Bank Nifty has bounced from the crucial support of upward sloping trend line - HDFC Securities Ltd

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Daily Technical View on Nifty

* Nifty is trading below 5,10, 20,50 and 100 DEMA, which indicates a down trend. 200 DEMA is placed near 23455

* Nifty has confirmed breakdown from bearish head and shoulder pattern on the daily chart. Right Shoulder top is placed at 25235 and unless that is taken out bearish pattern will remain valid.

* Previous Support zone of 24600-24650 is expected to act as a resistance for the short term. Positional resistance for the Nifty is placed at 25235.

* Bank Nifty has bounced from the crucial support of upward sloping trend line. Fresh selling momentum would come only below 50382. Pullback can not be ruled out from current levels. However, considering the primary trend higher levels should be utilized to lighten long commitments.

* Broader markets have started weakening, which is not a good sign for the overall health of the market. However, after recent fall, Nifty Smallcap index has reached a long-term support of 40 Week EMA, which acted as a reversal point in the month of June 2024. Decisive close below 40 WEMA could ignite the selling pressure in the smallcap index.

* Developed and Emerging Markets are holding their uptrend till now. However, move below certain levels can also change the trend for them.

Please refer disclaimer at https://www.hdfcsec.com/article/disclaimer-1795

SEBI Registration number is INZ000171337

Top News

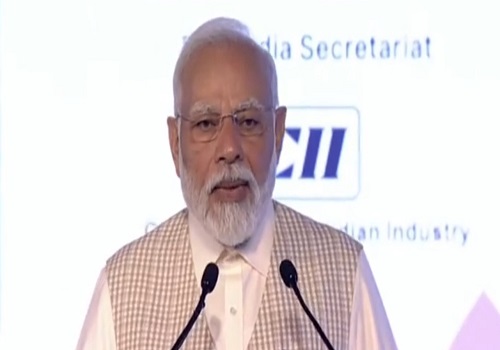

PM Narendra Modi congratulates RBI Governor for receiving A+ rating in Global Finance Centra...

Tag News

Indian markets to deliver positive returns for 9th year in a row, outperform US

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">