Bullion climbed above $4,325 an ounce, rebounding from a brief dip to edge toward a new record high - HDFC Securities

GLOBAL MARKET ROUND UP

Gold and silver prices surged on Wednesday as investors balanced anticipation of critical U.S. inflation data with a significant escalation in geopolitical tensions. Bullion climbed above $4,325 an ounce, rebounding from a brief dip to edge toward a new record high.

This rally was largely fueled by President Donald Trump’s order for a total naval blockade of all sanctioned oil tankers entering or leaving Venezuela, a move aimed at ousting President Nicolás Maduro by choking off the regime’s primary revenue source. As the U.S. military intensifies its presence in the Caribbean and warns of potential land strikes, the resulting "safe-haven" demand has pushed precious metals higher. Simultaneously, silver extended its own powerful rally, vaulting past $65.91 an ounce for the first time as it continues to outperform other commodities in 2025.

Market participants are now focused on Thursday’s Consumer Price Index (CPI) report, which will offer the final major clue of the year regarding the Federal Reserve's appetite for further interest rate cuts in 2026. Oil prices rebounded on Wednesday, with Brent crude climbing above $59 and WTI nearing $56, after President Trump ordered a "total and complete" naval blockade of sanctioned tankers linked to Venezuela. The move, which targets the nation's 700,000–900,000 barrels per day in exports, snapped a four-session losing streak and reintroduced a geopolitical risk premium to a market previously weighed down by oversupply fears.

Copper prices advanced by as much as 0.9% on the LME this Wednesday as investors sought a foothold ahead of pivotal U.S. inflation data that could dictate the Federal Reserve's 2026 interest rate trajectory. While recent Fed commentary has been divided—with Chicago Fed President Austan Goolsbee recently dissenting against a rate cut in favor of waiting for more data—he remains optimistic that significant easing could occur through 2026 if inflation aligns with targets. This monetary uncertainty, coupled with a backdrop of supply constraints and strategic front-loading by U.S. importers ahead of anticipated 2026 tariffs, has kept copper prices buoyed near record levels.

Gold

* Trading Range: 132500 to 134200

* Intraday Trading Strategy: Buy Gold Mini Jan Fut at 132,500 SL 131,800 Target 133700

Silver

* Trading Range: 198,300 to 208,000

* Intraday Trading Strategy: Buy Silver Mini Feb Fut at 202,500 SL 201,000 Target 205,500

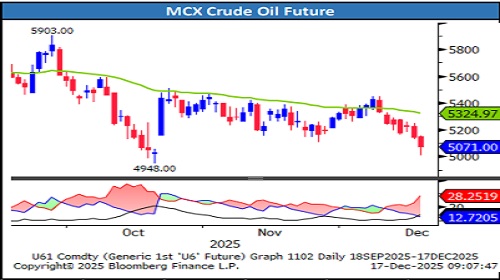

Crude Oil

* Trading Range: 4980 to 5250

* Intraday Trading Strategy: Sell Crude Oil Jan Fut on bounce at 5130 SL 5200 Target 5050

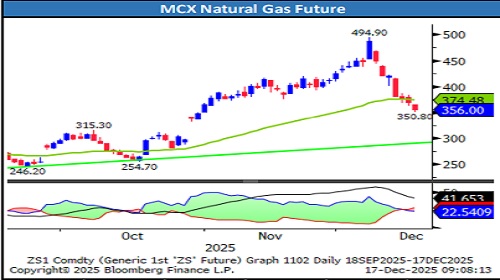

Natural Gas

* Trading Range: 350 to 380

* Intraday Trading Strategy: Sell Natural Gas Dec Fut on bounce at 365 SL 371 Target 355

Copper

* Trading Range: 1070 to 1130

* Intraday Trading Strategy: Buy Copper Dec Fut at 1105 SL 1095 Target 1125

Zinc

* Trading Range: 296 to 315

* Intraday Trading Strategy: Buy Zinc Dec Fut above 306 SL 302 Target 312

Please refer disclaimer at https://www.hdfcsec.com/article/disclaimer-1795

SEBI Registration number is INZ00017133