Buy Fine Organic Industries Ltd for the Target Rs. 5,386 By Prabhudas Liladhar Capital Ltd

Steady performance, expansion plans underway

Quick Pointers:

* ~159.9acres of land acquired in USA for setting up new manufacturing plant in June’25

* Rs650mn equity infused in subsidiary Fine Organic Industries (SEZ) Pvt during the quarter

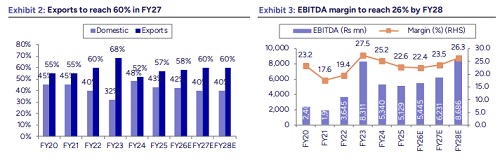

Fine Organic Industries (FINEORG IN) reported consolidated revenue of Rs6bn in Q2FY26, flat YoY and up 3% QoQ. Domestic demand improved during the quarter, while export demand remained stable. However, higher raw material prices versus last year majorly led to a 270bps YoY decline in EBITDA margin, with a slight sequential increase as well. All manufacturing facilities are operating at full capacity for the company, except for the Patalganga (foodgrade) plant, which the management has previously guided to be expected to achieve full utilization by the end of FY26. During Q4FY25, the company incorporated a wholly owned U.S. subsidiary to establish a manufacturing facility aimed at strengthening supply chain efficiency. Additionally, FINEORG acquired ~159.9 acres of land in June’25. The company has also received environmental clearance (with a few remaining approvals pending) for its Rs7.5bn greenfield project on SEZ land. Construction is expected to commence shortly and will take approximately 18 months to complete. We believe the upcoming SEZ facility and the planned U.S. manufacturing plant will be key growth catalysts. The SEZ project is expected to deliver peak revenue potential of Rs26bn, assuming an asset turnover of 3.5x, and should start contributing meaningfully to topline growth from FY28. At current valuations, FINEORG trades at ~27x FY27E EPS. We maintain our ‘BUY’ rating with a target price of Rs5,386, valuing the stock at 28x Sep’27 EPS.

* Consolidated revenue remained flat YoY, increased 2% sequentially: Consolidated revenue stood at Rs6bn (0% YoY/ 2% QoQ) (PLe: Rs5.7bn, Consensus: Rs5.9bn). Domestic and export sales accounted for 45% and 55% of revenue, respectively. H1FY26 revenue stood at Rs11.8bn increased by 4% YoY.

* Rise in input costs leads to 120bps YoY decline in gross margin: Gross margin stood at 41.6% (vs 42.8% in Q2FY25 and 40.4% in Q1FY26). Absolute gross profit was at Rs2.4bn, up 4% QoQ. RM cost in H1FY26 was higher compared to H1FY25 and increased slightly on a sequential basis as well. EBITDA came in at Rs1.4bn (-10% YoY / +9% QoQ) vs PLe: Rs1.2bn and Consensus: Rs1.3bn, with EBITDA margin at 22.6% (vs 25.3% in Q2FY25 and 21.0% in Q1FY26). H1FY26 EBITDA stood at Rs2.6bn, declining 11% YoY compared to H1FY25.

* Strategic expansion in USA: The company incorporated a wholly owned subsidiary in the USA in Q4FY25. In June’25, the company acquired ~159.9acres of land in Jonesville, South Carolina, to support future expansion plans and enhance manufacturing capabilities.

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271

.jpg)