The BFSI vertical also saw strong growth, supported by the Arttha banking platform and the closure of two significant deals. The outlook for BFSI remains positive, with a robust pipeline and expansion opportunities in India and the Middle East, following the acquisition of GAVS Technologies' Middle East business. Healthcare & Life Sciences has rapidly grown into top-three vertical, while Retail, CPG, and Logistics are showing promising growth, driven by easing discretionary pressures and new initiatives. EduTech vertical is experiencing softness, particularly in higher education, prompting a strategy shift towards professional development and partnerships.

* The company is focused on growth through various initiatives, including 15 GenAI Business Services (GBS) proof-of-concept projects, expected to convert into major orders. Verticalization into six industries is strengthening customer alignment, and acquisitions like PureSoftware and Aureus are contributing to revenue. A new growth strategy, led by Chief Growth Officer and a new sales team, resulted in 7 new logo wins in Q3

EBITDA margins expected to remain within 20%-22% band, Attrition at 15.3% in Q3:

HAPPSTMN aims to close FY25 with EBITDA margins between 20%-22%, having already achieved 22.1% for 9MFY25. Short-term margin pressure is due to investments in the GBS unit, new sales team, and verticalization, but future improvement is expected as consolidation benefits materialize. TTM attrition stood at 15.3% as of Q3FY25, slightly up from 14.4% in Q2FY25. This increase in attrition rate is seasonal and is expected to decrease in the next quarter. The company had 6,630 employees as of Q3FY25, with a net addition of 50 employees during the quarter.

Potential slowdown in IT spends amid Trump tariffs poses risk for HAPPSTMN:

The Company could encounter revenue challenges due to uncertainty over the Fed's interest rate decisions and concerns about a potential US economic slowdown. With 65% of its revenue from US, reduced IT spending or delayed contract renewals in key sectors may impact growth. Currency volatility also poses margin risks, though easing inflation and stable tariffs could boost demand.

View and Valuation:

HAPPSTMN is well-positioned for growth, driven by organic revival, strategic product engineering, digital transformation, and successful acquisitions. Despite short-term challenges, its focus on innovation, strong management, and expanding client accounts suggest sustained growth. We expect Revenue/EBIT/PAT to grow at CAGR of 16.6%/21.4%/25.8%, respectively, for FY25E-FY27E. We upgrade our rating to ‘BUY’ but lower our target price to INR750. Considering company's significant exposure to the US market & broad market correction, we have lowered our PE multiple to 32x (earlier 37x), based on the FY27E EPS of INR23.4.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131