Bank nifty started the week with a negative gap-down, and witnessed profit booking from the previous day`s high - ICICI Direct

Nifty : 25202

Technical Outlook

Day that was…

Equity benchmark declined for the second consecutive session amid Trump’s announcement on H1B visa fee hike. Nifty settled the day at 25202, down ~0.50%. Market breadth was in favor of declines, with an A/D ratio of 1:2 where broader markets underperformed the benchmark. Midcap and Small cap closed on a negative note down 0.70% and 1.20% respectively. Sectorally, barring Metal and Oil & Gas all indices closed in red. Where, IT, Pharma and Consumer Durables were the laggards.

Technical Outlook:

* Nifty started the week with a gap down, and made a failed attempt to sustained at higher levels which resulted in extended fall. As a result, the daily price action formed a Doji with upper wick carrying lower-low, indicating breather. Key point to highlight is that, Index heavy weight IT stock contributed the most of today’s fall amid Trump’s announcement on H1B visa fee hike.

* The current decline is the retracement of past three weeks >1000 points upmove, such breather should not be construed as negative as such breather makes market healthy instead the dips should be used as buying opportunity. Going ahead, a decisive close above previous sessions high would indicate pause in the down move and will pave the way towards 25800 in coming weeks wherein strong support is placed at 24700.

* Structurally, the rebound from April 2025 low till June 2025 high witnessed shallow retracement as it not even retraced 38.20% of the entire upmove while within the decline the pullback were limited to the tune to max 800 (refer chart) points the current upmove was >1000 points backed by across sector participation on the back of GST reforms which helped to improve market breadth while maintaining higher peak and trough intact, highlighting inherent strength. All eyes are on the progression of tariff negations. Any announcement on scrapping of additional 25% tariff or lowering reciprocal tariff rates would fuel further momentum in the market. Consequently, focus will shift towards export-oriented Textile, Capital Goods and Pharma stocks.

* Mirroring the Dow Jones move, Russell index (US Small cap index) clocked a fresh All Time High after 2021, indicating broadening of global rally.

* On the domestic broader market front, in a bull market scenario, average decline in Midcap and Small cap indices have been 27% and 29%, respectively. Buying in such scenario has been fruitful with >50% returns in subsequent 9-12 months. In the month of April, after 23% and 27% correction in Midcap and small cap, indices witnessed a sharp rebound and made a higher base in the vicinity of 52-week EMA. Currently, Midcap index is shying away 3% from its All Time High while small cap index is 8% away from All Time High. Hence, focus should be on accumulating quality stocks on dip.

* Our positive stance is further validated by following observations:

* a) Sentiment indicator at lows: Historically, rare occurrence of India Vix closing below 11 has eventually garnered double digit returns in subsequent 12 months.

* b) Market breadth: Constant improvement in market breadth highlights inherent strength. Currently, 59% stocks are trading above 50 days SMA while 67% stocks are trading above 200 days SMA compared to one month back reading of 41% and 58%, respectively.

Nifty Bank : 55285

Technical Outlook

Day that was:

Bank Nifty continued its losing streak for the second consecutive session and closed negative to settled at 55,285 down 0.31%. Nifty Private Bank index has mirrored the benchmark, ending the day at 26,915 down 0.21%.

Technical Outlook:

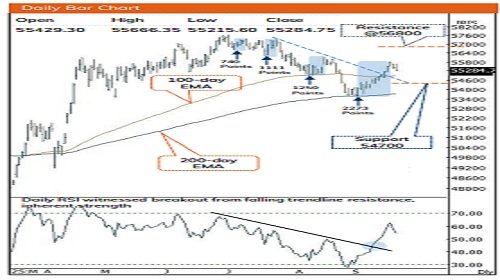

* Bank nifty started the week with a negative gap-down, and witnessed profit booking from the previous day’s high. As a result, the daily price action formed a bear candle with upper shadow, indicating breather after recent up-move.

* Key point to highlight is that recent decline indicates a healthy retracement of the prior three weeks rally of approximately 4.50%, which bodes well for resumption of the next leg of upside. Thereby, we believe supporting efforts will emerge from immediate support placed at 54,500 being 50% retracement of the current up move (53,561-55,540) and any decline from current level should be viewed as a buying opportunity. After favorable GST reforms now, all eyes are on the progression of tariff negations, any positive outcome could act as a trigger, driving the index towards 56800 being 80% retracement of the preceding decline (57628-53578).

* Structurally, Over the past 8-weeks of decline, the index has retraced 38.2% of its preceding 16-week, 21% rally, reflecting a slower pace of retracement. The subsequent rebound stands out as the strongest among the last three recovery attempts, reinforcing the view that the resumption of uptrend after slower pace of retracement.

* PSU Bank Index has mirrored the benchmark and closed on a negative note. Index has maintained its higher-high-low structure for the seventh-consecutive session, indicating upward trend remains intact and opening the door for the further upside towards its measured move target at 7690. However, immediate support is placed near 6970 being 50- day EMA

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631